India’s goal of becoming a developed nation by 2047 and achieving Net Zero by 2070 rests on an invisible but crucial foundation: access to critical minerals. Lithium for batteries, copper for electric vehicles, cobalt and nickel for solar and wind, and rare earths for electronics and defence — these are the new oil of the twenty-first century.

For decades, energy security was defined by oil imports. Today, our technological and green future depends on minerals mostly found abroad — in Australia, Chile, and the Democratic Republic of Congo. This makes the National Critical Mineral Mission one of the most strategic policy interventions of recent years.

READ I Inside GST 2.0 reforms: Will India’s tax overhaul work?

Why critical minerals mission matters

The critical mineral mission, with a planned outlay of ₹34,300 crore over seven years, seeks to secure essential supplies through domestic exploration and international partnerships. But its purpose runs deeper than mining: it’s about building India’s clean-tech supply chain, ensuring that manufacturing — from batteries to semiconductors — is not constrained by imported inputs.

The mission is India’s attempt to gain autonomy in the global clean-technology race. Success here will determine whether India can manufacture the green future or merely consume it.

Global demand and supply-chain risks

According to the International Energy Agency, between 2017 and 2022 lithium demand nearly tripled, cobalt rose 70 per cent, and nickel climbed 40 per cent. Clean-energy applications now drive over half of lithium and cobalt demand. Yet production and refining are concentrated in a few hands: China processes about 75 per cent of global output.

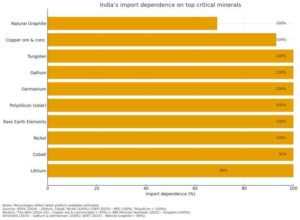

India’s dependence is acute. The Institute for Energy Economics and Financial Analysis reports that India imports 100 per cent of its lithium, cobalt and nickel, and 93 per cent of copper ore. As others race to secure supplies, India cannot afford delay.

India’s geology and overseas partnerships

Despite its mineral endowment, 80 per cent of India’s geological potential remains unexplored, according to the World Economic Forum. The Mission therefore combines domestic mapping with “mineral diplomacy” — joint ventures, long-term offtake deals and co-investment in mines overseas.

But mining alone will not ensure self-reliance. The higher value sits in processing and refining. Converting lithium into battery-grade carbonate or rare earths into magnets multiplies domestic value, creates jobs, and builds ecosystems of skills and suppliers.

De-risking the value chain

India’s mineral strategy must also confront price volatility, import shocks and sustainability. The first step is to treat waste as a resource. Recycling of end-of-life batteries and e-waste — often called urban mining — can meet a rising share of demand. India’s battery-recycling rules should therefore be strengthened with clear extended-producer-responsibility (EPR) mandates, fiscal incentives for hydrometallurgical plants, and public-private R&D on low-emission recovery technologies.

Second, the country needs strategic mineral stockpiles akin to its petroleum reserves. Small, rolling reserves of lithium, cobalt and rare-earth oxides would cushion domestic industries against supply disruptions. Combined with commodity-exchange hedging (LME/COMEX), this would help stabilise input prices for emerging sectors such as EVs and grid storage.

Third, accurate demand forecasting and offtake guarantees are vital. Linking mineral requirements to EV and solar targets allows investors to sign long-term offtake contracts with confidence. Transparent market data can also attract global finance and lower capital costs for refining projects.

Together, recycling, stockpiles and demand modelling would transform India’s mineral ecosystem from reactive to resilient — and from extractive to circular.

Permits, midstream, states and finance

Policy ambition must now meet administrative realism. India’s mining approvals remain slow compared to Australia or Canada. A digital single-window clearance with statutory time limits could cut project delays drastically. Open geological data through a national cadastre would attract private explorers and venture capital.

Building midstream capacity is equally crucial. The Mission should prioritise refining, precursor chemicals and magnet production — areas of highest value addition — rather than chase every mine licence. Integration with PLI schemes for advanced cell manufacturing, semiconductors and magnet alloys can anchor demand and scale.

Financing must go beyond the ₹34,300 crore public outlay. A blended India Critical Minerals Fund could pool multilateral, private and sovereign capital for exploration, refining and overseas equity. Political-risk insurance for projects in Africa and Latin America would further de-risk supply.

Since mining is constitutionally intertwined with states, cooperative federalism is essential. A new compact should link royalty sharing, benefit transfers from District Mineral Foundations, and incentives for green mining practices. States such as Odisha, Jharkhand and Rajasthan can pioneer integrated mineral corridors with reliable logistics, renewable power and water-efficient processing.

Finally, environmental, social and governance (ESG) norms must travel with speed, not trail it. Free, prior and informed consent (FPIC), water budgeting and tailings standards should be codified to secure a social licence to operate.

Policy actions and innovation ecosystem

For this Mission to deliver, collaboration is non-negotiable. Policymakers must provide regulatory clarity and stable fiscal incentives. Industry must commit to responsible extraction and invest in downstream value-addition. Universities and research labs need to push breakthroughs in recycling and low-carbon refining.

India must also practise proactive mineral diplomacy — joining mineral-security alliances, co-developing projects with partners in Australia and Africa, and establishing traceability standards for sustainable sourcing. These moves will embed India within the global clean-tech supply web, not leave it on the periphery.

If the twentieth century belonged to oil, the twenty-first will belong to critical minerals. The National Critical Mineral Mission is not just a mining plan; it is a national-security and industrial-policy instrument. By fusing geology with geopolitics and green goals, India can ensure its clean-energy transition rests on solid ground.

With the right mix of policy clarity, private investment and scientific rigour, India can turn its mineral wealth into strategic strength — building a clean-tech manufacturing base, cutting import dependence, and powering its Net Zero ambitions. The minerals may lie hidden beneath the ground, but the opportunity above it is immense.

Dr Hanuma Prasad Modali is Managing Director, Deccan Gold Mines Limited.