Indian startups experienced rapid growth just a few years ago, with new unicorns emerging at regular intervals. However, the startup ecosystem in the country seems to be facing a tough time with only three new unicorns emerging in 2023, compared to 24 in the year-ago period, according to the ASK Private Wealth Hurun Indian Future Unicorn Index 2023. This decline in new unicorn additions highlights a slowdown in the Indian startup ecosystem.

Reports have widely discussed the funding challenges faced by Indian startups. These companies have struggled to navigate the crisis triggered by the Covid-19 pandemic and the Russia-Ukraine war, which resulted in a crowdfunding crunch. Furthermore, a series of policy changes have dealt significant blows to startups and MSMEs (Micro, Small, and Medium Enterprises) at a time when they were already striving to secure themselves.

READ | MSMEs struggle as economic crisis grips major export markets

Recently, the Ministry of Corporate Affairs tightened regulations for small companies seeking funds through fintech platforms that connect businesses with investors. Additionally, several policies that provided liquidity benefits to MSMEs have been halted from this fiscal year, further exacerbating the challenges faced by the ecosystem. Moreover, the Registrar of Companies in Delhi and Haryana have started imposing penalties on companies that raise capital through technology platforms in violation of the Companies Act provision.

The number of unicorns in the country fell to 83 compared with 84 last year. It did not come as a surprise given the decline in investments reported by Indian startups this year. Indian startups attracted around $$24 billion in funding in 2022, which is a 33% drop compared with the previous year’s investment of $37.2 billion, says a PwC report. The situation is compounded by the global recession, which presents an even larger cash flow problem for startups.

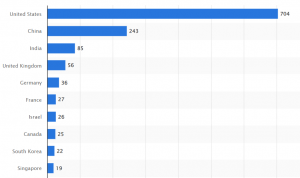

Number of unicorns as of November 2022

Self-inflicted issues

Some of the problems faced by the country’s startups are of their own making. They have unsustainable business models, leading to a decline in valuations. However, despite the prevailing negativity, funding to the right companies continues. One noteworthy example is Byju’s, which was once considered a darling of US investors but suddenly became a liability for them. Byju’s is just one case among the 18 companies that were dropped from the Hurun list last year.

Despite the ups and downs of recent years, industry analysts maintain their belief in the potential of the Indian startup story. Anas Rahman Junaid, chief researcher at Hurun India, predicts that the number of unicorns in India will reach 200 within the next five years.

Furthermore, the regulatory issues faced by Byju’s are unlikely to impact funding for the Indian startup ecosystem, as high-net-worth individuals still exhibit significant interest and have ample funds.

Regulatory challenges to startups

Industry watchers say that the government should support the startup ecosystem, instead of burdening it with strict regulations. While governance issues at some startups have undermined overall confidence, the government should defer imposing tougher norms until the economic situation improves. At present, policymakers must focus on supporting the budding startup ecosystem. India can also learn from neighbouring China, which boasts over 1,000 unicorns. For India to achieve economic growth, startups will play a crucial role.

Startups themselves must adopt prudence and intelligence in their business plans. Those that continue to burn through cash will ultimately fail. Investors advise startups to minimize expenses by prioritizing product-market fit over excessive spending on customer acquisition.

Sequoia, now known as Peak XV Partners, remains the biggest patron for Indian startups. As the largest investor in the ecosystem, it has stakes in 37 unicorns. Bengaluru continues to be the startup capital of India, housing 53 potential unicorns. Kaivalya Vohra, the twenty-year-old co-founder of quick commerce startup Zepto, holds the distinction of being the youngest co-founder in the Hurun index.

India currently has 51 gazelles, startups valued at over $500 million and likely to become unicorns in three years, and 71 cheetahs, valued at $250 million and likely to become unicorns within five years, says the Hurun list.