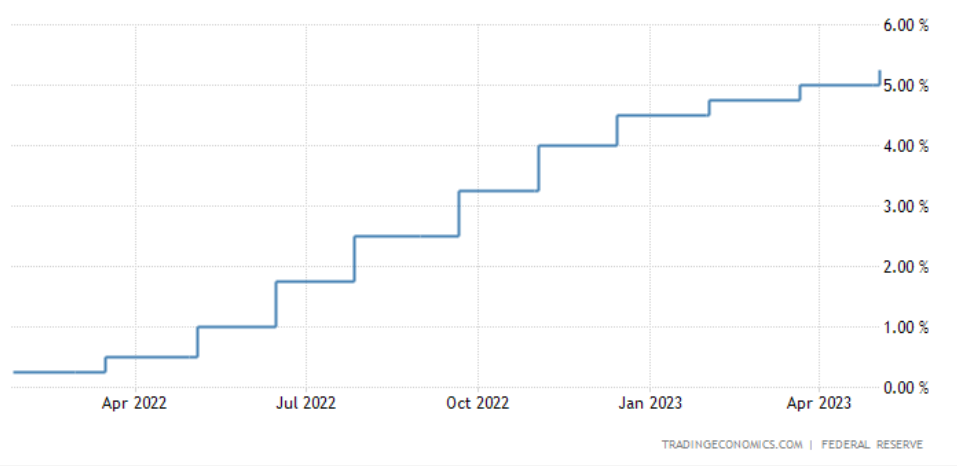

The Federal Reserve hiked its benchmark interest rate by 25 basis points, marking the tenth consecutive raise in a year, but gave clear hits that it may pause monetary tightening soon. The Federal Open Market Committee unanimously decided to raise the federal funds rate to 5-5.25%, a level unseen since the global financial crisis of 2007-8.

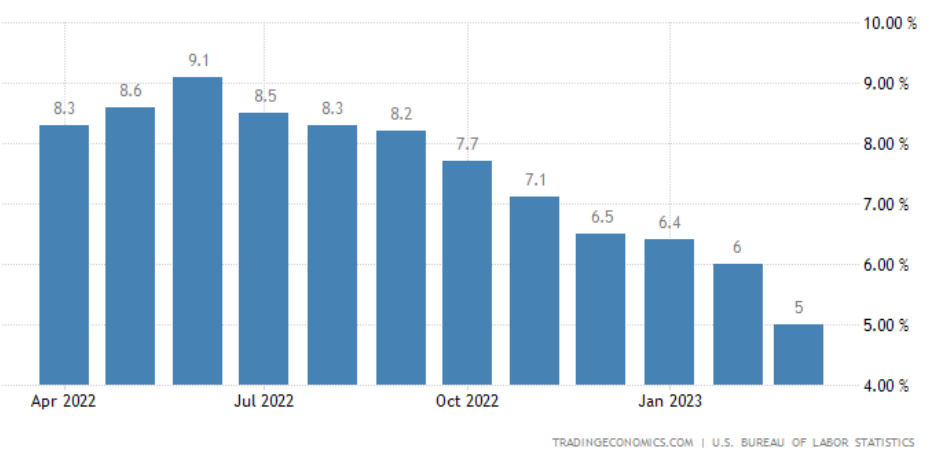

The Fed said that the economic activity in the US continued to expand at a modest pace. The hike is aimed at achieving maximum employment and an inflation rate of 2% over the longer run. The FOMC statement said that job gains have been robust in recent months, and that the unemployment rate has remained low. The Committee said it is mindful of inflation risks, which it says remain elevated.

READ I Closing the biodiversity gap: How biocredits could save our ecosystems

Fed confident of US economy’s health

The FOMC said it would continue to reduce its holdings of treasury securities and agency debt and agency mortgage-backed securities, as announced earlier. It also approved a 25 basis points increase in the primary credit rate to 5.25%. The Committee expressed confidence over the health of the US banking system. It expects tighter credit conditions for households and businesses to weigh on economic activity, hiring, and inflation.

The FOMC statement suggests that the Federal Reserve is taking a cautious approach to monetary policy as it seeks to balance the need to support economic growth while maintaining its inflation target. The decision to raise interest rates and reduce the holdings of government debt reflects the committee’s view that tighter credit conditions may be necessary.

United States Fed funds rate hikes

United States consumer inflation rate

The FOMC said it would take into account the fact that its rate rises may take time to have an impact on the economy while deciding the extent of future rate hikes.

“In light of these uncertain headwinds, along with monetary policy restraint we put in place, our future policy actions will depend on how events unfold,” Fed chair Jay Powell said.

The European Central Bank is likely to follow Fed lead by raising interest rates for the seventh meeting running as it battles sticky inflation. The ECB has hiked the rates by 350 basis points since July 2022 to bring inflation down to targeted 2%. The last three ECB meeting saw 50 basis point hikes.

Most monetary authorities have already hinted that they are at the peak of interest-rate hiking cycles. Inflation targeting by central banks have dented economic growth in all major economies.

The Reserve Bank of India had paused its tightening cycle in its April 6 monetary policy committee meeting, bringing an end to an year of hikes that saw interest rates rising by 250 basis points. The policy repo rate is expected to have peaked at 6.5%. The bank has made it clear that the action to bring down the inflation would be gradual and protracted, but said it will be ready to act appropriately if situation warrants.