In recent years, Bitcoin has made the leap from being a speculative “alternative asset” to becoming a genuinely integrated financial instrument within the mainstream capital markets and institutional ecosystem. This transition matters for portfolio design, financial regulation, monetary policy and systemic risk. Recognising this shift is crucial for policymakers seeking to engage with the digital-asset frontier in a measured, effective way.

When Bitcoin emerged in 2009 it was posed as a decentralised, peer-to-peer digital currency, an alternative outside the conventional banking and capital market system. Over the 2010s it attracted speculative retail investors, was treated largely as a volatile “crypto play” and operated in regulatory grey zones. Academic reviews from as late as 2021 still described it as a novelty in economics and finance. However, starting around 2022–2025 a clear transformation is underway: institutional ambition, regulatory progress, expanding infrastructure and links to traditional assets are aligning to make Bitcoin more mainstream.

READ I AI in education: ChatGPT has changed homework forever

Institutional adoption and market integration

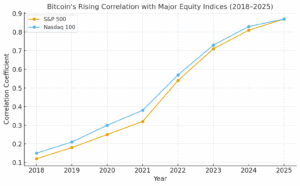

A key indicator of this transition is the rising correlation between Bitcoin and conventional equity or financial-market indices. A recent study finds that Bitcoin’s correlation with the Nasdaq 100 and S&P 500 rose to as high as 0.87 in 2024, driven by the launch of spot Bitcoin ETFs and corporate treasury holdings. This degree of co-movement implies Bitcoin is no longer just a “stand-alone” speculative asset but is becoming part of diversified portfolios, subject to the same swings as equities and thus to mainstream risk-factors.

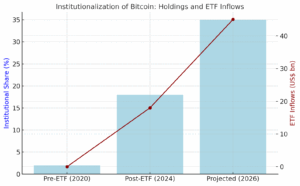

Another line of evidence: a comprehensive survey of finance-literature finds that Bitcoin now exhibits traits of both speculative and safe-haven assets — paradoxically — but importantly is treated as a “legitimate financial instrument” rather than simply a curiosity. On the institutional-adoption front, recent commentary shows that regulation is unlocking vast pools of capital: one estimate suggests that unlocking even 2-3 % of global institutional assets could channel $3-4 trillion into digital-asset investment. Together these point to structural shifts: from retail-only, from speculation-only, from isolated to integrated.

Implications for diversification, risk and portfolio strategy

This shift carries significant implication for portfolio design and risk-management. Earlier analyses treated Bitcoin as a low-correlation diversifier; the new high-correlation evidence means that this assumption needs revision. Portfolios that included Bitcoin as “uncorrelated” may no longer enjoy the intended hedge.

Furthermore, structural research finds that Bitcoin price shocks explain 18 % of equity price fluctuations and 27 % of commodity fluctuations over longer horizons. Such spill-overs underline that Bitcoin is now a systemic factor rather than a niche one.

For corporate treasuries too: research on firms holding Bitcoin shows an average beta of 0.62, and in some cases greater than 1, meaning the asset’s behaviour aligns closely with that of equities or risk assets. Hence the myth of Bitcoin as “disconnected from markets” no longer holds; its fortunes are increasingly tangled with the broader financial ecosystem.

Global comparisons and regulatory context

Looking globally, the transition is uneven but visible. For instance, banks in countries with advanced innovation capacity and financial inclusion are more likely to hold cryptocurrency exposures. The Bank for International Settlements (BIS) finds that this “shadow crypto-financial system” is increasingly interconnected with mainstream banking.

Meanwhile regulatory frameworks are advancing: the EU’s Markets in Crypto‑Assets Regulation (MiCAR) went live in January 2025, giving digital-asset firms clearer legal footing; U.S. regulatory shifts around ETFs and banking participation are opening institutional gateways. In contrast, some central banks remain cautious: for example, a board member of the Czech National Bank said Bitcoin’s volatility and evolving institutional behaviour make it unsuitable for reserves. These variations illuminate that Bitcoin’s move into the financial mainstream is not yet uniform, but the trend is clear and accelerating.

From alternative asset to embedded financial instrument

The key pivot is this: formerly Bitcoin was treated as an alternative asset — outside mainstream finance, uncorrelated, speculative. Today it is morphing into an embedded financial instrument — accessible by institutional investors, linked to equity markets, part of portfolio strategies, subject to regulation and systemic interactions. The shift is more than semantic.

This re-definition matters for policymakers. Treating Bitcoin as peripheral ignores the potential contagion channels, regulatory arbitrage and systemic risks. Recognising it as part of the financial architecture means regulation, oversight and infrastructure must evolve accordingly.

Takeaways for India and beyond

For an economy such as India’s, this evolution carries distinct policy imperatives. First, regulators must update frameworks for digital-asset inclusion in institutional portfolios, ensuring prudent access rather than outright denial. The old paradigm of crypto as purely retail, speculative needs replacement.

Second, risk-management infrastructure must evolve: stress-testing portfolios that include Bitcoin, evaluating hedging strategies in light of higher correlation and systemic spill-overs. Third, financial-inclusion objectives (which cryptocurrency originally promised) must not ignore regulation. A Bangladeshi-style unregulated proliferation is no substitute for robust oversight. Fourth, global interoperability and cross-border issues matter: as digital-asset flows transcend jurisdictions, India must collaborate on international standards and regulatory cooperation.

Bitcoin’s journey from outsider to insider demands a policy shift from prohibition or ignorance to engagement and governance. Doing so will permit harnessing the innovation and investment-opportunity while safeguarding the integrity and stability of the financial system.

Bitcoin’s transition from alternative asset to integrated financial instrument is more than market-speak—it is a structural change in how the world’s capital markets, institutions and regulators interact with digital assets. Policymakers ignoring this evolution do so at their peril. The time has come to build frameworks that reflect Bitcoin’s new role—not as crypto hobby-horse, but as bona fide financial instrument requiring inclusion, regulation and oversight.