In September 2020, the Big Four accounting firms along with World Economic Forum’s (WEF) International Business Council (IBC) unveiled a white paper in an attempt to standardise ESG (Environment, Social and Governance) reporting.

The white paper titled “Measuring Stakeholder Capitalism: Towards Common Metrics and Consistent Reporting of Sustainable Value Creation” offered a new framework for ESG reporting. The framework states to have leveraged the existing frameworks, brought together the best of all and thereby is in a position to provide the business world with a comprehensive set of ESG benchmark matrices without reinventing the wheel. The framework recommends

- 4 Pillars: Principles of governance, people, planet and prosperity

- 21 Core set of Stakeholder Capitalism Matrices (SCM)

- 34 extended matrices

- Disclose or explain the approach for each of the matrices

IBC has appealed to its more than 120 members and the global business community to adopt the framework and set the standards.

READ I SDG agenda a pipe dream without sustainable peace, disarmament

Having delivered by the who’s who of the industry and by keeping a much-needed objective of global standardisation at its core, the framework can potentially deliver significant relief to the confused business world. While the framework looks to make redundant the efforts of a large number of existing reporting entities such as the Global Reporting Initiative (GRI), the Task Force on Climate-related Financial Disclosures (TCFD), the International Integrated Reporting Council (IIRC), Climate Disclosure Standards Board (CDSB), and the Sustainability Accounting Standards Board (SASB). It needs to be seen whether the efforts by Big Four and WEF will reasonably align the global community towards standardisation.

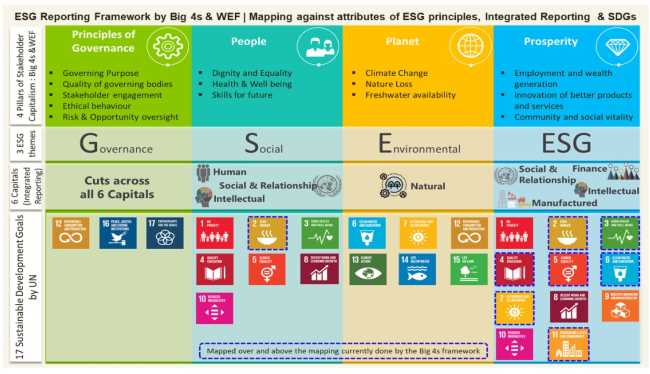

While the debate and discussions continue, represented in the graphic that attempts to map the framework against three most commonly referred adjacencies, the foundational principles of ESG, Integrated Reporting (IR) and the UN’s Sustainable Development Goals (SDGs).

READ I A transparent global tax regime can help achieve SDGs

The comparison raised three big questions.

Will the new framework replace Integrated Reporting?

IR has gained a lot of traction and adoption in recent years. Businesses globally were just about to embrace IR as the ultimate response to reporting expectations. Should all the drive towards IR now be diverted? The paper goes on to mention that IIRC will continue to complement the new framework. But then there is significant overlap and overhead in coexistence. How do we logically explain that while the original intent was to standardise and remove duplication? Well, this question is applicable to all the frameworks out there facing a displacement.

READ I Decriminalisation of corporate offences may be counterproductive

What criteria were followed by the framework in mapping its pillars to SDGs?

One who understands SDGs closely may soon agree to Professor Carol Adam’s observation here that “the importance of the SDGs is mentioned, and the SDG symbols are scattered around the paper, misleading the uninformed reader to thinking saving the planet and its people is the goal”. One may tend to think that the mapping, although a little tricky could have been done more diligently. For e.g.

SDG2 (zero hunger) does not find a mapping in the framework. If SDG1 (eradicate poverty) could be mapped against the pillars “people” and “prosperity”, SDG2 could definitely find a place there too.

SDG11 (sustainable cities and communities) does not also find a place in the mapping. The pillar “prosperity” covers “community and social vitality” and one of the matrices is “percentage of revenue from products and services designed to deliver specific social benefits or to address specific sustainability challenges”. Wonder why these definitions did not help SDG11 to earn a tick in the mapping sheet.

SDG3 (good health and well-being), SDG4 (quality education), SDG5 (gender equality), SDG6 (clean water and sanitation) and SDG7 (affordable and clean energy) — all are integral parts of Universal Basic Services (UBS). Aren’t achieving them an indicator of prosperity? The mapping does not say so. SDG1 (eradicate poverty) and SDG10 (reduced inequalities) were multi-mapped whereas their respective close partners SDG2 (zero hunger) and SDG5 (gender equality) were not equally honoured.

READ I Covid-19 and recovery: How India can reach 10% plus growth orbit

What is the framework’s stand on SDG?

The framework does not give any clear guidance or perspectives on if and how corporates must respond to SDGs and how the principles will coexist with the framework. The conversation appears to be limited to the half-hearted mapping. That is not helping the cause of global standardisation and adoption. In all, 193 countries have signed up to deliver SDGs agreeing to them as the goals for humanity. If delivering SDG is fundamental to humanity, can it be different for governments, corporates and communities? Corporates may have a different approach, varying levels of relevance with respect to each SDG and a different set of indicators to measure them, but they must also exist for the same purpose as humanity and hence it feels logical and imperative that their goals and performance are made relevant and discussed in similar terms.

Conclusion

The adoption of any new framework gets tougher when finding answers to such fundamental questions are left to the imagination. It only adds to the very confusion the framework is expected to remove. Until such clarity is delivered, let the case of ESG reporting remain curious and an opportunity to explore.

(Thara TK specialises in corporate strategy, governance, ESG and sustainability. She is a qualified independent director.)

Thara TK is a renowned expert in sustainability and technology. She is the founder of ESG Minds.