Sustainable business is an established term that connotes well beyond financial performance and markets. Yet, we persistently separate business and sustainability into two different compartments. Even more strangely, we strictly tag business-related as financial and sustainability-related as non-financial. We adamantly separate them through strategy, risk assessment, materiality assessment and reporting.

It took a strong and collective push by investors, regulators, the Covid-19 pandemic and concerned millennials to blend and blur boundaries. From this mix arose integrated thinking to address the looming risks. This article zooms down into materiality, risks and integrated thinking through the single lens of sustainable business. We analyse their interdependencies; and relate how the major frameworks reflect on them. The term materiality has acquired a new meaning in connection with sustainability. The debates and definitions are being waged on many parameters.

Single or double materiality: Whether the stakeholders need to focus on the impacts of externalities on the business alone (single or monodirectional) or must they stretch the focus to the impact of the business on the externalities too (double or bidirectional).

Financial materiality: Should the financial implication on business by an attribute be the only deciding factor for prioritising materiality?

READ I ESG reporting: Climate change, state emergency and stakeholder pursuit

The most widely practiced disclosure frameworks SASB and GRI stand on either side of this argument. SASB is primarily investor focussed and uses financial materiality as the guiding principle. In other words, SASB helps to assess the material aspects that influence enterprise value. On the other hand, GRI emphasizes on double materiality and supports both financial and impact materiality. It prioritises topics that reflect the most significant impacts on the economy, environment, and people, including impacts on human rights.

IASB is finalising its blueprint for proposed International Sustainability Standards Board (ISSB). The initial guidelines published so far recommend investor focussed materiality leading to enterprise value. A prioritisation of climate change is visible. Soon the ambit will have to traverse other investor needs across ESG (Environmental, Social and Governance) matters.

India’s National Guidelines on Responsible Business Conduct (NGRBC) defines sustainability as the outcome achieved by balancing the social, environmental and economic impacts of business. Having established its objectives on this definition, SEBI’s Business Responsibility and Sustainability Report (BRSR) addresses double materiality to cover both financial and impact aspects.

READ I Tax, investment and salaries in an ESG focused world

By adopting double materiality, BRSR shares the principles with Corporate Sustainability Reporting Directive (CSRD), the largest regulatory framework proposal by European Union (EU). The different alignment exhibited by different standards and regulators raise the following questions on how they will address:

Dynamic materiality: What is not material (or financially material) today may quickly change tomorrow: for example, the pandemic.

Investor heterogeneity: What is material (or financially material) to some may not be so for others. For example, Malaysia’s Top Glove was dropped from 3 indices, faced a ban by US and dropped valuation as soon as reports of human-rights violations came out. Human-rights may not be considered as financially material by all frameworks.

We may not find global consensus on the definition of a ‘reasonable investor’, which is being reflected in the directions different standards and regulators have taken. Given the sheer number of stakeholders involved and the complexity of jurisdictions, it is quite obvious that the global consolidation and consensus effort is going to be time consuming. As they align and converge in due course of time, SEBI has taken a quick and decisive step in establishing BRSR emphasizing accountability and leadership through the adoption of double materiality.

READ I Looming trouble: Auditing and accounting professions face AI heat

Materiality assessment

Materiality assessment is the process by which every business determines aspects that are material to it and to its stakeholders. The importance and impact of material aspects in these two dimensions need due consideration. While the standards and frameworks act as a guideline, businesses must boldly decide their own material aspects, determine who their stakeholders are, and how stakeholders assess importance and impacts.

A thorough materiality assessment has the potential to demonstrate or expose quite a lot about the business attitude, culture, tone at the top, strategic thinking, corporate governance, thought leadership, quality of leadership and corporate communication.

Enterprise Risk Management

ERM is increasingly stretching to include sustainability along with traditional risks of business, financial, market, customer, economy, geopolitical, supply-chain, litigation, reputation , regulatory, data and security.

A detailed sustainability risk assessment can be a parallel process that eventually feeds the identified risks into the ERM framework. Modern enterprise processes , governance and mitigation will then be embedded. Most ESG standards and frameworks encourage businesses to explore and disclose risks and opportunities related to sustainability.

SASB’s industry focussed disclosures are leading entities to identify the financially material risks and opportunities associated with their business.

GRI has a dedicated section, Disclosure 102 -15, on key impacts, risks and opportunities. It covers extensive qualitative and quantitate disclosures on a business’ significant economic, environmental and social impacts, and associated risk and opportunities. GRI further explores risks through multiple other sections by seeking disclosures related to how the sustainability risks are processed by ERM.

