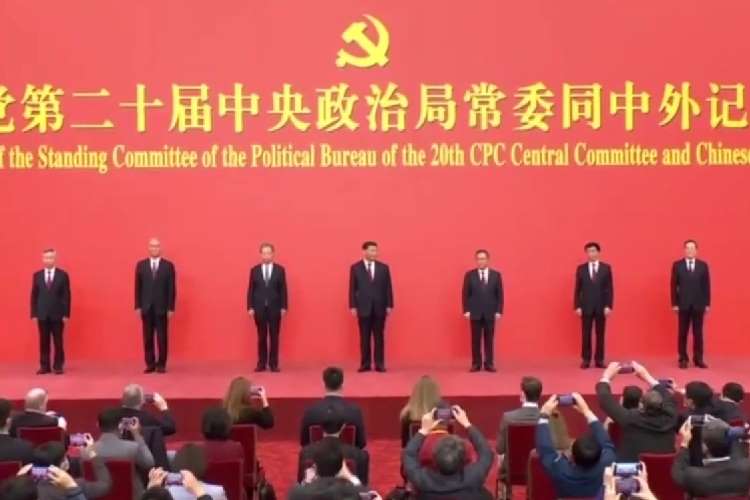

Chinese economy faces headwinds: Xi Jinping has secured a third term as the general secretary of the Chinese Communist Party at the 20th party congress ended on Sunday. The Chinese president consolidated his power by forcing his rivals into retirement and filling the vacancies with his loyalists. The party Congress saw a major reshuffle of economic and financial leadership and adopted development security, technological self-reliance and common prosperity as the guiding principles for the next five years.

Xi’s leadership saw China’s ascent as a global power – from the world’s factory to a global leader in technology and a military power that can challenge the US. The biggest challenge for the new team is to revive the slowing economy and protect it from a possible recession that threatens to derail the Western economies.

READ I Chinese economy: Experts see growth engine cranking up soon

Chinese economy faces crisis

Xi’s new team will have to grapple with a series of crises – the economy is facing a fall in factory output because of the country’s strict No Covid policy and global headwinds. It is also facing a possible banking collapse and a real estate bubble that could snowball into a severe crisis. China’s GDP growth was just 0.4 in the second quarter and the economy is expected to miss the 5.5% target set for the whole year.

China’s big city suburbs are littered with unfinished projects. Evergrande, China’s second largest property developer, is the most indebted real estate company in the world. Abandoned projects with rows of empty concrete shells, and unoccupied buildings symbolise the troubles of the world’s second-largest economy.

The IMF has cited the slowing Chinese economy as one of the three major threats to the global economy along with the Ukraine crisis and runaway inflation in most economies. The multilateral lender has cut China’s GDP growth forecast for 2022 to 3.2% compared with a growth rate of 8.1% in 2021. For 2023, IMF has projected a lower growth rate of 2.7%. If China clocks lower growth rates than the targeted 5.5%, it will have a major impact on the world economy.

Falling exports poses problems

The biggest challenge for the new economy team is the declining exports. China’s emergence as a global economic powerhouse has a lot to do with the export-led growth strategy followed by China.

Chinese exports rose 7.1% in August compared with the same month last year to $314.9 billion, the lowest since June 29 if the fall during Covid months are excluded. Exports growth fell way below July’s 18%. Fell in exports growth is partly because of the fall in factory output which was hit by the severe heat wave and drought in August. The Chinese government’s strict lockdowns to curb Covid-19 flare-ups will affect the factory output further.

The biggest worry is the slowing growth rate in exports to some of China’s largest trading partners. Shipments to the European Union rose by 11.1% in August from a year ago, below the 23.1% gain in July. Exports to the US shrank by 3.8% compared with a 11% rise in July. China’s trade surplus fell for the first time since February to $79.39 billion in August. The surplus stood at $101.26 billion in July.

Imports also stunted, growing at 0.3% in August to $235.5 billion, the weakest growth since April. Imports have grown 2.3% increase in the previous month. Poor trade figures posted by China in August had rattled the financial markets across the world.

In the 20th National Congress of the Chinese Communist Party, Xi defended China’s zero-Covid policy. While most world nations lowered the guard against the Covid-19 pandemic, China continues to maintain a strict zero-Covid policy that promotes massive testing and strict lockdowns when cases are detected. In September, more than 30 cities with a population of 65 million have total or partial isolation in place. China still has quarantine up to 10 days for people entering the country.

The weakening of yuan also failed to give an impetus to Chinese exports. The yuan lost 0.36% to 6.98 a dollar and is threatening to breach the crucial 7 a dollar mark. With slowing domestic and global demand, Chinese economy will continue to struggle, posing challenges to Xi and his economy team.