Trump tariff India exports impact: August trade figures delivered more than an impression of volatility—they revealed resilience. Despite the hefty new 50 per cent tariffs imposed by the United States on many Indian exports, India has posted solid export growth, narrowed its trade deficit, and shown in concrete terms that its exporters are responding to external pressure. If policy is properly steered, India’s export economy can offset the damage, not simply sustain but build strength via diversification of products, markets and trade policy.

The August 2025 trade data paints a picture of an economy that is both nimble and robust. Combined exports of merchandise and services rose by 9.34 per cent year-on-year, a performance that cannot be dismissed as statistical noise. Merchandise exports alone grew by 6.7 per cent, reaching $35.1 billion compared with $32.89 billion in August 2024.

READ | Trump tariffs push India towards US plus 1 pivot

More significantly, the momentum was broad-based. Electronics, engineering goods, gems and jewellery, petroleum products and pharmaceuticals all recorded healthy gains. Electronic goods exports surged by nearly 26 per cent, a sign of the growing depth of India’s high-value manufacturing capacity. Gems and jewellery rose by more than 15 per cent, petroleum products by 6.5 per cent, and pharmaceuticals by close to 7 per cent.

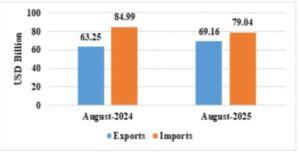

Total trade during August 2025

At the same time, India’s merchandise trade deficit narrowed to $26.49 billion from $ 27.35 billion in July, aided not only by rising exports but also by a sharp 10 per cent fall in imports. Services continued to provide a powerful cushion, with exports climbing to $34.06 billion in August from $30.36 billion a year earlier. The services trade surplus for April-August stood at nearly $81 billion, up from $68 billion last year. This combination of strong merchandise exports and a widening services surplus underscores the resilience of India’s external sector.

Merchandise Trade during August 2025

The impact of Trump tariffs

These achievements are all the more remarkable when placed against the backdrop of punitive US tariffs. President Donald Trump’s decision to raise duties to 50 per cent on a range of Indian goods was a clear act of trade aggression, justified in Washington as a response to India’s continued purchase of Russian oil. The immediate effect was visible in shipments to the US, which fell from $8.01 billion in July to $6.86 billion in August. The decline was most pronounced in labour-intensive sectors such as textiles, leather, gems and jewellery, and seafood—industries that employ millions in small towns and semi-urban clusters.

Merchandise Trade during April-August 2025

Economists have already begun to quantify the damage. Moody’s has projected that the tariffs could shave around 0.3 percentage points off India’s GDP growth, while the Chief Economic Adviser has warned that the loss could be closer to 0.5-0.6 percentage points. The costs will not be evenly distributed. Exporters of petroleum products, pharmaceuticals, and electronics are relatively insulated, while smaller producers of labour-intensive goods face a far harsher reality. The danger is not just the immediate loss of revenue, but the possibility that Indian firms could permanently lose market share if competitors from Vietnam or Bangladesh secure long-term contracts in the US market.

Diversification in motion

Yet, the August data also suggests that Indian exporters are already adjusting. Shipments to markets outside the United States have gained momentum, with notable increases to the United Arab Emirates, Hong Kong, China, and Germany. These markets are absorbing part of the output that might otherwise have gone to America. In the April-August period, while the US remained India’s largest export destination, the contribution of other economies to incremental export growth was unmistakable.

The diversification is not only geographic but also sectoral. Non-petroleum, non-gems and jewellery exports grew strongly, pointing to the emergence of a more balanced product basket. Electronics have become a star performer, benefiting from both global demand and domestic policy support under the production-linked incentive scheme. At the same time, imports of gold, silver and other luxury goods have fallen sharply, reflecting both subdued demand and perhaps the reallocation of resources towards productive sectors. This dual shift in the export-import mix has helped to cushion the tariff shock.

Policy is also nudging the economy in the right direction. Reductions in GST rates on inputs and intermediate goods, combined with efforts to streamline logistics and lower transaction costs, have made Indian firms more competitive. Simultaneously, trade negotiations with the European Union, the United Kingdom, and the Gulf countries are progressing, creating the possibility of securing new preferential market access that can offset losses in the US.

Why tariffs can be offset

There are at least three reasons why the impact of the US tariffs, while serious, need not be devastating. The first is the strength of services exports, which continue to grow at a double-digit pace and provide a large surplus that helps offset merchandise trade losses. The second is the potential for import substitution. As imports of certain goods fall—whether due to higher prices or supply adjustments—domestic producers are stepping in to meet demand, which over time will strengthen backward linkages and create competitiveness in global markets.

The third is the emergence of new destinations for Indian exports. Asia, the Middle East, and parts of Africa are becoming reliable absorbers of Indian goods, even as developed markets remain under strain.

This does not mean that all risks are contained. Small and medium enterprises in textiles, jewellery and leather are especially vulnerable. For them, the loss of orders is not a temporary inconvenience but an existential threat. If government support is not timely, many may close, leaving behind unemployed workers and distressed families. The rupee has also weakened under the pressure of tariffs and capital outflows, raising the cost of imports and debt servicing. Inflationary pressures are another concern, particularly if domestic substitutes for imports are costlier than global supplies.

Turning challenge into opportunity

The response, therefore, must be both immediate and long-term. In the short term, relief must flow to vulnerable sectors. Export credit must be made more accessible, export incentives disbursed without delay, and logistics bottlenecks cleared. These measures will give smaller firms a fighting chance to ride out the turbulence. In parallel, negotiations must intensify with partners in Asia, Europe, and the Gulf to accelerate free trade agreements that can open alternative markets. Diplomacy should also be used to challenge unfair measures at the World Trade Organisation and to secure exemptions where possible.

In the medium to long term, India must persist with upgrading the product mix. More investment in electronics, pharmaceuticals, speciality chemicals, and engineering goods is necessary if exports are to move up the value chain. Branding, design and research and development must accompany production, so that Indian exports are not confined to low-margin segments. Domestic reforms—whether in labour laws, land acquisition, or regulatory approvals—must continue to reduce costs and increase competitiveness. Infrastructure investments in ports, roads, cold storage and logistics must remain a priority, as must the maintenance of macro-economic stability through prudent currency and reserve management.

The August trade data demonstrates that India’s export economy is not fragile. On the contrary, it has the capacity to expand even in the face of external shocks. The imposition of tariffs by the United States is undoubtedly disruptive, but it need not be crippling. With careful diversification of markets and products, coupled with targeted government support and strategic trade diplomacy, India can protect vulnerable sectors while continuing to climb the ladder of global trade. What external headwinds threaten, sound policy can overcome. The challenge is real, but so too is the opportunity to emerge as a more diversified, more competitive, and more resilient export powerhouse.