A dedicated section focuses on risks and opportunities related to climate change; and across various topics such as corruption, tax governance, hazard identification, human rights, occupational health and safety management systems.

BRSR’s item 24 under Section A – General Disclosures provides an opportunity to disclose all material risks and opportunities identified and their respective financial implication, without being specific about any topic. In the subsequent sections it further probes risks related to product/service through their lifecycle; health and safety management systems; human rights; and data privacy.

As we can see, a number of sustainability risks naturally get selected under ERM on their own. A sustainability risk assessment process and the frameworks ensure completeness and addressing of stakeholder priorities.

ERM and Sustainability: Blurring boundaries

We were conditioned to relate ‘materiality’ to sustainability and ‘risks’ to business. Thanks to the insistence by the global frameworks and standards, we are now able to visualize both terms in both contexts. We are now increasingly seeing how sustainability related material aspects are becoming more and more financially material and are also finding their way into ERM, increasing the intersection.

The recent developments, environmental agenda driven shareholder activism in ExxonMobil; Activist climate resolution winning against Royal Dutch shell’s emission targets; Adani Ports being dropped from indices for their association with Myanmar military that reportedly caused human rights violation; winning of climate change litigation by civilians against the Australian and Indonesian governments are all examples that demonstrate this increasingly seamless overlap between ERM and sustainability.

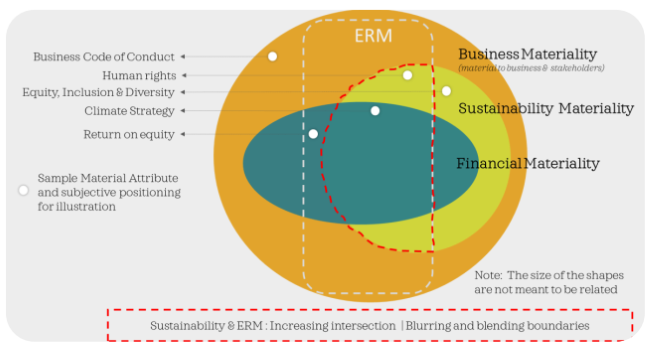

The diagram below portrays the definition and overlap of influence of the terms we discussed so far.

- We have business materiality and ERM at enterprise level. All business material aspects need not turn out to be a risk but it is logical to see how all major risks are related in one way or the other to business materiality.

- Sustainability and financial materiality overlap with each other and are subsets of business materiality.

- ERM can cut across financial, sustainability and business materiality individually or through their space of intersection.

The frameworks do not explicitly ensure the interconnection between materiality and risks. However, we can see how they are tightly interconnected from their very definition and the way frameworks have defined and designed disclosures around them.

It will be ideal to carry out enterprise risk assessment and materiality assessment as two separate tasks and then matched against each other to ensure completeness and correlation of interdependencies. A matured organization with established processes, governance and aligned enterprise operations shall observe significantly aligned outcomes out of the independent assessments. The matching exercise will serve as a validation of excellence.

We will potentially witness this overlap of ERM and sustainability materiality maximising before they start to separate out when the system matures enough to integrate sustainability more proactively and by design into the core business strategy.

Double materiality and sustainable businesses

Integrated thinking is the decision making and management process that expands mindset boundaries; nurtures inclusive business models; embraces complexity; makes room for uncertainty; and enables long term vison and value. According to Integrated Reporting, integrated thinking is the active consideration by an organization of the relationship between its various operating and functional units and the six capitals (Natural, Social and relationship, Human, Manufactured, Intellectual and Financial) that the organization uses or affects.

As we can see it is impossible to think integrative without the consideration of double materiality. In our opinion, the merger of SASB and Integrated Reporting into Value Reporting Foundation presents us with the first integrated toolkit that gives us the clarity of prescriptive disclosures and the freedom of principle-based framework.

We believe, GRI’s merger into Value Reporting Foundation will not only be the natural step in the simplification of the reporting ecosystem but will also strongly establish double materiality as a global practice. Double materiality is fundamental to integrated thinking and will drive sustainable businesses. There is really no alternative.

(Shailesh Haribhakti is a renowned chartered accountant and corporate leader based in Mumbai. Thara TK specialises in corporate strategy, governance, ESG and sustainability. She is a qualified independent director.)