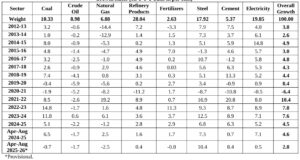

India’s eight core sector industries, which account for 40% of the Index of Industrial Production (IIP), are both suppliers of essential inputs and bellwethers of the economy’s health. In August 2025, they recorded their fastest growth in over a year, expanding 6.3% compared to a year earlier. The rebound followed a slowdown to 3.7% in July and a contraction of 1.5% in August 2024, according to the commerce ministry.

The surge was led by coal, fertilisers, and refinery products, while oil and gas continued to drag on the index. Coal output jumped 11.4% after a steep 12.3% contraction in July. Fertiliser production rose 4.6%, and refinery products grew 3% after a decline the previous month. Steel expanded 14.2%, slightly slower than July’s 16.6%. Cement and electricity saw steady gains of 6.1% and 3.1%, respectively. Crude oil fell 1.2% and natural gas 2.2%, though both declines were less severe than in July.

Economists note that much of the momentum reflects a low base. Aditi Nayar of ICRA expects IIP growth for August to be in the 4.5–5.5% range, aided by mining. Madan Sabnavis of Bank of Baroda pointed to strong infrastructure demand, with construction activity likely to rise post-monsoon and fertiliser output gearing up for the rabi sowing season.

READ I Doha Summit exposes OIC’s powerlessness against Israel

Manufacturing surveys show resilience

Private surveys also suggest an upbeat outlook. The HSBC India Manufacturing PMI, compiled by S&P Global, climbed to 59.3 in August, its highest in 17 months. The index signalled robust output, new orders, and job creation, since any reading above 50 marks expansion. The contrast between the mixed performance of core sectors and the buoyant PMI highlights the uneven nature of India’s industrial recovery.

Despite the August rebound, industrial growth in April–July slowed sharply. Output rose only 2.3%, less than half the pace of a year earlier. This underlines the fragility of the recovery. Weak consumer demand, high borrowing costs, and global uncertainty continue to hold back momentum. The stronger performance in core sectors does not offset the softness elsewhere.

Why core sector growth matters

The eight industries are critical to India’s economic engine. Coal production feeds directly into power generation and industrial activity. Cement and steel underpin construction and infrastructure projects. Fertilisers are vital for agriculture. Growth in these inputs often precedes broader gains in manufacturing and services. The August revival therefore matters not just statistically but for its wider economic ripple effects.

The optimism in August is tempered by three risks. First, the growth is flattered by last year’s weak base. Second, gains remain uneven, with hydrocarbons dragging even as coal and steel surge. Third, overall IIP growth at just 2.3% in the first four months of the year reflects a broader slowdown.

Annual growth rates of India’s core industries

India’s dependence on coal offers short-term relief but raises long-term concerns. Power sector reforms remain incomplete, with unresolved issues of grid integration, distribution losses, and financial stress at state utilities. Without structural fixes, industrial growth could plateau despite near-term gains.

Policy imperatives for sustained growth

The government’s infrastructure spending will continue to drive demand for steel, cement, and coal in the coming quarters. But this is not enough. A durable recovery requires broad-based consumer demand, deeper manufacturing diversification, and an energy mix less reliant on fossil fuels. Sustained industrial momentum will depend on investment in efficiency, innovation, and policy reforms that unlock bottlenecks in power and logistics.

India cannot afford complacency. The core sector’s bounce is a positive signal, but the economy needs a synchronised revival across sectors to build a resilient and sustainable industrial base. Growth driven by base effects and a handful of industries will not suffice. What is required is a durable, broad-based recovery anchored in structural reform.