Kerala has long been a fascinating case study in India’s development narrative. In recent times, the state has found itself at a crossroads of development in the face of new challenges and fresh opportunities. There is a need to analyse Kerala’s development trajectory, highlighting the need for regional autonomy and innovative financing mechanisms to usher in a new era of growth.

Kerala’s development journey has been characterised by a distinct set of strategies that set it apart from other Indian states. For years, the state has embraced a development strategy anchored on three key pillars: redistribution of income, land reforms, and public provisioning of services. These efforts have translated into higher wages, equitable land distribution, and accessible healthcare and education services for its citizens.

READ I Vision 2047: India sets sail towards maritime excellence

Migration and acceleration of growth

The turning point in Kerala’s development story was a wave of migration and foreign remittances. The 1980s marked a watershed moment, where the state witnessed an extraordinary transformation in its economic landscape. The per capita income grew exponentially, leaving behind the stagnation that had gripped the economy in the preceding decades.

As we look at Kerala today, more than three decades after this momentous shift, we cannot ignore the new challenges that have emerged. These challenges are threefold: second-generation problems in the service sector, stagnation in productive capacity, and unemployment of its educated population.

To address these multifaceted challenges, Kerala requires a fresh approach to development. This new paradigm hinges on three core components:

- Devolution and participation: The state needs to promote decentralised decision making through initiatives like the People’s Planning Campaign (PPC). Empowering communities to have a say in local governance can improve service quality and enhance productivity in various sectors.

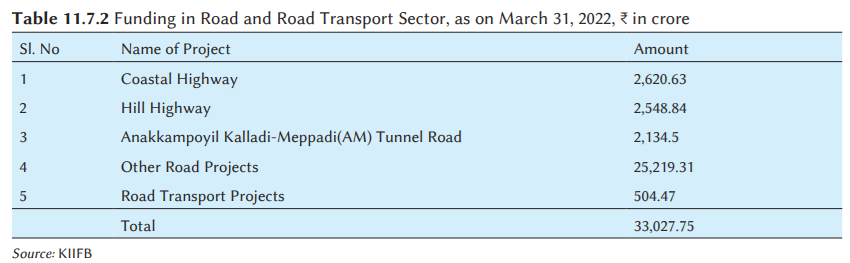

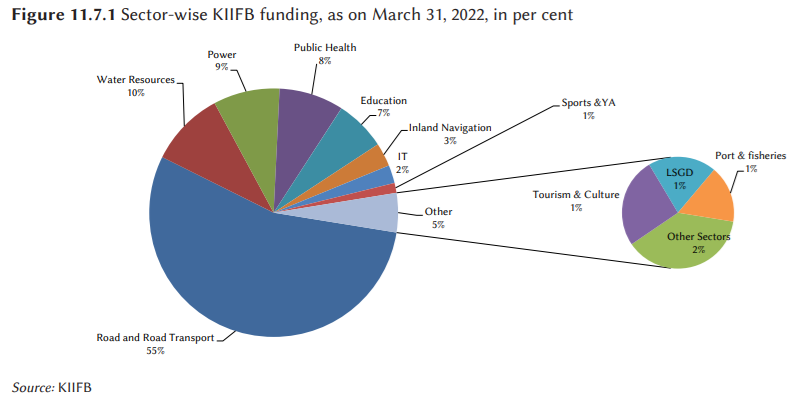

- Infrastructure development: Kerala faces a substantial infrastructure deficit, and addressing it is paramount to sustained growth. Extra-budgetary financing can play a pivotal role in bolstering infrastructure development across the state.

- Knowledge economy: Focusing on knowledge-based sectors and skill-oriented industries can usher in a new era of productivity and innovation. This shift will necessitate a transformation in the technological base of production in Kerala.

Additionally, restructuring higher education to promote research, innovation, and entrepreneurship is crucial in nurturing a knowledge-based economy.

