The Pradhan Mantri Jan Dhan Yojana played a major role in India’s socio-economic transformation through the financial empowerment of the poorest strata of the society. Conceived as a cornerstone of India’s development agenda, PMJDY represents more than a policy initiative; it is a big step towards democratising financial access for millions. This review examines its objectives, implementation, and the far-reaching impact in bridging the financial divide in India.

The Union government launched PMJDY as its flagship financial inclusion initiative. This programme seeks to ensure access to financial services for all households, especially those previously unbanked or underserved financially. The implementation of PMJDY stemmed from the recognition that access to financial services is crucial for economic growth and poverty reduction.

The government’s objectives with PMJDY include fostering financial literacy, encouraging savings, simplifying access to credit, and facilitating the direct transfer of government benefits into bank accounts. Key goals are to provide financial services, promote savings among the unbanked, and ensure financial inclusion, thereby reducing reliance on informal financial institutions and supporting formal banking channels.

READ I The Climate-Changed Child: UNICEF report a stark reminder of the looming crisis

Jan Dhan Yojana and inclusive banking

PMJDY introduces several key components to advance financial inclusion. These include promoting financial literacy, facilitating access to credit and insurance products, offering RuPay debit cards, and establishing zero-balance bank accounts. The programme prioritises mobile banking and direct benefit transfers to enhance the integrity of transactions.

Effective implementation of PMJDY involved various strategies such as door-to-door campaigns, mobile banking vehicles, financial literacy camps, and a focus on enrolling underrepresented communities and women. The government also collaborated closely with banks and financial institutions to streamline account opening processes and ensure comprehensive coverage.

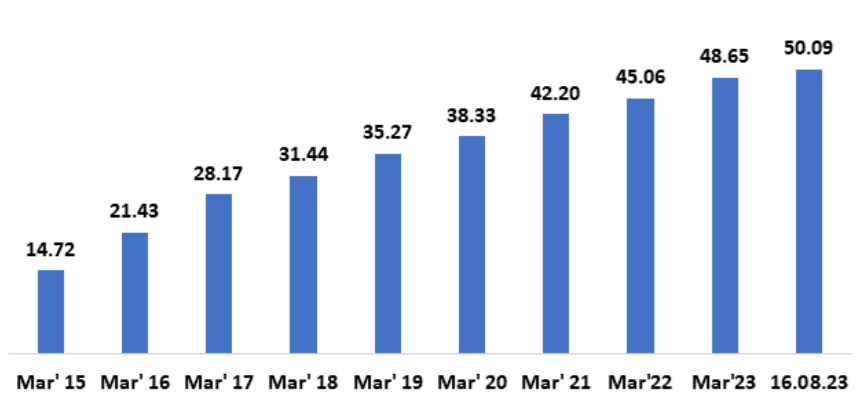

Number of Jan Dhan Yojana accounts (in crore)

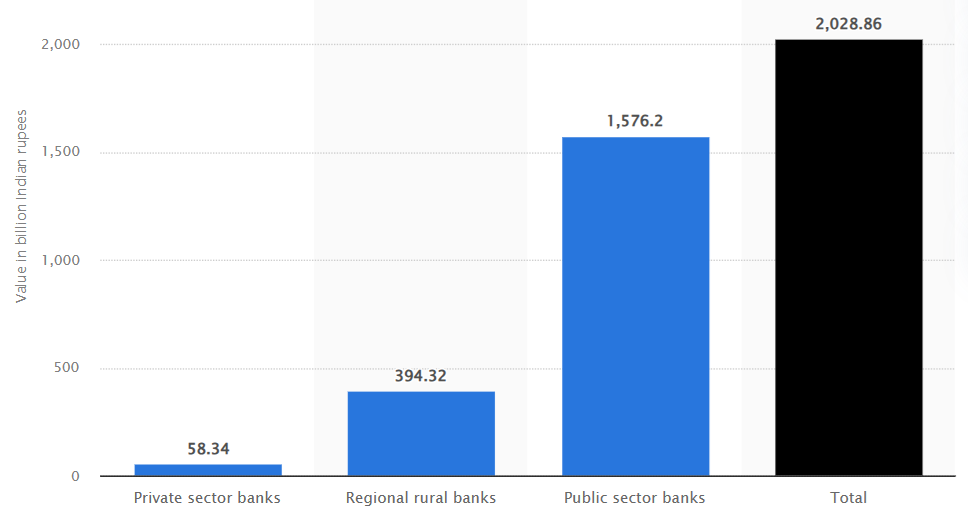

PMJDY deposits in August 2023 (billion rupees)

PMJDY has made significant strides in advancing financial inclusion in India. Over the past decade, millions of previously unbanked individuals have joined the formal banking system, leading to improved savings habits, enhanced access to credit and insurance, and a reduction in exploitative practices by informal lenders. The programme has been key in the efficient distribution of subsidies and benefits, reducing wastage and ensuring effective allocation.

A major achievement of PMJDY has been the substantial increase in the number of bank accounts nationwide, expanding formal banking services to previously underserved populations and regions. PMJDY has significantly improved the availability of financial services in India’s remote and rural areas. Mobile banking vehicles and banking outlets have brought banking services closer to villagers, reducing the need for extensive travel to distant branches.

The programme has also facilitated the expansion of insurance and pension plans, linking bank accounts with government-sponsored schemes to provide financial security in times of adversity. However, PMJDY faces challenges such as managing duplicate and dormant accounts, enhancing financial literacy among stakeholders, and preventing misuse and fraud. Valuable lessons include the importance of a holistic approach to financial inclusion, leveraging technology, and continuous efforts to improve financial literacy.

Future improvements could focus on enhancing security features, implementing targeted financial education programmes, and strengthening monitoring systems. Integrating PMJDY with other social welfare programmes could further augment its effectiveness.

Success stories and socioeconomic impact

There are numerous examples of individuals benefiting from PMJDY, from migrant laborers transferring funds to their families to rural entrepreneurs accessing loans. These stories highlight the programme’s role in transforming lives and promoting socioeconomic development. By enabling access to banking services, individuals have improved their financial stability and opened up entrepreneurial opportunities, contributing to economic growth.

While PMJDY has achieved significant milestones in financial inclusion, addressing challenges like duplicate accounts, financial literacy, and fraud is crucial for its continued success. Its impact on socio-economic progress is undeniable, but ongoing monitoring and adaptation are essential to ensure its long-term effectiveness and achievement of universal financial inclusion.

The Pradhan Mantri Jan Dhan Yojana stands as a testament to the power of financial inclusion in driving socio-economic progress. While PMJDY has undeniably etched significant milestones in India’s financial fabric, it also highlights the need for vigilance, adaptability, and continuous improvement. Its success is not just in numbers, but in narratives of lives transformed and dreams realised. PMJDY’s legacy continues to inspire, reminding that at the heart of sustainable development lies the key of inclusive finance, unlocking potentials and a more equitable future.

(Dr Firdous Ahmad Malik is Assistant Professor of Economics at University of People, Pasadena, California. Khair ul Samar is doctoral fellow at Department of Economics at Islamic University Science and Technology, Jammu and Kashmir.)