Donald Trump’s economic statecraft looks like the business end of a tornado—tariffs whirling, taxes slicing, the dollar wobbling, crypto memes barking in the background. Chaos, however, can be engineered. Read the fine print of the House-passed “One Big Beautiful Bill” and especially its Section 899, and the pattern sharpens: bend every market—goods, capital, currency, even sentiment—to force re-industrialisation at home while blunting foreign leverage abroad.

The strategy is recognisable. The question is whether the edifice it seeks to smash will fall the way the demolition experts have sketched—or crush unexpected parts of the house.

READ I Court ruling tilts India-US trade talks in Delhi’s favour

Five pillars of Trump’s coherent—but risky plan

Taxing capital, not just containers: Section 899 empowers the president to slap a 5-20% withholding and income-tax surcharge on investors from countries that impose “unfair” levies on US companies—read Europe’s digital-services taxes and the OECD’s minimum-tax crusade. It turns Wall Street into a negotiating table: cross us and your investors bleed. That is conceptually the same as a tariff, only the strike point is the balance sheet, not the loading dock.

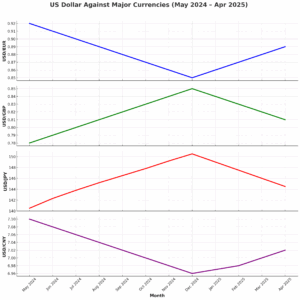

Dollar weakness by design: Trump has never hidden his impatience with a strong greenback. A deliberately softer dollar raises export competitiveness, pushes imports down, and reduces the real burden of Washington’s debt mountain. The Treasury now talks of “competitive” rather than “strong” currency policy, a linguistic nudge that traders have heard; the dollar index has slid 7% since January.

Crypto populism as shock therapy: Appointing Elon Musk to head the Department of Government Efficiency (DOGE) and tweeting thumbs-up for Dogecoin is not monetary policy but mood music. It signals that official Washington is willing to flirt with alternatives to orthodox fiat, buying rhetorical space for a weaker dollar without admitting to it. Meme coins provide the rebel soundtrack to a planned devaluation.

Tariffs as industrial scaffolding: The new 25% duties on cars and parts, plus 10-20% reciprocal tariffs on almost everything else, are sold as national-security tools. In reality they are old-school import-substitution, irrespective of whether the supply chain actually migrates to Kansas or merely hops from China to Vietnam.

Multilateral shed burning: From freezing WTO appellate appointments to threatening to skip the G20 in South Africa, the administration’s message is blunt: if rules hamper US leverage, torch them and bargain bilaterally where size ensures advantage. The method is to turn every forum into a table of one.

Why the chessboard may flip

Having a playbook is not the same as winning the game. Each plank of Trump’s strategy courts a boomerang effect that could leave the United States less, not more, dominant.

Foreign funds hold roughly 30% of US Treasuries and 25% of the equity market. Surcharge them via Section 899 and Brussels will retaliate—€95 billion in counter-measures are already drafted—and portfolio managers could diversify faster into euro or yen assets than Washington anticipates. Higher Treasury yields would crowd out the very re-shoring investment the tariffs hope to spark.

The dollar’s dominance endures not by decree but by trust—legal predictability, deep markets, rule of law. Competitive depreciation erodes all three. An Atlantic Council monitor shows the dollar’s share of global reserves sliding from 66% in 2014 to 58% in 2024; Beijing’s yuan, still tiny, is nonetheless doubling its slice. Once investors price a currency for politics rather than policy, selling can outrun any tactical gains in exports.

Dogecoin rallies are fun; they are not a lender of last resort. In a crisis, payment systems clear in central-bank money, not memes. If Washington’s signals persuade foreigners that the Fed’s balance-sheet integrity is negotiable, the flight will be to gold and IMF Special Drawing Rights, not Shiba Inu tokens.

Brooking’s modelling shows that 10% universal tariffs shave 0.8 percentage points off US GDP and 1.2 points off global output within two years, even before retaliation. PIIE’s newer study finds that a 20% tariff collects less cash than a 10% levy because the economy shrinks faster than the tariff rate rises. That is the mathematics of beggar-thyself.

Walking away from the WTO and WHO frees America from constraint, but it also vacates the chair at the drafting table. The EU’s Carbon Border Adjustment Mechanism, China’s electric-vehicle standards, and the BRICS payments platform advance precisely because the US has chosen to carp from outside rather than negotiate inside. Influence leaks like gas from a punctured pipe—silently until someone lights a match.

The hidden fiscal trap

A weaker dollar and higher tariffs do not by themselves fund a $3 trillion tax-cut-cum-industrial-subsidy programme. The Congressional Budget Office warns that interest costs will exceed defence outlays by 2027 under current projections. Should foreign buyers demand even a 50-basis-point risk premium, the additional annual debt-service bill would wipe out the projected tariff revenue twice over. The next president may discover that populism cannot repeal compound interest.

Trumpism assumes that a superpower can bully markets the way a landlord bullies tenants—threaten eviction and they pay up. But capital markets are more like water: block one channel and they carve another. Likewise, supply chains reroute; allies hedge; currencies re-price. Systems thinking teaches that complex networks respond non-linearly: small shocks can trigger phase changes. The administration’s moves exhibit strategical coherence, yet they underestimate systemic adaptation.

The gamble of high-voltage statecraft

Yes, there is method in the disruption. Section 899, tariff walls, dollar jawboning, crypto pageantry, and multilateral vandalism all serve a single thesis: the United States must sacrifice some financial hegemony to regain industrial primacy and bargaining muscle. That is a legitimate strategic proposition, not mere whim.

Where method becomes hubris is in assuming a neat payoff—factories humming, allies subdued, debt manageable, and dollar supremacy intact enough to finance it all. Economic ecosystems rarely honour such choreography. Push too many variables simultaneously and feedback loops bite back. Investors may flee, allies may align elsewhere, the dollar might drift from king to first among equals, and the fiscal keel could crack.

Trump’s wager is that America can absorb the turbulence better than its competitors. History is less certain. Empires stumble not only when foes grow stronger but when their own balance of trust and coercion tilts too far to the latter. Convert every instrument of soft power into a blunt weapon and eventually even friends wear armour.

America may yet re-tool its industry and trim its trade deficit—but it could do so in a world where the rules are no longer written in Washington and the dollar no longer buys unquestioned deference. In trying to strengthen its grip, the nation risks loosening its anchor. The method is real; the outcome remains an open experiment in the physics of power.

Shailesh Haribhakti is a Chartered and Cost Accountant, an internal auditor and a certified financial planner. He is a board chairman, audit committee chair and independent director at some of the country's most preeminent organisations. He is a thought leader on the Indian economy and public policy.