The World Bank annual report has cut the global growth forecast for this year to 1.7% from 3% and warned that the world is perilously close to a global recession. Weak growth in the United States, Europe and China will lead to the third slowest expansion of the world economy in the last three decades, says the report. The Bank attributes the slow growth this year to a series of jumbo interest rate hikes effected by the central banks of the major economies, disruptions caused by the Russia-Ukraine war and the worsening financial condition.

Coordinated action by nations will be needed to reduce the risk of a global recession and debt crisis in emerging markets and developing economies that have limited policy space, says the report. These countries must ensure focused fiscal support to vulnerable groups, curb inflation expectations, and ensure resilience of financial systems.

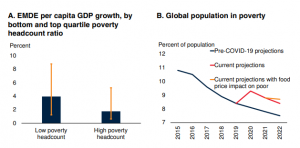

High interest rates in developed economies will deprive emerging markets and developing economies of investment capital. The global recession will hit the poorer countries hard. The World Bank predicts a meagre 1.2% growth in per capita income in 2023 and 2024 which will lead to an increase in poverty rates. Investment growth will remain low in most emerging market and developing economies, says the report. Further shocks could push the world into a recession and small states dependent on trade will be especially vulnerable. High energy prices will dim the outlook for energy importing nations across the world.

READ I Budget 2023: Start-ups need help to overcome funding freeze

Asia shines amid global recession fearas

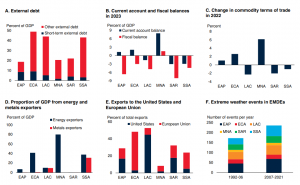

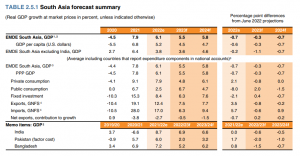

South Asian economies will also be severely affected by the impact of Russia-Ukraine war, rising interest rates across the world, and slow growth in trading partners. The region will grow 5.5% this year compared with 6.1% in 2022 despite the rest of the world facing a global recession. The global headwinds will affect trade, hospitality, and manufacturing in the region.

Indian economy expanded 9.7% during April-September 2022, backed by robust private consumption and fixed investment growth. High inflation that stayed above the RBI’s tolerance limit of 6% forced the central bank to raise the policy repo rate by 2.25 percentage points since May 2022. Despite sticky inflation and widening trade deficit, India may still remain the world’s fastest growing major economy. The Indian economy will grow at 6.9% in 2022-23, compared with 8.7% in the previous year.

South Asian currencies depreciated by 10% on an average in the second half of 2022. The economies of the region are expected to grow 5.5% in 2023 and 5.8% in 2024. The World Bank has cut the growth rate to below 6.5%, the region’s 2000-19 average growth. The growth rate for the region is still robust because of high growth in India, Maldives, and Nepal.

While the US will manage to avert a recession this year with a 0.5% growth, weak global economy will slow down the US businesses and consumption, says the report. The US economy will be vulnerable to supply chain disruptions in case of an escalation of Russia-Ukraine war or a surge in Covid-19 infections. The Euro area will also experience weakness because of a slowdown in China, a major importer from the region. While the Euro zone economy will shrink next year, China will grow 4.3%, a percentage point lower than the earlier forecast. The developing countries will grow 3.4% this year.