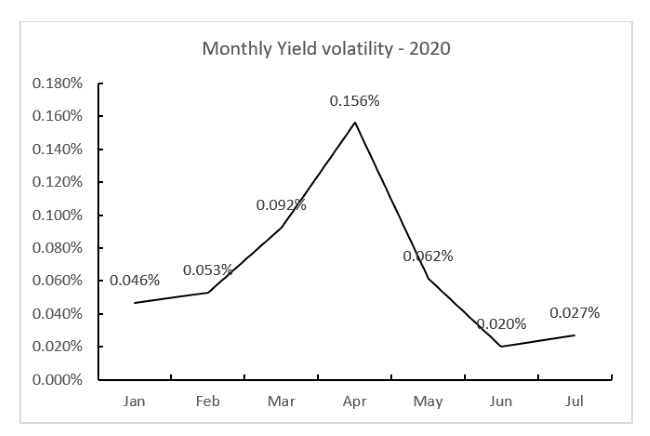

Historically, government securities have been the beneficiaries of uncertain times, economic crises and falling stock prices. This is because they are generally considered less risky. However, April 2020 witnessed an almost unprecedented selloff in both stocks and bonds, witnessing the highest volatility in 10-year Indian Government bond yield in recent past.

There are reasons why the markets experienced an unusual simultaneous selling of stocks and bonds. The key factor is the COVID-19 pandemic triggering demand for cash balances, resulting in selling across major assets and disrupting the conventional correlation between stocks and bonds. COVID-19 forced lockdowns; businesses started building cash balances to cover fixed expenses. Also, the usual investors’ motive of buying bonds when stocks selloff may have been inhibited by an expectation that the government need to finance fiscal packages. Investors have become risk averse as they foresee market risks in the prevailing economic conditions.

READ I Covid-19, monetary policy on financial markets

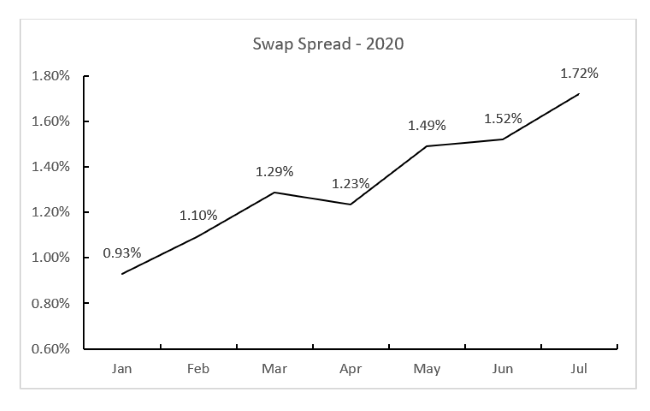

In order to measure the risk aversion and the market risk present in the current Indian financial market, we examine the swap spread from the beginning of 2020. The swap spread is measured as the difference between the swap rate — the rate of the fixed leg of an interest rate swap — and the yield on Indian government bonds with similar maturity. In this case, which are using the 10-year bond as benchmark. We see that the curve replicates the pattern witnessed during the financial crisis of 2007-09. The widening of the spread suggests that there is a greater level of risk aversion in the market. Widening spread indicates a fall in liquidity caused by increased market risk. However, the swap rates are far from negative, indicating that the financial strength of the Indian government is not in threat and hence investing in Gilts during these uncertain times is still safe and advisable.

