In an unprecedented action, the Federal Reserve has raised the benchmark interest rate by a massive 75 basis points for the second consecutive time with members voting unanimously for the move to bring down runaway inflation. Not that Fed has much choice — the world’s largest economy is struggling under price increases unseen since the 1980s.

The Federal Reserve usually nudges the interest rate up and down by 25 basis points to tackle inflation and adjust money supply. The two consecutive hikes of 75 basis points are a first in the recent history of the Federal Reserve, The action reflects the seriousness of the situation where inflation ruling at 9.1%. It had hiked the benchmark rate by 0.75% in June, 0.5% in May and by 0.25% in March. The latest rate hike will take the overnight borrowing rates to a range of 2.25-2.50%. Fed has indicated that it expects the interest rates at a range of 3.25-3.5% by the year-end.

READ I Indian economy: IMF and other forecasters miss domestic, global pain points

US economy slowing down

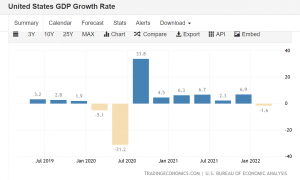

The US economy is already slowing down. It shrank 0.9% in the second quarter of 2022 after shrinking1.6% in the first quarter. With the economy is showing the signs of slowing down, the Fed needs to tread carefully. Overdoing inflation targeting could land the economy in a deep recession, or worse in stagflation, where the economic growth is slow and inflation remains high. The thinking at Fed is clear — it sees persistently high inflation as a bigger threat than an economic downturn. The Fed’s record is not inspiring. It managed to avoid recession only thrice in the last 11 monetary tightening cycles.

Fed chief Jerome Powell did not provide a guidance on the future of inflation targeting and did not mention the quantum of the next hike expected in September. This could be an indication of the confusion created by conflicting macroeconomic signals emanating from the US economy. By not offering a guidance, the Fed will retain freedom and flexibility to act according to the emerging inflation scenario.

The Fed had rolled out a series of steps to cushion the economy from the impact of the Covid-19 pandemic. It had slashed the interest rates to zero, leading to heavy spending by households and businesses. This along with close to $5 trillion stimulus package by the government led to overheating of the economy and inflation shot up to 4-decade high levels. The Fed has already raised its benchmark rate four times this year to cool the economy.

READ I Monkeypox threat: Concerns rise as WHO sounds alarm

Interest rate hikes and recession fears

There are apprehensions about the central bank’s war on inflation with macroeconomic indicators sending out conflicting signals. Inflation is at 40-year high levels, unemployment rate is at record low levels, and consumer spending is steady – the conditions look like a text book case for aggressive rate hikes. But the US economy has shrunk in the first two quarters of the year, and looks like slowing further. A slowing economy normally requires a freeze on rate hikes. The conflicting signals emanating from the economy seem to have created confusion among economists and analysts.

The rate hikes will weaken the economy by making borrowing costlier for individuals, businesses and governments. But the Fed may go ahead with its inflation targeting till it sees some weakness in the labour market. It wants to cool down the overheated economy to bring down inflation without triggering a recession. But economists feel that the series of aggressive rate hikes will land the US economy in deep recession.

The Fed has no option but to address the price rise – annual inflation rate is ruling at 9.1%, the highest since 1981. The low-income groups are troubled by big increase in the prices of food, fuel, and electricity. In June, hiring remained healthy with businesses adding 372,000 jobs. The economy saw 2.7 million jobs being added so far this year. The demand for labour is pushing the wages, which is fuelling the inflation further. While two quarters of negative growth can be technically seen as a recession, but a situation where incomes and jobs and rising can hardly be called one.