Marcos Poplawski-Ribeiro serves as the deputy chief of the Fiscal Policy and Surveillance Division at the IMF. With a wealth of experience, he has held positions in the IMF’s research, fiscal affairs, and African departments. He is an expert in public finance, macroeconomics, and international economics, and has published in top academic and policy journals. Mr. Poplawski-Ribeiro earned his PhD in economics from the University of Amsterdam. Recently, he spoke at a webinar organised by EGROW Foundation on the complex relationship between fiscal policy and inflation. Edited excerpts:

The gross fiscal deficit can lead to inflation under certain circumstances. It refers to the excess of total government expenditures over its total revenues, excluding borrowings. When faced with a high fiscal deficit, governments often borrow or print money to finance their spending. When the government borrows from the central bank to cover the deficit, it increases the money supply and results in inflation. If the government finances the deficit by issuing bonds or borrowing from the market, it increases the demand for funds, leading to higher interest rates. Higher interest rates can stimulate inflationary pressures by increasing borrowing costs for businesses and individuals.

If the fiscal deficit is not effectively managed and leads to increased government spending without a corresponding increase in output, it can put pressure on prices. This is because government spending creates excess demand without a corresponding increase in the supply of goods and services, leading to inflationary pressures. The relationship between gross fiscal deficit and inflation is complex and can be influenced by various other factors, such as the overall macroeconomic condition, monetary policy measures, supply-side constraints, and the effectiveness of fiscal management. While high fiscal deficit can contribute to inflationary pressures, it is not the sole reason, and other factors need to be considered while assessing the inflationary impact.

READ I RBI Financial Stability Report: Banking system resilient, but not immune to risks

Fiscal deficit and inflation

Analysis of the April 2023 fiscal monitor published by the International Monetary Fund (IMF) would be relevant here. Public finance and inflation are closely connected. Inflation and its shocks can affect fiscal policy, including the indexation of public wages and social spending programs. Conversely, public finance, government spending, and fiscal deficits can contribute to aggregate demand and potentially lead to inflationary pressures. With the significant rise in global inflation, particularly in advanced and emerging economies like Brazil, the importance of studying this relationship has increased.

There are three key questions that require investigation.

- It is important to understand the impact of inflation on fiscal accounts and how this relationship is influenced by institutional factors like indexation, which can affect how inflationary shocks impact public finance.

- There is a need to study the distributional effects of inflation on households in countries with varying levels of economic and financial development.

- It is also necessary to understand the role of fiscal policy in achieving price stability.

To address the first, the theoretical construct through which inflation can impact public finances in the short term has been laid out. These drivers include the increase in nominal GDP caused by inflation, which influences the tax base and various fiscal variables linked to GDP. The role of indexation becomes pivotal as specific variables in certain countries are automatically adjusted based on inflation, thereby amplifying inflationary shocks. Furthermore, the structure of sovereign debt, including its amount, maturity, and linkage to inflation, can have an impact. Market expectations of inflation are also important, as they influence economic forecasts, bond prices, and the cost of government financing.

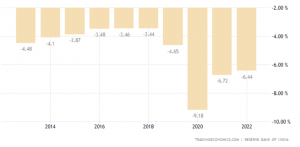

India: Fiscal deficit of Union government

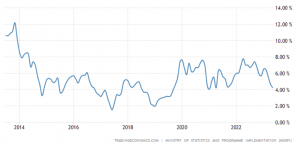

India: Inflation based on consumer price index

A survey was conducted in 179 IMF member countries to understand their indexation practices. The survey focused on four variables: personal income tax brackets, pension indexation, indexation of social system programs to inflation, and indexation of public wages. Responses were received from 116 to 176 countries regarding the status of indexation for these variables. The results indicate significant variations in indexation across countries and groups. Advanced economies have higher levels of indexation compared with emerging markets and low-income countries.

Within advanced economies, pension systems and social assistance programs show a strong degree of indexation to inflation. However, public wages display less indexation than expected. As a result, the prevalence of indexation in emerging markets may change if inflation persists, raising concerns and risks. It is important to note that indexation to inflation involves a trade-off. On one hand, it ensures that civil servants receive compensation that maintains their real rates, thus facilitating quality retention and increased productivity in the public sector. On the other hand, excessive indexation may contribute to a spiral of wage growth and more persistent inflation. Consequently, governments must make decisions regarding this trade-off and determine the extent to which they index inflation in public works.

An econometric analysis was conducted on the impact of inflationary shocks on public finance in 85 countries spanning the years 1962 to 2019. The analysis shows that a one percentage point rise or fall in inflation results in an average change of 0.6 percentage points of GDP in public debt. Most of the decrease in debt is caused by unexpected inflation, referring to inflation that was not anticipated by the economy.

Unexpected inflation has two effects.

- It leads to a rise in nominal GDP in line with inflation, thereby increasing the denominator in the debt-to-GDP ratio.

- It triggers automatic revenue increases as the tax base expands in nominal terms due to higher prices on which value-added tax (VAT) is imposed.

Consequently, individuals automatically pay more VAT. Additionally, a temporary decline in primary deficits occurs as a result of the inflationary shock. This happens because budgetary spending is typically predetermined in nominal terms. Therefore, when an unforeseen inflationary shock occurs during the year, the nominal budget serves as an upper limit, resulting in a decrease in real terms of the expenditure level. The combination of rise in the denominator and the temporary reduction in deficits contributes to a decrease in public debt. This would be significant for countries with a debt-to-GDP ratio higher than 50% and those with substantial levels of public debt.

The effects of inflation and its implications for public debts, household well-being, and income distribution are diverse. An inflationary shock does not have a substantial impact on inflation or public debts, indicating a potential positive effect. However, if inflation persists and becomes anticipated, the positive effect on public debts may diminish.

