Venomics, an evolving field in medical science, is offering several solutions made from venom from snakes, insects, and other animals. Medical science has been developing cures of many ailments using venom derivatives. Recently, after two years of pandemic-induced economic turbulence, the Reserve Bank of India has taken the bitter pill of tightening monetary policy to reduce the pain of high inflation.

The Indian economy is at a crossroads. In needs to choose between easy money supply as a tool for growth and tight monetary policy to reduce inflation. Changes in monetary policy need careful consideration as persisting high inflation can adversely affect growth. In India, where prices of onions and tomatoes have the potential to topple governments, inflation is an emotional issue, and its occurrence is pervasively resented. Inflation is a delicate matter that must be addressed well in time and its solution cannot be a popular cure.

READ I Global recession fears intensify after US Fed’s bold rate hike

Growth vs inflation

In the pandemic era, when economic slowdown was the main concern, the policies were kept easy by monetary authorities across the world. Country after country took several measures to keep interest rates low and infuse ample liquidity into the financial systems. The numerous measures, inter alia, included emergency funding provisions, schemes for payment deferment, and provision of guarantees. Whether India went overboard with easy monetary policies to allow inflation to reach these levels, or it was necessary in challenging times is a question for debate by academicians and economists.

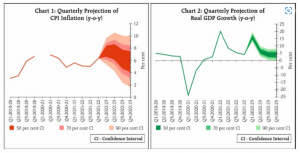

The inflation rate of 7.04 % in May 2022 requires quick policy interventions before it is too little, too late. High prices in other countries including the US, where inflation rate is 8.6 % in May 2022, is hardly a solace for the common man. The June 2022 monetary policy statement expects inflation to remain above the upper tolerance level of 6% through the first three quarters of 2022-23 is a matter of concern.

Whether inflation has an impact on the common man is a rhetorical question. Today in our country, the issue for the common man is not only rising prices but also negative real interest rates that are eroding their life savings. Fall in stock markets is aggravating the situation for people investing in stocks and mutual funds. With the wholesale price index escalating month after month and reaching 15.88 percent in May 2022, having low retail inflation in near future may remain a dream, considering producers will eventually pass on higher costs to consumers.

READ I Timely action on inflation needed to avert hard landing

Hobson’s choice on prices

A student of economics can easily explain that inflation can be a cost-push or demand-pull. The present inflation is more related to supply-related factors leading to an increase in costs. As if lockdowns were not enough, the Russia-Ukraine war has crippled supply chains and led to spiralling costs of various key commodities such as fertilizers, crude, oils, base metals, and grains. The rise in prices of crude oil directly leads to an increase in logistics costs impacting all products. In recent months freight charges have been trending upward exacerbating wholesale prices and leading to retail inflation.

For years, India has taken an accommodative monetary policy stance to facilitate economic growth. There is a premise that inflation will lead to growth as extra money will chase demand and lead to growth. However, with inflation, the risk of stagflation also looms large. Squeezing demand through a reduction in money supply is a difficult proposition as it has the potential to squeeze margins or bring losses to producers who must absorb higher costs with low demand. There is a dichotomous situation, considering that inflation is induced by supply-related factors, rather than on account of high demand that is being addressed with monetary tightening.

Many researchers have found that while the relationship between inflation and growth is positive at low levels of inflation, it is negative or insignificant at high levels. Further, liberal monetary policy may not be equally good for all constituents of business. Firms may have growth in nominal terms and decline in real terms. The unequal rise in the prices of goods also increases the risks for firms.

While the Indian economy is known to show high resilience, the government cannot become complacent. The solutions to high inflation may relate to fiscal prudence or changes in monetary policies. These solutions can also be imperfect and come with side effects. While there are no wonder drugs, at least there are medicines that have been tested time and again. There are treatments available, and success lies in how well we can administer a cocktail of medicines. It is a long process, and its effectiveness will be known over time. Till then, the policy makers can only hope for the best.

(The author is an expert in business strategy and finance and a former Deputy Director of The Institute of Chartered Accountants of India.)