Will India face recession in 2023? This would be the biggest question on everyone’s mind as finance minister Nirmala Sitharaman prepares to present Budget 2023 on February 1. While economists and industry leaders believe that the Indian economy is resilient to global developments, there is a lurking fear, especially when there is news of layoffs by large multinational companies.

With a global recession looming large and with high inflation and unemployment already affecting large economies such as the US and Europe, the common man waits with bated breath for the upcoming Budget with the hope that the government will bring in measures to insulate the Indian economy from global risks. From the tax perspective, there are some fundamental changes that the government should consider to sustain the growth momentum of the current year and for reaching the targeted growth despite the global headwinds.

READ I Budget 2023: Needed — a long-term roadmap for urban infrastructure

Income tax rates and slabs

From an individual tax perspective, the tax slabs and rates have remained unchanged since FY 2017-18 and the new tax regime (optional) that the government introduced in FY 2020-21 doesn’t seem to have found favor with taxpayers; majority of them have continued to opt for the old tax regime. The government should consider raising the basic exemption limit from Rs 2.5 lakh to Rs 5 lakh and also reduce the tax rate for taxable incomes above Rs 10 lakh to 25% which would broadly be in line with the headline rate for companies.

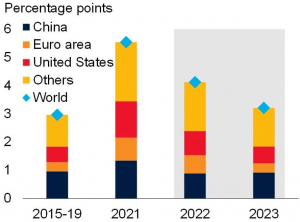

India annual GDP growth

Global economic growth trends

Further, there has been long-standing demand to increase the deduction under section 80C from Rs 1.50 lakh to at least Rs 3 lakh as this limit was last revised in the 2014 Budget. Additionally, to incentivise savings and boost fund flow to the economy, the cap should be increased further to Rs 5 lakh for taxpayers with income above Rs 10 lakh and requiring the higher amount excess over Rs 3 lakh (or Rs 1.50 lakh if this remains unchanged) to be invested in equity linked saving schemes, as that would be beneficial for both the taxpayer and the economy.

Gifts can be received tax free up to Rs 50,000 and on occasion of marriage, without any cap, and in certain situations, amounts from tax approved trusts. Where an amount is received by family member of a deceased, the amount in excess of Rs 50,000 is taxable. On compassionate grounds, family and friends, employer / fellow colleagues usually come together to pool resources, to support the family and the amount so received should also be exempted from tax as in case of amounts received during Covid pandemic and on occasion of marriage.

READ I Budget 2023 will raise social sector spending despite fiscal constraints

Budget 2023 and corporate tax reforms

For companies, the government of India has, in recent years, brought in various tax relief measures from the slashing of corporate tax rate from 30% to 22% to offering reduced 15% tax rate for new manufacturing companies along with a host of other incentives. However, the need of the hour is to boost India’s manufacturing capabilities by incentivising R&D.

Globally, as countries compete to promote themselves as manufacturing hubs and R&D centers, Taiwan has become the latest nation to allow local chipmakers to turn up to 25% of their annual research and development expenses into tax credits to incentivize domestic manufacturing. India too should introduce special incentive schemes, formulate credit mechanism or re-introduce the erstwhile weighted deductions across all sectors and not just limit them to specific sectors.

Over the past few years, compliance burden has increased tremendously for taxpayers, especially from a withholding tax perspective. The objective of deduction and collection of tax at source is to track recipients of income and to ensure it does not escape taxation.

Over period, TDS / TCS provisions have become quite complex in terms of taxing single transactions under TDS as well as TCS (such as the purchase of goods under section 194Q as well as under section 206C), levying TDS / TCS on high-value transactions which are typically taxed in the hands of the payer/ receiver (being registered taxpayers), penalising and prosecuting the deductor even on small defaults. Therefore, there is a need to revamp the current TDS /TCS provisions for simplifying the tax collection regime and reduce the tax compliance burden on the taxpayer.

Needless to mention, simplification and rationalisation of the current capital tax regime which has become too complex owing to different tax rates depending on different asset classes, holding periods, and other factors, is long overdue and may be addressed in this Budget.

Apart from this, in today’s environment of uncertainty where the majority of M&A deals especially involving start-ups have a clause for earn-out payment or contingent consideration, the same are sought to be taxed in the year of share transfer while no real income has accrued. In the interest of principle of parity, it would be reasonable to tax such contingent consideration only in the year of receipt of consideration.

In the end, there are expectations galore from Budget 2023 and the latest provisional direct tax collections released recently clearly reflect the good year we had so far. While there may be apprehensions for bigger economies heading towards recession in 2023, the Indian economy is expected to be resilient to such global pressures and seems to be headed toward a decent growth in the year ahead.

(Promod Batra and Rahul Arora work with Deloitte Haskins and Sells LLP.)