Infrastructure finance through KIIFB

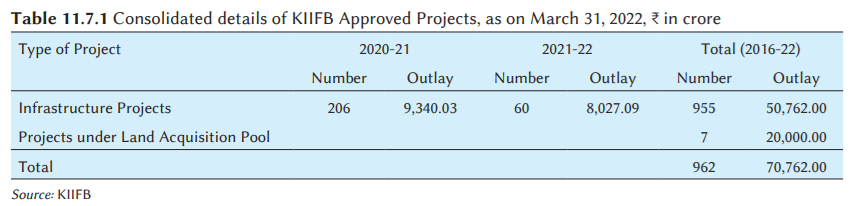

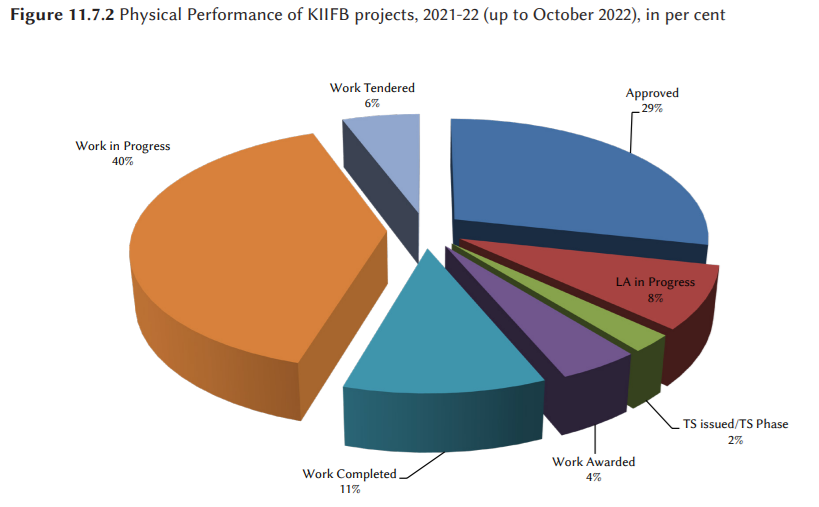

While the outlined development paradigm is promising, a critical piece of the puzzle lies in financing these initiatives effectively. Kerala’s innovative approach, embodied by the Kerala Infrastructure Investment Fund Board (KIIFB), offers a fresh perspective on infrastructure financing.

KIIFB stands as a departure from conventional financing methods. By outsourcing projects to specialised institutions that secure loans and oversee construction, Kerala can ensure a consistent flow of investments into infrastructure development. This approach optimizes resources and unlocks the potential for large-scale infrastructure projects that would be otherwise unattainable through traditional means.

Of course, no initiative is without its challenges and risks. Proper prioritisation of projects, legislative oversight, and safeguards against corruption are essential to ensure transparency and accountability. Robust mechanisms for monitoring and auditing have been put in place to mitigate these risks. Furthermore, managing liquidity to prevent a crisis is paramount. A sophisticated asset and liability matching mechanism has been deployed to ensure a balance between inflows and outflows, preventing any liquidity shortfalls.

Fiscal disparity and autonomy

One contentious issue currently at play revolves around the definition of state government borrowing. The Union government contends that KIIFB borrowing should be included in the state’s fiscal deficit calculation, which could have repercussions for the state’s fiscal stability. This matter underscores the need to reevaluate the implementation of fiscal rules at both the Union and state levels, ensuring equity in development opportunities across the country.

Kerala’s development journey is unique, marked by its regional autonomy and nuanced approach to growth. While fiscal responsibility is vital, it is equally important to accommodate regional differences and encourage flexibility in development strategies. Kerala’s chosen path has yielded commendable results, and initiatives like KIIFB exemplify a promising direction for the state.

As Kerala navigates the complexities of its development challenges and opportunities, it must remain steadfast in its commitment to regional autonomy. Balancing regional nuances with fiscal responsibility is the key to Kerala’s sustainable and equitable future. The road ahead may be challenging, but with the right mix of innovative financing and a nuanced regional approach, Kerala is poised for a brighter tomorrow.

(Dr TM Thomas Isaac is a former finance minister of Kerala. This article is the edited transcript of Dr Isaac’s presentation on ‘Financing of Kerala’s Infrastructure’, organised by Centre for Development Studies, Thiruvananthapuram.)