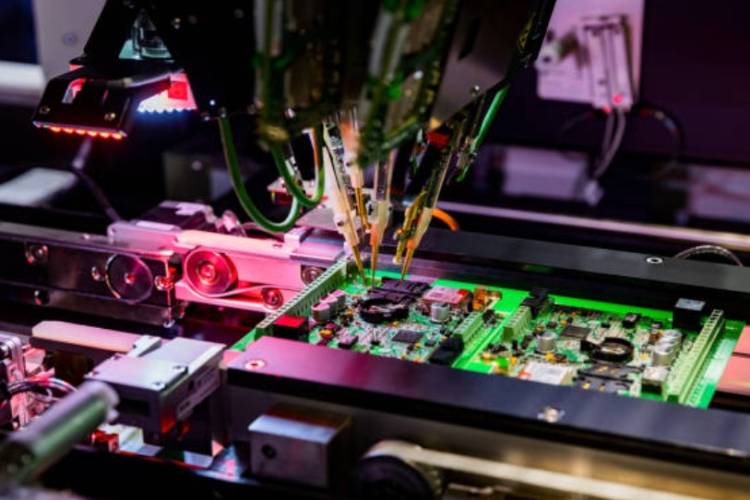

India’s remarkable ascent in smartphone manufacturing stands as a testament to its growing manufacturing capabilities. Over the past decade, India is increasingly becoming a larger player in electronics manufacturing and risen up in the global electronics value chain.

To put things into perspective, India is the second largest manufacturer of smartphones globally, only second to China. Furthermore, India has emerged as the largest exporter of smartphones to the United States, surpassing China, with its share of American smartphone imports surging from 13% in 2024 to 44% in 2025. Domestically, Indian smartphone manufacturing value has risen 28-fold from 18,000 Crore INR in 2014-15 to 5.45 Lakh Crore INR in 2024-25.

READ | Skilled migration threatens to derail Viksit Bharat dream

India’s success in smartphone manufacturing hinges on both its sound policy framework as well as global geopolitical tailwinds. India has found itself nestled between the geopolitical trend of diversifying production outside China and policy reforms by the government aimed at bolstering domestic manufacturing.

How are government policies strengthening Indian electronics manufacturing?

One of the most important policy reforms instrumental in strengthening the Indian electronics manufacturing sector is the Production Linked Incentive (PLI) Scheme brought out by the Government of India. In March 2020, as a part of the Atmanirbhar Bharat Initiative, 1.97 Lakh Crore INR budget was allocated towards PLI schemes across various sectors over a span of five years.

Production Linked Incentive scheme works by providing financial incentives to firms that produce an additional output over and above what they produced in the previous year as opposed to traditional industry subsidy policies. If a firm produces more this year than the year before, it will be rewarded by the government by a subsidy worth a percentage of the additional output produced this year.

Such a subsidy provision structure bolsters Indian manufacturing in the target sectors in many ways. Firstly, the scheme rewards subsidies based on additional output produced which provides a predictable revenue stream for firms. Secondly, the Production Linked Incentive policy spreads the disbursement of subsidy over 5 years. Being structured in this way, the scheme incentivises manufacturers to increase their production. This would cause firms to invest more in new capital equipment and modern technology and thereby undertake long term investment in the Indian manufacturing ecosystem.

Notably, since the Production Linked Incentive scheme was announced in March 2020, it has already attracted 1.76 Lakh Crore in long term private sector investments even before much of the allocated PLI subsidy has been disbursed. As a result of these private investments pouring into the domestic smartphone manufacturing sector, India’s smartphone value addition has jumped from 12% to 20% over the last 5 years.

Furthermore, unlike traditional industrial subsidies, the Production Linked Incentive scheme fosters competition and efficiency. Blanket support to domestic industries usually makes them less efficient as it shields them from foreign competitive pressures. Thus, such subsidy policies mostly fail to make domestic industry more competitive internationally. However, production linked incentives do not provide blanket support to the domestic electronics manufacturing and export sector. Instead, it rewards the subsidy based on the additional output produced.

