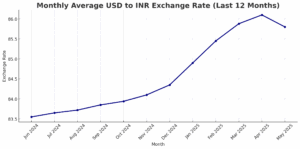

The rupee, after flirting with Rs 85.81 in early trade, ceded ground to finish at Rs 86.08 to the dollar on Wednesday—a modest 0.1% slip from Tuesday, but a telling one. Month-end import payments, a tentative uptick in Brent to $67.8 a barrel, and a firmer dollar index combined to outweigh the lift from buoyant equities and an uneasy Iran-Israel truce. Forward markets registered the stress instantly: the one-year implied yield rose 7 basis points to 1.96% after the Reserve Bank announced fresh liquidity withdrawals.

Strip away the day’s noise and a familiar pattern re-emerges. In the very short run, deft RBI liquidity management can still smooth volatility; over the next few quarters, the unforgiving arithmetic of the twin deficits will set the range; and over the longer horizon, only sustained gains in productivity and institutional reform can keep the rupee from a slow, calibrated decline.

READ I World’s largest data breach spurs rush to passkeys

RBI steadies nerves

Oil continues to write the rupee’s daily script. When West Texas Intermediate settled above $75 on June 18, refiners scrambled for dollars and the currency slipped to Rs 86.48, a two-month low. Yet within a week it staged its best rally as crude fell and safe-haven dollar positions unwound. Foreign investors remained cautious, selling $211.5 million in net equities on June 23.

The RBI steadies nerves through the forwards market. One-year dollar-rupee implied yields jumped 5 basis points to 1.94% on June 25, immediately after the Bank announced a Rs 1 trillion seven-day variable-rate reverse-repo auction to drain surplus liquidity—a clear signal of readiness to deploy reserves and liquidity tools rather than surrender the spot rate.

The arithmetic of deficits

Economics is ultimately arithmetic, not alchemy. The current-account deficit widened to 1.1% of GDP in the first quarter of FY25 as goods imports rose faster than services exports. Each $10 rise in crude inflates the import bill by roughly $13–14 billion and the CAD by about 0.3 percentage points.

On the fiscal side, private-sector projections place the combined Centre-plus-state deficit at about 7% of GDP in FY26—an improvement on the pandemic years, yet still large for a nation that depends on foreign capital to fund investment. A narrower political majority in New Delhi heightens the temptation for populist spending. A recent FX survey now pegs December-end fair value closer to Rs 85.5–86, abandoning earlier hopes of an 84-handle.

If oil averages $85 and the Federal Reserve keeps rates high into 2026, analysts expect the rupee to drift into the Rs 87–88 zone by next year unless exports or inward FDI deliver a positive surprise.

Productivity rise or peril in long term

Think-tank research converges on a simple truth: reserves alone cannot buy enduring strength.

The National Institute of Public Finance and Policy notes that RBI intervention kept the rupee in a narrow band through FY24, but warns the strategy is viable only while capital inflows exceed the CAD. The Observer Research Foundation contends that the “2025 investor realignment” will persist only if India lifts total-factor productivity by embedding into global supply chains and modernising logistics.

Forex reserves, at $698.95 billion for the week ending June 13 2025, are impressive but not impregnable. At the peak of the taper-tantrum in 2013, India lost the equivalent of two months’ import cover in a matter of weeks. A decade later, the bill is bigger: financing three months of imports would now cost roughly $200 billion. Unless India’s share of world merchandise exports rises from 2% to at least 5% by 2035, the rupee will remain on a managed-depreciation path.

Policy will decide the rupee’s fate

Institutionalised energy hedging: A liquid, rupee-denominated crude-oil futures contract would let refiners hedge systematically rather than panic in the spot market each time geopolitics flares.

A credible fiscal glide path: Returning the combined deficit below 6% of GDP within three years will anchor inflation expectations and free monetary policy from fiscal dominance.

Deepening on-shore derivatives: Raising position limits for foreign portfolio investors and market-makers will reduce hedging premia and make the rupee a cheaper currency in which to do business.

Export-linked credit: Extending priority-sector status to tradable services—software, fintech, logistics—would replicate the success of pre-shipment finance that powered merchandise exports in the 2000s.

Credibility first, complacency never

India has weathered worse storms. The 1991 crisis, the 2013 taper-tantrum and the 2020 pandemic all highlighted the same lesson: credibility cushions the rupee better than market heroics. Today’s war-chest of nearly $700 billion is reassuring, but it can evaporate if oil spikes, capital flees to a suddenly generous US Treasury, or domestic politics slips into fiscal adventurism.

The path to a resilient rupee is therefore clear, if not easy: keep the deficit honest, raise productivity through structural reform, and internationalise the currency by invoicing at least a tenth of India’s oil and commodity imports in rupees over the next five years. Should these steps succeed, the currency could test the low-80s by early next decade; should they fail, the rupee will revisit the high-80s long before then.

The choice rests with the government—and the rupee will faithfully record the verdict.