Union Budget 2022: With growing urbanization, citizens expect faster, safer, energy-efficient, economical, and cleaner connectivity modes. Authorities have addressed the challenge and the country has witnessed an unprecedented push towards asset creation across various infrastructure sectors.

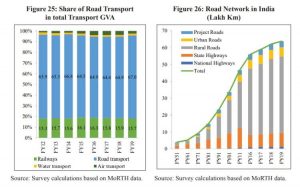

The National Highways Authority of India targeted the construction of around 4,600 km of National Highways in FY 2021-22. A similar spate was observed in village roads with the addition of approximately 18,000 km in FY22 under the ambitious Pradhan Mantri Gram Sadak Yojana.

While infrastructure asset creation is essential to economic growth, it is equally prudent to ensure effective maintenance and utilisation of assets – a critical component in this vision being prioritisation of routine maintenance and mainstreaming of a scientific approach towards asset management.

Studies conducted by the International Labour Organisation (ILO) suggest that a timely investment of one rupee on the maintenance of road infrastructure saves over three rupees in the long run. Yet, India allocates around 1% of the total infrastructure budget for maintenance, compared with about 51% assigned by the US for improving the condition and performance of highways.

READ I Indian economy 2022: Striving for self-sufficiency, growth

Budget 2022 to focus on asset maintenance

Considering the strategic importance of timely maintenance, it may be imperative that the government adopt innovative strategies to ensure the area gets the needed push. In this budget, the government may contemplate increasing the funding for maintenance and prioritising maintenance over construction for a specified period to preserve the assets already constructed. Some more strategies that may be considered in the area include:

- Adopting innovative contracting models such as an output performance based system of asset management to ensure that the infrastructure created is in optimal condition throughout its useful life

- Developing policies for state and regional authorities to prioritise and plan asset management models to ensure that the assets maintenance is prioritised as per condition and future requirements

- Giving an impetus to environment-friendly and cost-effective technologies to ensure faster and greener asset maintenance/management

- Dovetailing various schemes for integrated results, e.g. MNREGA funds for asset maintenance.

Budget 2022 must focus on demand, jobs, reforms

While the above investments are bound to be cost-effective in the long run, they may increase the short-term burden on the exchequer. To address the fund constraints, the Budget 2022 could consider a more tax-efficient and user-friendly mechanism like allowing tax benefits in Infrastructure Investment Trust (InvIT) to initiate retail participation in the instruments and eventually scale up the investor base.

While InvITs are pooled investment vehicles that draw institutions and wealthy individual investors with returns from underlying assets such as the toll road, they have demonstrated their capabilities to attract diverse players and have attracted two international pension funds — Canada Pension Plan Investment Board and Ontario Teachers’ Pension Plan Board — in the recent past. These can be further expanded and bundled to include maintenance of multiple assets.

Similarly, in the previous budget, the government launched National Monetisation Pipeline (NMP) as a roadmap to monetise various brownfield infrastructure assets. Roads, railways, and power sector assets combined account for over 66% of the total estimated value of the assets planned for monetisation.

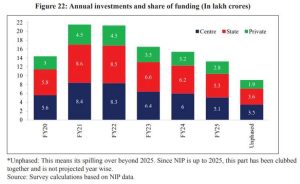

While it is envisaged that the funds generated from monetisation will act as an alternative financing instrument for the creation of new infrastructure planned under the National Infrastructure Pipeline (NIP) across the country, the government may consider allocating a portion of the funds for asset maintenance as well.

To accomplish the objectives of the NMP scheme, the Budget 2022 may implement NITI Aayog’s proposal to bring InvITs under the ambit of the Insolvency and Bankruptcy Code (IBC) to attract retail and institutional investors. Since these trusts are not considered as legal persons, the IBC regulations are not currently applicable for InvIT Loans, deterring lenders from participation. Bringing them under the IBC purview will give an added level of comfort for investors.

(Pranavant is Partner, Vishal Gupta is Director, and Rahul Pandey is Associate Director with Deloitte Touche Tohmatsu India.)