READ I Income tax assessments: Personal hearing may be needed in many cases

The outlook

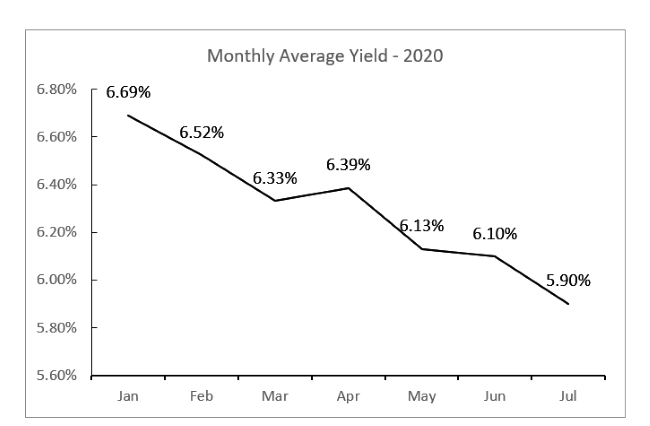

The measures taken to contain the spread of COVID-19 have already shown an adverse effect on consumer spending and producer value chains. This has disrupted the availability and the circulation of money in the system. We expect an ongoing decline in global growth. Besides the initial emphasis on growth post-COVID era, investors will increasingly seek to focus on the financial health of the companies, alternatively the resilience of the companies will be tested. As we show below, the Indian bond markets have responded in line with the investor sentiments. However, most market participants are still warry of the uncertainties in future are hesitant to trade in the secondary markets. During this time we also see gradual return on new issuances by companies and other institutions as they require cash to sustain their operations. Yet, the full impact of the sudden halt of the economy is not yet fully absorbed by the capital markets. But we do expect that the current level of interest rates to stay longer.

READ I Comparison of Covid-19 impact on India and G7 economies

Investment policy

Although the overall impact of the ongoing pandemic is uncertain, global recession is looming. We feel that some of the future negative effects have not yet been fully factored in by the financial markets in India. Furthermore, there is a likelihood that the feedback loops in the system will trigger panic in the financial sectors (e.g. asset price declines and bankruptcies), impacting the real economy. While a large part of the relief funds of the RBI has been recently priced, what remains to be seen is whether the RBI will deliver more and in which way. Therefore, caution in asset allocation is the way forwards in the years 2020 through October 2021. Cautious allocation asks for a defensive stand wherein investors should focus on high-quality names.

READ I All Inclusive Economic Development: The GDP alternative offers a better measure

Overall focus should be on investing in Gilts for sustainable risk diversification. While investing in companies, focus should be on those with solid impact and sustainable fundamentals, sound balance sheet, decent cash cash-flow visibility and strong management team. Therefore, for creating bond-impact funds, we will recommend to maintain a neutral duration, i.e. immunizing interest rate sensitivity and minimizing re-investment risk, keeping its positions in Gilts, high quality (semi-) sovereigns and corporates. The cash position remains relatively high to guarantee high liquidity and to able to participate in new issuance opportunities. A fund that is defensively positioned, will outperform of the benchmark. The high volatility of bond prices and the continuous flow of worrying news are not an environment to make large allocation shifts in the portfolio.

During times of uncertainty, some may view overnight funds as the safest category of debt funds available. However, investors must keep in mind that these funds are not designed to optimise returns. Instead, investors in overnight funds have to compromise on returns in exchange for safety and liquidity. As an example, while it might be attractive to allocate some money to an overnight fund; it is not advisable to shift your portfolio entirely to overnight funds, simply to avoid risk. If the risk appetite of an investor is low, but his or her investment horizon is longer (say 3‐6 to 12 months), more returns can be earned by investing in liquid funds or ultra-short duration funds that hold high-quality bonds.

READ I Race to Covid-19 remedy: Will the Oxford vaccine fail?

The bottom line

Bond markets in India are now firmer. The economic upheaval from COVID-19 witnessed a massive rush to build cash balances sparking an unprecedented simultaneous selloff in stocks, bonds and commodities. While stock prices remain under pressure, the cross-market selling has abated – bonds, in particular, are firmer – which is likely a reflection of the massive liquidity added into the bond market by governments around the world. Even though the returns offered by the Gilt funds are moderate, the funds provide secure and safe asset quality.

In uncertain times, when capital markets are declining and you want safer returns on your investments, then Gilt funds are the best mutual funds to ride on the interest rate volatility. Moreover, it is an opportunity to be a part of the nation-building process through investment while earning returns. The top three Gilt funds that exhibited good performance on past 5-years’ returns considering the global economic uncertainties are SBI Magnum Gilt Fund, Nippon India Gilt Securities Fund – Growth and Aditya Birla Sun Life Government Securities Fund.

(Dr Anandadeep Mandal is Assistant Professor in Finance at the University of Birmingham, UK. Dr Neelam Rani is Associate Professor (Finance) at IIM Shillong.

Dr Neelam Rani is an Associate Professor in the area of Finance at IIM Shillong.