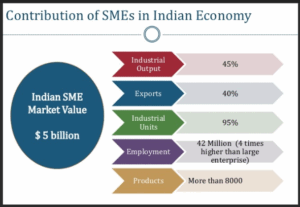

Small and medium enterprises form the backbone of India’s economy—contributing nearly 30% to GDP, 45% of manufacturing output, and employing over 110 million people. Yet, despite their scale, most SMEs remain on the periphery of India’s digital revolution.

In a global economy driven by speed, scale, and innovation, legacy practices are quickly becoming obsolete. India’s SMEs are not quite the German-style Mittelstand—highly specialised, globally competitive, and technologically agile. They still struggle with structural issues: limited access to credit, lack of skilled labour, and poor adoption of innovation. As India eyes its $5 trillion target, digital transformation is no longer optional. It is essential.

READ ICost of war: How conflicts reshape the economy

SMEs’ post-pandemic acceleration

Historically, SMEs lagged in adopting digital tools due to inadequate capital, digital illiteracy, and piecemeal policy execution. However, the post-pandemic landscape has altered the equation. Government initiatives like BharatNet and Digital India have catalysed infrastructure growth, making digital adoption more feasible even in semi-urban and rural clusters.

Digital transformation encompasses more than just website creation or WhatsApp marketing. It includes cloud-based ERP systems to boost operational efficiency, AI-driven analytics for smarter business decisions, and e-commerce integration to reach broader markets. According to a 2024 NASSCOM study, digitally enabled SMEs saw productivity gains of up to 30% and a 15% boost in customer acquisition within a year. For instance, textile businesses in Surat have begun using AI-powered stock forecasting tools, reducing inventory costs by 20% and easing cash flows.

Such innovations go beyond efficiency—they bring SMEs into the fold of formal, competitive, and globally connected markets.

Creating ecosystems, not just enterprises

Digitalisation does more than transform individual enterprises—it strengthens the entire SME ecosystem. From digital B2B platforms to fintech-backed lending and supply chain integration, SMEs are increasingly embedded in regional and global value chains. This integration reduces transaction costs and improves information flows, which in turn enhance competitiveness.

Financial technology has played a pivotal role. Platforms like KredX and RazorpayX offer data-backed credit, providing a lifeline to SMEs traditionally underserved by banks. Digital payment systems such as UPI, e-invoicing, and real-time GST compliance are making it easier for small firms to manage working capital and comply with regulatory demands.

These changes are not merely cosmetic. In export-oriented sectors like handicrafts, auto parts, and chemicals, digital compliance builds institutional credibility—critical for establishing trust with global buyers and reducing trade friction.

Government’s push—and its limits

Public policy is beginning to align with these needs. Initiatives such as the MSME Champions portal, the Credit Linked Capital Subsidy Scheme (CLCSS), and the Digital Saksham programme aim to bridge the digital divide for small firms. The 2025 Union Budget’s proposal for a Digital Accelerator Fund promises to co-finance tech upgrades and skill development, while ONDC is attempting to level the playing field for small sellers by providing e-commerce access beyond dominant platforms.

Yet challenges persist. Fragmented implementation, lack of tailored solutions for micro-enterprises, and the limited reach of digital upskilling programmes mean that much of rural and lower-tier SME India is still excluded. Unless these bottlenecks are addressed, digital transformation risks becoming an urban and elite phenomenon, leaving behind those who need it most.

Building India’s own Mittelstand

The path forward must be systemic. Digitally empowered SMEs are not just more productive—they are more resilient, innovative, and export-ready. Their transformation improves overall productivity, drives formalisation in labour markets, and enhances India’s export elasticity—strengthening the GDP multiplier.

To unlock this potential, India must adopt a tri-pronged strategy: expanding digital infrastructure, ensuring policy coherence, and building institutional capacity. Sector-specific support and regional targeting will be vital. Public-private partnerships can accelerate spillovers of best practices, while industrial clustering can reduce adoption costs and stimulate innovation.

A holistic digital strategy will allow India to nurture its own Mittelstand—a network of globally competitive SMEs rooted in local strengths but elevated by smart policy and modern technology. Digital transformation is no longer a support tool. It is the central engine of SME growth and, by extension, national economic progress.

Naman Mishra is a doctoral student, Bennett University, Greater Noida. Aneesh KA is Assistant Professor, Department of Economics, CHRIST University, Delhi NCR Campus.