Also, as firms expand their production, they increase their procurement of capital equipment and raw materials which establishes a network of smaller suppliers and logistics providers. Production Linked Incentives also foster the development of ancillary industries and help build a domestic supply chain ecosystem helping push India further up the global electronics value chain.

Geopolitical factors that are driving Indian electronics manufacturing sector

Rising tensions, trade war and souring relations between the West and China has also played a major role in the recent rise of Indian electronics manufacturing and export sector. Due to the Chinese industrial overcapacity, the lack of transparency and intellectual property theft, Western investors and policymakers are becoming increasingly wary of investing in China as well as relying on China for critical supply chains. Thus many multinational companies are diversifying their manufacturing bases away from China and into India as a part of their “China + 1” strategy.

A notable example of the shift in the geopolitical environment benefitting Indian electronics manufacturing sector is Foxconn. Foxconn is the world’s largest manufacturer of electronics including Apple’s products. In response to simmering Western and Chinese tensions, Foxconn has increasingly invested and expanded its production footprint in states like Tamil Nadu. Foxconn’s move resembles the broader sentiment amongst electronics manufacturers that are now preferring to manufacture in India over China.

Policy Reforms Have Helped but Challenges Remain

Indeed, India’s rise in smartphone manufacturing has been remarkable. However, policy reforms implemented so far may not be sufficient to catapult India higher up the global electronics value chain.

India’s value addition from smartphone manufacturing still falls short of that of China, underscoring the necessity for India to deepen its component ecosystem, invest in semiconductor manufacturing and enhance domestic electronics & chip R&D capabilities

The Government of India has brought about schemes like SPECS (Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors) and ECMS (Electronics Component Manufacturing Scheme) to help develop a robust domestic component system. However, the effectiveness of these schemes in deepening India’s component system, to an extent, is held back by high material and logistics costs, high and complex tariff slabs, lack of domestic electronic R&D capabilities and labour market tech skills gap. Furthermore, high capex, low turnover-to-investment ratio feature of component manufacturing and high gestation periods makes it less attractive to investors resulting in a somewhat underdeveloped domestic component manufacturing ecosystem.

The Road Ahead

The growth of the Indian electronics manufacturing sector underscores the success of government policies like Production Linked Incentives and liberalization reforms. These initiatives have attracted substantial private investment internationally and successfully positioned India as a competitive alternative to China in global supply chains. However, there still exist challenges that could potentially limit India’s ability to rise further up the global electronics value chain.

India must focus on, firstly, to rationalize its tariff structure by lowering and simplifying its tariff slabs especially for crucial input materials and intermediate goods for component manufacturing. Secondly, India must invest in high quality transport and logistics infrastructure under PM Gati Shakti to reduce transport time and cost. These policies, together, can reduce cost of production for component manufacturing, thereby making India a more attractive destination for investments in component manufacturing.

Furthermore, India can focus on expanding corporate tax deductions for R&D expenditure, especially in AI, chips and electronics to bolster domestic R&D capabilities, expand existing GoI schemes like SAMARTH UDYOG and Skill India to reskill Indian workforce with skills required by employers in electronics sector, accelerated depreciation for electronics component manufacturing and extending credit guarantees for electronics components manufacturing. Additionally, to shrink gestation periods and thereby foster investment in electronic components manufacturing, India must simplify land acquisition and environmental clearances through single-window clearance mechanisms and remove bureaucratic hurdles and fast-track factory approvals.

Only with persistent policy reforms and geopolitical tailwinds, India can emerge as a major player in global electronics manufacturing.

Saicharan Mugunthan is a Public Policy intern.

Srinath Sridharan is a strategic counsel with 25 years experience with leading corporates across diverse sectors including automobiles, e-commerce, advertising and financial services. He understands and ideates on intersection of finance, digital, contextual-finance, consumer, mobility, Urban transformation, and ESG. Actively engaged across growth policy conversations and public policy issues.