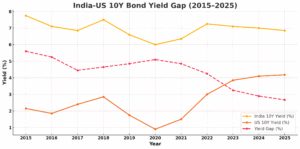

In December 2013, India’s benchmark 10-year government bond yielded a daunting 9.19%, against just 3.04% on the US Treasury. The 615-basis-point gulf was more than a quirk of markets—it distilled global anxiety over India’s inflation, policy drift and institutional fragility.

Eleven years on, the chasm has almost vanished. India’s 10-year paper now hovers near 6.25%, while its US counterpart has climbed to 4.61%. The spread, at 165 basis points, has narrowed by roughly three-quarters. Far from being a footnote in traders’ notebooks, the shift signals a fundamental re-rating of India’s macroeconomic credibility in a far more demanding, multipolar world.

READ | India GDP leap: Strong state economies key to India’s race to $14k incomes

Yields as a barometer of trust

Yields, particularly on long-dated sovereign bonds, are essentially price tags on national trust. They reflect how domestic and foreign investors assess inflation risks, fiscal health, external vulnerability, and institutional effectiveness. A higher yield implies greater perceived risk, and vice versa.

In 2013, India was grouped among the so-called ‘Fragile Five’—emerging economies seen as most vulnerable to external shocks. Inflation was running hot in double digits, the rupee had tumbled in a taper tantrum, and the current account deficit was widening. The country had yet to implement major tax, banking, and infrastructure reforms, and the political mood was uncertain. The wide yield gap was the world’s way of demanding a risk premium from India.

Contrast that with today. Inflation is relatively under control. The GST regime, though imperfect, has vastly expanded India’s tax base. The Insolvency and Bankruptcy Code has introduced a culture of credit discipline. India’s foreign exchange reserves are near record highs. And the fiscal deficit, though elevated, is being managed with greater transparency and intent. All these factors have contributed to the compression of India’s yield relative to the US—a country now facing its own fiscal questions in a post-COVID, high-debt world.

What compressed the gap

It is important to disentangle whether the narrowing gap is primarily due to India’s improving macroeconomic fundamentals or external developments like US monetary policy shifts. In truth, it is a combination of both.

On India’s side, yields have declined thanks to:

- A credible inflation-targeting regime implemented by the Reserve Bank of India;

- Greater fiscal coordination and budget transparency;

- Institutional reforms in financial markets and public finance;

- Increased participation by domestic institutional investors like EPFOs, insurers, and mutual funds in the sovereign debt market.

On the US side, the rise in Treasury yields reflects aggressive rate hikes by the Federal Reserve in response to pandemic-era stimulus and post-COVID inflation. The US 10-year yield has risen from around 0.5% in mid-2020 to over 4.5% today. That surge has helped narrow the gap mechanically, even as India’s yields have stayed largely stable.

Yet, India’s ability to keep its yields anchored amid global turbulence is not incidental. It is a marker of policy credibility, institutional maturity, and economic resilience.

How India stacks up

India is not the only emerging market undergoing a re-rating. However, it is one of the few that have combined high growth with relative macroeconomic stability. Countries like Brazil and South Africa still carry wide yield spreads versus the US, driven by local fiscal stress and political noise. India’s narrowing gap thus stands out not just as a numerical milestone, but as an outlier success story in a turbulent global landscape.

This is further reinforced by investor behaviour. India has consistently attracted stable capital, even during periods of global risk aversion. With the upcoming inclusion in JP Morgan’s Global Bond Index for Emerging Markets, billions in passive flows are expected to enter Indian government securities. The narrowing yield gap reinforces India’s case as a viable, low-risk emerging market bond destination.

Implications for India’s growth

A tighter yield spread has several significant implications.

Lower external borrowing costs: As the perception of sovereign risk declines, Indian corporates, public sector units, and financial institutions can tap international markets at more competitive rates. This lowers the cost of capital, incentivises infrastructure investment, and broadens funding options beyond domestic banks.

Greater foreign appetite for Indian debt: With global fixed-income investors searching for stable yield in a volatile world, India’s improving credibility makes its bonds attractive—especially given relatively stable exchange rates and central bank independence.

Reduction in ‘carry trade’ volatility: For years, India’s high-yield bonds attracted speculative hot money via carry trades—borrowing in low-interest countries to invest in high-yield emerging market debt. A narrowing yield gap reduces this arbitrage and brings in more stable, long-term investors.

Pressure on fiscal prudence: A compressed spread may lower borrowing costs for now, but it also limits India’s room for fiscal indiscipline. Any signs of populist overreach or slippage could prompt a swift re-widening of the gap, especially as global investors become more yield-sensitive.

Bond yield narrows: A note on subnational risk

While India’s central bond credibility has improved, there remains a wide divergence in how markets price risk at the state level. State Development Loans (SDLs) often trade at a 30–70 basis point premium to central government bonds, depending on the issuing state’s fiscal health. This divergence highlights that India’s fiscal reform story is still incomplete—and that the Centre’s gains must now be deepened at the level of federal financial architecture.

If India is to build a mature, broad-based bond market, state-level fiscal transparency, debt ceilings, and market discipline must be part of the next phase of reform.

What could reverse the gains?

The narrowing yield gap is a reflection of current investor trust. But trust, as always, is fragile. Several factors could reverse the trend:

- A deterioration in fiscal discipline, especially due to election-cycle spending;

- Global geopolitical escalations that raise risk premiums across emerging markets;

- A weakening of central bank independence or regulatory oversight;

- A sudden rise in oil prices affecting India’s import bill and inflation expectations.

India must stay alert. The yield gap is not a trophy; it is a temperature gauge. Complacency could quickly lead to overheating.

Srinath Sridharan is a strategic counsel with 25 years experience with leading corporates across diverse sectors including automobiles, e-commerce, advertising and financial services. He understands and ideates on intersection of finance, digital, contextual-finance, consumer, mobility, Urban transformation, and ESG. Actively engaged across growth policy conversations and public policy issues.