An alternative analysis using quarterly data which focuses on the impact of an inflationary shock on private expansion as a percentage of GDP reveals that such shocks lead to a significant fall in private expansion, leading to temporary reduction of public debt.

It is necessary to examine the distributional effects of inflation. Three channels related to household well-being and income distribution are explored. The first channel investigates the influence of inflation on households’ consumption baskets. Those who heavily consume goods such as food may be more affected if the prices of those goods rise above the average inflation rate. The second channel examines the impact of inflation on households’ real income, also known as the income channel, which is influenced by factors such as wage indexation. The third channel explores the impact of inflation on households’ balance sheets, considering their assets and liabilities.

To analyse these channels, the author utilizes microdata obtained from household surveys and other sources in six countries: Colombia, Finland, France, Kenya, Mexico, and Senegal. These countries represent a combination of advanced economies, emerging markets, and low-income countries. The effects of observed inflation between 2021 and 2022 are simulated on the different channels using this microdata.

As households become wealthier, the inflation they experience decreases. This trend is more noticeable among the poorest households compared to the wealthiest households, except in advanced economies like Finland, where the trend differs. In low-income countries, the impact of inflation on food prices is more substantial compared to other items in the consumption basket. The poorest 20 percent of households in these countries are particularly affected by food price inflation. In contrast, in advanced economies like Finland, the impact of food prices is lower due to food items comprising a smaller share of the household’s consumption basket.

In advanced economies like Finland and France, lower energy prices and energy consumption, as well as transportation consumption related to energy, have a more significant influence on households compared to food prices. In these economies, energy and transportation play a larger role in how inflation affects households. While the average effect of inflation remains consistent across income groups, the composition of its impact on households varies. The proportion of expenses related to energy, housing, and transportation varies across income groups.

The importance of the consumption channel remains pivotal as it shows that its impact on households decreases across income groups, particularly affecting low-income households. This effect is more noticeable in Kenya compared to Finland. Additionally, the income channel that involves wage adjustments and other forms of compensation in response to inflation has a major impact on the distribution of inflation impact. Wage adjustments were not adequately adjusted for inflation in Finland, resulting in a negative effect. Therefore, the analysis highlights the differences in how inflation affects various income groups, focusing on consumption patterns, food prices, energy, transportation, and wage adjustments in different economies.

The effects of inflation on households’ remuneration and the distribution of wealth in Colombia and advanced economies are examined, with a specific focus on the wealth channel. It explains that when a country aims to control inflation, households may experience a decline in their remuneration in real terms. However, in Colombia, remunerations were adjusted higher than the inflation rate, leading to a positive effect. The analysis reveals an inverted U-shaped effect on household income and the distribution of household income for disadvantaged economies.

This effect is observed through the wealth channel, specifically in terms of redistribution from net lenders to net borrowers during inflationary periods. For example, for a borrower with mortgages or loans, the nominal value of the loan remains the same, but the real value decreases due to inflation. This results in a positive wealth effect for middle-income households in Finland who are net borrowers. Conversely, wealthy households who are net lenders may experience a negative effect on their balance sheets if their assets, such as housing properties, do not appreciate with inflation.

In the context of low-income households, who typically have limited access to borrowing and assets, relying primarily on cash as their main asset can have a considerably negative impact during a period of inflation. This is because the value of their cash decreases in real terms. Furthermore, the effects of inflation and its redistribution vary among different age groups, corresponding to their stage in life. Younger households who are net borrowers experience a positive effect from inflation, whereas older households who are likely to be net lenders experience a negative effect. Findings based on data from Finland and France demonstrate the significant effects of inflation across different income levels. In every income bracket, younger households benefit from inflation, while older households are negatively affected.

To address the third question of whether fiscal policy influences inflation, two methods were employed. Firstly, an empirical analysis was conducted using data collected from 1950-2019 for 18 advanced economies to establish the relationship between fiscal policy and inflation. An important outcome was that government spending in the US had a positive and significant impact on inflation. Notably, following a spending shock lasting three to four quarters, inflation in the US increased by approximately 0.5 percentage points.

This finding underscores the substantial effect of fiscal policy on inflation. The findings also reveal that prior to 1985, fiscal policy had a significant impact on inflation. A one percentage point rise in government spending led to 0.9-1 percentage point increase in inflation across 18 advanced economies. In the more recent period from 1986 to 2019, this effect remained statistically significant, although slightly smaller. A percentage point increase in government spending resulted in 0.5 percentage point increase in inflation.

Furthermore, the study explores how fiscal policy could support monetary policy in reducing inflation. A new model called the Interior Genius Agents Duke and Asian models, which incorporate income distribution, was introduced. This enabled the authors to analyse how fiscal and monetary policies can influence both macroeconomic aggregates and income distribution in the model. Government spending and fiscal policy have had a substantial impact on inflation in the past, and this influence remained consistent over time. The potential role of fiscal policy in complementing monetary policy is required to address inflation.

Therefore, inflation shocks lead to increased public debt in the medium term, but relying on inflating the debt away is not a desirable or sustainable solution. Indexation of budget items can help preserve their real value, but there is a trade-off between adequately compensating civil servants and maintaining high quality. Excessive indexing of public finances can contribute to more persistent inflation. The distributive effects of inflation on households are more intricate than commonly perceived. These effects depend on households’ consumption patterns and their income and financial status. Inflation tends to redistribute wealth from net lenders to net borrowers in the economy.

Well-targeted fiscal restraint can support monetary policy in restoring price stability while safeguarding those most affected by the rising cost of living. It should recognise the importance of central banks’ response, particularly in large emerging markets like India and Brazil which have implemented more effective monetary policies in response to inflationary shocks compared with advanced economies.