Rural demand slump: In the April edition of its World Economic Outlook, the IMF raised India’s GDP forecast for FY25 by 30 basis points to 6.8%, citing continuing strength in domestic demand and a rising working-age population. This reinforces India’s status as the fastest-growing major economy in the world. The Indian economy’s ability to defy the global slowdown trend highlights its robust macroeconomic fundamentals.

Historically, India has been a consumption-driven economy, with private consumption accounting for approximately 58-60% of the GDP. Strong domestic demand has helped the economy remain resilient amid various external economic and geopolitical shocks. However, recently, the growth drivers have shifted, with private consumption growth slowing and government-led capital expenditure spurring robust GDP growth.

READ I Unemployment figures hide widening job gap in South Asia

Fiscal policy powers GDP growth

India’s fiscal policy has been crucial in shaping the current economic trajectory. The government’s strategic adjustments, including increased spending on infrastructure and social programmes, have stimulated growth across various sectors. Enhanced public investment has not only provided direct economic stimulus but also encouraged private sector participation. These fiscal policies are designed to create a multiplier effect that sustains economic expansion and mitigates the impact of global economic fluctuations.

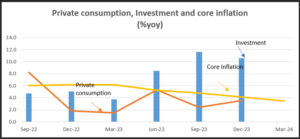

Before COVID-19 pandemic, from 2009 onwards, India’s GDP grew at an average rate of 7% annually, with private final consumption expenditure (PFCE) slightly outpacing this at 7.2% year-over-year. During this period, investment growth lagged at around 6%. Post-COVID, except for a brief surge in consumption due to pent-up demand, there has been a notable slowdown in private consumption, while investment has surpassed both GDP growth and PFCE growth rates.

Since September 2022, GDP has grown at 6.8% year-over-year, while private consumption has increased at a dismal average of 3.8%, and investment growth has reached 7.4%. According to the National Sample Survey Office (NSSO), PFCE is projected to slow from 6.8% in FY23 to 3.0% year-over-year in FY24, with further deceleration to 1% by the fourth quarter. This trend aligns with the core inflation rate (excluding volatile items like food and fuel), which has moderated from 6% to 3.4% from September 2022 to March 2024.

India’s consumption pattern presents a complex puzzle for policymakers and economists. Despite moderation in private consumption and core inflation, high-frequency indicators such as consumer loan growth, passenger vehicle sales, residential sales, and GST collections—which serve as proxies for consumption demand—continue to show robust growth. Since September 2022, consumer credit has surged at an average rate of 25% annually, and passenger vehicle sales have increased by 16%. GST collections have reached an all-time high, and the housing market is booming, with residential sales in the top seven cities rising 30% year-over-year in FY24.

The rise of digital technologies and the expansion of the service sector represent another pivotal aspect of India’s economic growth. The government’s push for digitalisation, including significant investments in digital infrastructure and support for technology startups, has fostered innovation and entrepreneurial activity. This digital transformation is not just enhancing productivity across sectors but also making services more accessible to the general population, thereby contributing to economic inclusivity and growth.

Rural demand slowdown

Turning to the rural economy, which comprises 70% of India’s population and about 50% of total consumption, the impact of the pandemic, high rural inflation, and reduced subsidies have strained consumer budgets. High-frequency indicators like two-wheeler and tractor sales, agricultural exports, and fertilizer sales have shown discouraging trends. Tractor sales, a gauge of rural investment, have decreased by 9% in FY24, while fertilizer sales have contracted by about 2%. Agricultural exports have also declined by 8% in FY24. However, signs of recovery are visible, such as in two-wheeler sales, which, after declining by 0.7% in the first half of FY24, have begun to stabilise.

Monthly rural consumption expenditure

India’s performance in international markets has also played a significant role in its economic resilience. Despite global trade tensions and economic uncertainties, India has managed to maintain a favorable balance of trade in several key sectors. Efforts to diversify export markets and enhance competitiveness through policy reforms have bolstered India’s standing in the global economic arena. This resilience in exports contributes significantly to the overall economic health and helps stabilise domestic industries.

According to Nielsen, FMCG sales have improved since the third quarter of FY24, growing 5-6% year-over-year in volume terms, driven by a recovery in rural demand. This uptick is evident in the increased sales of daily essentials such as food staples, soaps, shampoos, detergents, and tea. Sustaining this demand is crucial for accelerating consumption. Despite the economic recovery post-pandemic, rural wage growth has remained steady at 5-6%, while a sharp rise in rural inflation has led to negative real wage growth, severely limiting the purchasing power of rural households. Rural inflation remained higher than urban inflation in FY23 (6.8% vs. 6.4%) and continued this trend into FY24 (5.6% vs. 5.2%).

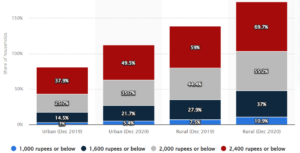

The debate over whether the rural demand slowdown is structural, potentially indicative of a K-shaped recovery, continues. The latest Household Consumption Expenditure Survey highlights a stark disparity in spending between the wealthiest and poorest segments. The bottom 5% of India’s rural population has an average monthly per capita expenditure (MPCE) of Rs 1,373, compared with Rs 2,001 in urban areas. Conversely, the top 5% in rural and urban areas spend an average of Rs 10,501 and Rs 20,824, respectively, with the richest 5% spending nearly eight times more than the poorest 5% in rural India, and 10 times more in urban areas.

For India’s economy to achieve meaningful and resilient growth, boosting rural demand should be a top priority for the new government’s agenda. The upcoming full Union Budget should focus on increasing government spending on rural infrastructure, providing tax rebates for the economically disadvantaged, and implementing targeted subsidies for the rural poor.

(Prachi Priya is a corporate economist based in Mumbai.)