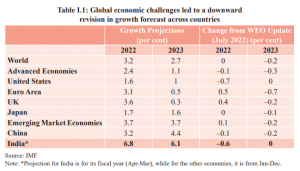

The Budget Session of Parliament came to life with the release of the Economic Survey for 2022-2023. Presented by Finance minister Nirmala Sitharaman, the Survey expects the Indian economy to grow 6-6.8% for the next financial year despite global headwinds. This is slightly lower than the previously projected 7% as the impact of geopolitical crisis is likely to weigh on global growth. However, India may still remain the fastest growing major economy.

Here is how macroeconomic indicators fared in the current financial year. Major worries for the finance minister would be persistently high consumer inflation and the mounting current account deficit. These numbers will have a bearing on the growth prospects of the Indian economy. The Survey has highlighted other risks such as elevated commodity prices, high interest rates, and a depreciating rupee.

READ | Budget 2023: Indian Railways seeks Rs 2 trillion allocation

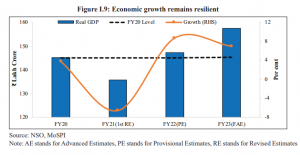

According to the survey, the Indian economy will shine because of five growth boosters viz higher capital expenditure (capex), private consumption, credit growth to small businesses, strengthening corporate balance sheets, and return of migrant workers to cities. Of these, capex is expected to be central to GDP growth. Over past years, the government has provided an increased impetus for infrastructure development and investment through the enhancement of Capex.

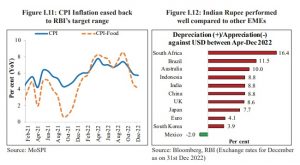

CPI inflation eases; rupee shines compared to peers

The Economic Survey was prepared under the guidance of the chief economic adviser, V Anantha Nageswaran, by the department of economic affairs in the finance ministry. It offers a glimpse into the state of Indian economy in the financial year 2022-23, while offering the outlook for the coming financial year.

Global economic challenges weigh down growth forecast

Inflation remains sticky

The Reserve Bank has projected headline inflation at 6.8% in FY23, which is outside the upper band of 6% in its target range. At the same time, it is not high enough to deter private consumption and also not so low as to weaken the inducement to invest, according to the survey. However, if inflation declines in the upcoming financial year, and if real cost of credit does not rise, then credit growth is likely to be brisk in FY24. Also, the challenge of falling rupee may weigh down inflation outlook.

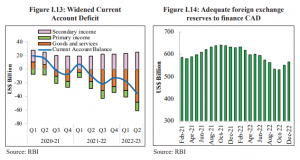

Current account deficit may rise further

The global commodity prices have been on a high ever since the war in Russia and Ukraine broke out. This may continue in the upcoming financial year too, which may cause a further widening of the Current Account Deficit or CAD. The loss of export stimulus is also possible as the slowing world growth and trade shrinks the global market size in the second half of the current year which is not good news for CAD. Current Account Deficit widens when there is lesser influx of the money via exports of goods and services as opposed to a bigger outgo of currency due to imports.

Private consumption and growth

A bright spot for the Indian economy has emerged in private consumption which is expected to remain elevated in the upcoming financial year. Sustained increase in private capital expenditure is imminent with the strengthening of the balance sheets of the Corporates and the consequent increase in credit financing it has been able to generate. The economic output of the country is set to increase by at least four times the amount of capex.

Economic growth remains resilient

States have also stepped up to improve capex plans. Like the central government, states also have a larger capital budget, the survey said. This was supported by the centre’s grant-in-aid for capital works and an interest-free loan repayable over 50 years.

Employment and social infrastructure

As on December 31, 2022, a total of over 28.5 crore unorganised workers have been registered on eShram portal, a government database for unorganised workers. Labour markets have recovered beyond pre-Covid levels, in both urban and rural areas, with unemployment rates falling from 5.8% in 2018-19 to 4.2% in 2020-21.

In the social infrastructure too, India has improved significantly with an increase in Gross Enrolment Ratios (GER) in schools and improvement in gender parity. GER in the primary-enrolment in class I to V as a percentage of the population in age 6 to 10 years – for girls as well as boys have improved in FY22. The survey also cited the findings of the 2022 report of the UNDP on Multidimensional Poverty Index which says that 41.5 crore people exited poverty in India between 2005-06 and 2019-20.

Clean energy gives hope

India has been leading the charge against climate change with a switch to renewable sources of energy and the efforts are expected to continue in FY24 as well. In fact, India is being seen as the most important nation in the fight against rising global warming and whatever the nation does to cut down on greenhouse emissions will be followed by other countries too, experts believe. The government, along with the private sector, has progressively worked towards increasing the share of renewables which in future is expected to deliver dividends. A gradual but calibrated energy transition is likely, meeting the country’s sustainability targets and giving primacy to its national developmental goals.

Climate change mitigation

India declared Net Zero Pledge to achieve net zero emissions goal by 2070. The country achieved its target of 40% installed electric capacity from non-fossil ahead of its target of 2030. Further, the National Green Hydrogen Mission will enable India to be energy independent by 2047. The country has also become a favoured destination for renewables with investments in seven years standing at $78.1 billion.

Silver linings

Going ahead, there are two silver linings for the Indian economy. With a possibility that there will be subdued global growth, oil prices will also stay low, which is music to the ears of any government relying heavily on crude imports to meet its energy demands and who is also facing a widening CAD. This means the overall external situation will remain manageable for the government and policymakers. Further, the agriculture and allied sector has also been promising for the Indian economy over the past several years and the upcoming year will be no different.