By Rajeshree Sabnavis and Mansi Sanghavi

Unlike the previous budgets where the finance minister had to follow the conventional budget making exercise of allocating scarce funds to various sectors, Budget 2021 was anticipated keenly by all stakeholders who expected one like “no other”. The once in a century phenomenon of Covid-19 hit the global economy hard in 2020, and countries came up with stimulus packages to tide over the crisis triggered by the pandemic.

The health sector cornered the lion’s share of the resources made available to fight the economic crisis, forcing the governments to raise money from the market to fund infrastructure, skill development, agriculture, banking and education. India too, like other countries, suffered the economic blow in 2020. Budget 2021 was an opportunity to put the economy back on track and to trigger a V-shaped recovery.

READ I Labour reforms: What do the 4 labour codes mean to businesses, workers

Healthcare, which emerged as the top priority in the current financial year (2020-21), witnessed an allocation of more than Rs 2 lakh crore in 2021-22, more than twice in the previous year. Apart from the health sector, the finance ministry has given utmost importance to infrastructure sector in Budget 2021 by allocating Rs 5.54 lakh crore, despite an expected fall direct and indirect taxes. This move is much appreciated as it will generate additional employment, reduce the income gap and eventually increase the spending capacity of individuals leading to a virtuous circle of economic growth. The Budget should also have offered tax benefits on research and development spend, given its thrust on Innovation as one of the six pillars.

Financial sector reforms in Budget 2021

Financial markets had reasons to cheer. What needs to be seen is the effective implementation of the plans and policies. The government and the corporate sector have time and again stressed on the importance of attracting foreign investments into India. Raising of the FDI limit in insurance sector to 74% from 49% is a welcome move. Further, 100% tax exemption on income of Sovereign Wealth Funds and Pension Funds earned from investment in Indian infrastructure will certainly encourage foreign investors.

READ I Budget 2021: Monetisation of land key to fiscal consolidation, not spending cuts

The proposal to consolidate and streamline the provisions of four Acts — The SEBI Act, 1992; Depositories Act, 1996; Securities Contracts (Regulation) Act, 1956; and Government Securities Act, 2007 — into a single Securities Market Code will not only ease the compliance burden on market participants, it will also reduce the need for multiple registrations and reduce disputes on overlapping subjects. The government’s plan to establish a regulated gold exchange will be achieved by notifying SEBI as market regulator and setting up warehousing facility to facilitate an effective commodity market ecosystem.

Focus on banking reforms

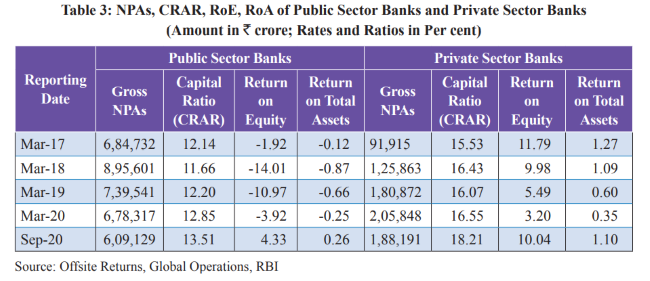

India’s public sector banks have been suffering from huge amounts of provisioning and write-offs. The government has now set out on a mission to clean bank books for a fresh start by allowing ARCs and AMCs to consolidate and take over stressed assets. This will help the banks tide over the liquidity crisis, however, it would be interesting to see how swiftly realisation of value materialise. An additional effort has been made to revive stressed public sector banks by recapitalising them by Rs 20,000 crore.

READ I Technology and business growth: Seven guidelines for small and medium enterprises

Creating a new investment space for private sector in the areas where the government held a near monopoly is surely one of the many positives of Budget 2021. The Narendra Modi government’s disinvestment and strategic sale policy clearly lays down a roadmap for such divestment, which will eventually lead to better management, inflow of private capital, and technological upgradation.

The country was spared of the pre-budget fears of an increase in tax rates for corporates and HNIs, increase in long-term capital gains tax and levy of an additional Covid cess. In the overall evaluation, Budget 2021 has more positives than negatives. The government seems to be firm on its commitment to revive the economy from the current crisis.

(Rajeshree Sabnavis is founder of Rajeshree Sabnavis & Associates, a Mumbai based tax consultancy firm. Mansi Sanghavi is manager, Rajeshree Sabnavis & Associates. Views are personal)