The Securities and Exchange Board of India (SEBI) has been struggling to keep a check on Foreign Portfolio Investors (FPIs) despite tightening the noose around them by slapping stringent norms. This is because the entities that control these FPIs are situated in jurisdictions that do not have clear norms around FPIs. While these entities may have economic interest in the FPIs, they do not exercise control over them. This has created opaque structures around FPIs, leaving the regulator scrambling.

Tax havens are countries that offer foreign businesses and individuals minimal or no tax liability for their bank deposits. Some of these countries such as Mauritius, the Netherlands, Singapore are politically and economically stable, and have lenient laws on taxation. This makes them attractive to corporations and wealthy individuals who want to avoid paying taxes in their home countries. It is estimated that 5.3 trillion pounds, or about 8% of the world’s wealth, is kept in offshore tax havens.

READ | Dedollarisation in action: Nations seek to reduce dependence on the dollar

To improve transparency, Sebi has mandated additional disclosures from FPIs. This is particularly aimed at FPIs with concentrated holdings in a single group. The goal is to address systemic issues and to identify the ultimate beneficial ownership of offshore funds. This is because there are concerns that FPI inflows are being used to conceal ownership of Indian shares by certain entities.

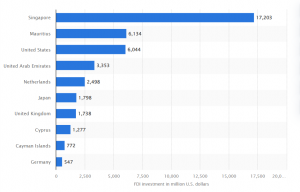

Tax havens major sources of FPI inflows into India

An expert committee appointed by the Supreme Court has previously associated Sebi’s difficulties with the repeal, in 2019, of the 2014 provisions on opaque structures. This made it difficult for Sebi to identify holders of economic interest. The expert committee was also tasked to investigate if there was violation of the minimum public shareholding norms and if there was a failure to disclose transactions with related parties with respect to the allegations raised by the Hindenburg Report.

The Hindenburg Report

In January 2023, Hindenburg Research, a New York-based activist investor group, accused the Adani Group of engaging in accounting fraud and a stock manipulation scheme for decades. The report alleged that the Adani Group artificially inflated stock prices by creating a false sense of scarcity to boost demand. This led to higher prices owing to demand and supply reaction. The report also alleged that the Adani Group had failed to disclose transactions with related parties. The Hindenburg report suggested that the stocks of Adani Group that should be held by the public were offshore funds tied to Adani. The report led to a sudden plummet in Adani Group’s stock prices. Sebi has since launched an investigation into the allegations.

SEBI came under fire for its inability to identify the ultimate beneficiaries of certain FPIs associated with the Adani Group. According to SEBI rules, promoters cannot own more than 75% of a company’s shares, but the Hindenburg report suggested that some of the shares held by the public in the Adani Group were owned by offshore funds tied to the Adani family. This raised concerns that the Adani Group was using these offshore funds to circumvent SEBI’s ownership limits.

SEBI has also been under pressure to regulate FPIs as the Financial Action Task Force (FATF) is set to review India in November 2023. The FATF is an international body that sets standards for combating money laundering and terrorist financing. If FATF finds that India is not doing enough to regulate FPIs, it could blacklist India, which would make it more difficult for Indian companies to raise capital from abroad.

Tax havens a global problem

Tax havens allow companies to avoid paying taxes in their home countries, which can deprive governments of much-needed revenue. In 2020, Amazon was found to have paid zero corporation tax in Europe, despite generating €44 billion in sales income. This was because Amazon had special agreements with the Luxembourg tax authorities that allowed it to shift profits to Luxembourg, where the tax rate is much lower.

READ | NPA crisis: Govt, RBI at odds on loan defaults

The problem with tax havens is that they allow companies to gain an unfair advantage over their competitors. Companies that operate in tax havens can afford to charge lower prices, which can drive out local businesses. This can have a negative impact on the economy.

In recent years, there has been growing international pressure to crack down on tax havens. In 2021, 136 countries, including India, agreed to a global minimum tax rate of 15% for large multinational corporations. This is a significant step forward in the fight against tax avoidance.

However, more needs to be done. Tax havens are still a major problem, and companies continue to find ways to exploit loopholes in the system. Regulators need to be vigilant in their efforts to crack down on tax avoidance, and governments need to work together to ensure that tax havens are no longer a viable option for companies that want to avoid paying taxes.