The external sector of an economy is pivotal for economic development and expansion, offering access to international opportunities. It fosters innovation and productivity through capital inflows, technology transfer, and market expansion. Nations leverage their comparative advantages in international commerce to enhance efficiency and specialisation. Foreign remittances are vital for sustaining domestic investment and consumption, while competitive international markets increase export potential, underpinned by effective exchange rate management. Thus, the external sector is critical for a country’s economic trajectory, resilience, and long-term prosperity. India, looking to become a development country by 2047, faces challenges in maximising its external sector’s potential.

India’s external sector

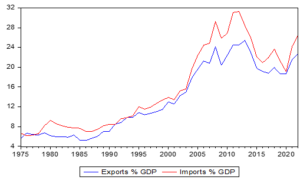

Over the years, India’s integration into the global economy has deepened, as reflected in the increasing share of imports and exports in its GDP. Despite economic fluctuations, the consistent rise in both exports and imports underscores India’s growing global trade involvement. However, the export-to-GDP ratio has often been lower than the import-to-GDP ratio, leading to persistent trade deficits, particularly after 2005.

This imbalance highlights the challenges in achieving trade equilibrium, suggesting a reliance on imports to meet domestic demand. Yet, recent increases in exports indicate efforts to enhance international competitiveness, possibly aided by favorable policies or economic conditions. India’s trade dynamics emphasise the need for strategic management of trade imbalances to foster export-led growth, especially as protectionist policies have recently reduced both exports and imports.

READ I Kerala vs Centre: The state must balance welfare spending with fiscal prudence

India’s increasing global economic integration has exposed it to international market fluctuations and geopolitical tensions. While integration has offered benefits like enhanced market access and diversified economic activities, it also requires India to navigate global economic cycles and political uncertainties effectively. These dynamics can impact trade volumes, investment flows, and economic stability. Therefore, understanding and strategically responding to global economic trends is crucial for India to safeguard its interests and sustain growth.

Tilted foreign direct investment

Foreign investment flows into India predominantly targets the services sector, sidelining the crucial manufacturing sector, which offers extensive economic linkages. Despite government initiatives like “Make in India” and production-linked incentives, FDI remains skewed towards services, likely due to easier business operations compared to manufacturing. Additionally, Indian manufacturing faces obstacles like complex land acquisition, restrictive labor laws, high logistics costs, and a large unskilled labor force. From 2014 to 2022, FDI in services surged, while manufacturing’s share of total FDI equity inflows declined, raising concerns about job creation for India’s youthful workforce.

Technological advancements are reshaping industries and economic sectors worldwide, presenting both opportunities and challenges for India. The rapid growth of digital technology, automation, and renewable energy sectors can drive India’s economic transformation and create new employment avenues. However, this shift necessitates significant investments in skills development and infrastructure to harness these new technologies effectively and mitigate the risk of obsolescence in traditional sectors.

India remains a top recipient of remittances, crucial for family incomes and economic stability. Despite fluctuations, remittances showed an upward trend until a decline post-2008, affected by global economic shifts, stricter immigration policies, and Indian expatriates’ employment challenges. Addressing the factors behind the remittance slowdown is essential for sustaining this important income source.

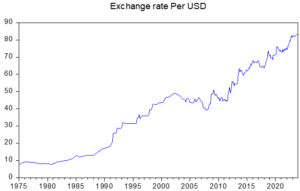

Consistent exchange rate depreciation

Effective exchange rate management is vital for developing countries to promote economic stability and growth. India faces a pattern of currency depreciation, reflecting global financial pressures and impacting trade competitiveness, inflation, and investment confidence. Stabilising the exchange rate is imperative for India’s economic stability in the face of global uncertainties.

India’s external sector is crucial for its economic integration and growth. However, challenges like trade deficits, skewed FDI, decreasing remittances, and currency depreciation hinder progress. Policymakers must focus on export-led growth and stable exchange rate policies to enhance economic resilience and prosperity, as highlighted by former RBI Governor Raghuram Rajan. Proactive management of these issues will bolster India’s external sector, ensuring sustained growth and international competitiveness.

As India integrates further into the global economy, environmental sustainability becomes increasingly critical. The external sector must align with environmental goals to ensure long-term economic viability and meet international standards and expectations. This includes adopting cleaner technologies, reducing carbon footprints, and managing natural resources efficiently. Such measures not only contribute to global environmental efforts but also enhance India’s competitiveness in a world increasingly focused on sustainability.

(Aamir Ahmad Teeli is a doctoral fellow at the department of economics, Central University of Tamil Nadu. Adil Hussain Reshi is doctoral fellow at the department of Economics at Baba Ghulam Shah Badshah University, Rajouri.)