Airfare surge pricing: For many travellers, buying an airline ticket during festivals or emergencies has ceased to feel like a routine market transaction. Prices swing sharply within hours, seats vanish without warning, and passengers are left unsure whether what they are paying reflects demand or something more structural.

That unease raises a larger question: how should competition policy respond to algorithm-driven airfare surge pricing in concentrated markets that provide essential services? Recent judicial scrutiny of airfare volatility has sharpened attention, but the concern is not episodic. India’s civil aviation sector illustrates how consolidation, automated pricing, and weak oversight can combine to strain standard assumptions about competition and consumer choice.

READ I Steel cartel probe tests India’s competition regime

Market concentration and pricing power

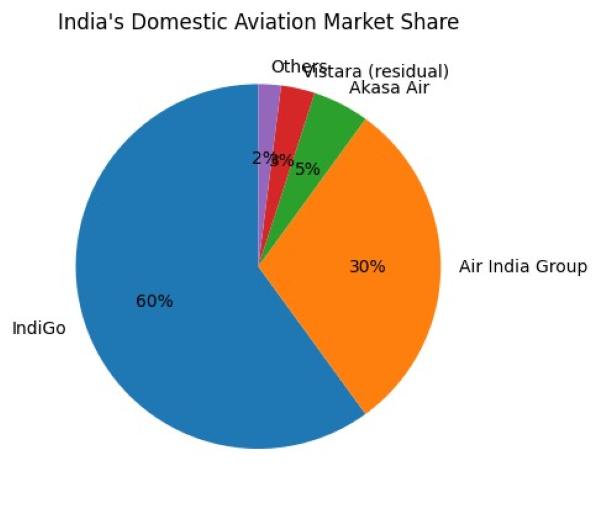

Over the last ten years, consolidation has turned Indian civil aviation into an oligopoly, with a few carriers dominating most domestic routes. In such markets, fares are shaped not just by demand and supply but by market power, capacity constraints, and strategic conduct. When fares triple during festivals or mass gatherings, the relevant question is not whether demand is high, but whether competition is adequately disciplining pricing behaviour.

The Supreme Court’s recent intervention matters because it recognises that air travel is no longer discretionary in many contexts. During emergencies, religious congregations, or family obligations linked to festivals, flying becomes a necessity. In these situations, unconstrained pricing can undermine consumer welfare and implicate constitutional guarantees relating to equality, mobility, and dignity.

READ I Corporate dollar borrowing boom carries a familiar risk

Airfare surge pricing in an oligopolistic market

Modern airline pricing relies on dynamic algorithms that adjust fares in real time based on demand signals, booking patterns, and available capacity. In theory, this improves efficiency by allocating scarce seats to those willing to pay more. In practice, in a concentrated market, algorithms can entrench market power.

When only a few airlines operate on a route, pricing systems do not function independently. They respond to similar data, face comparable capacity limits, and may converge on high-fare outcomes without explicit coordination. This form of tacit algorithmic alignment sits uneasily with competition law frameworks designed to detect human intent rather than machine-driven outcomes.

Petitions before the Supreme Court have drawn attention to opaque fare escalations and the absence of oversight over pricing algorithms. Without transparency or accountability, passengers cannot distinguish between legitimate dynamic pricing and exploitative price extraction enabled by concentration.

READ I US-Canada trade enters an era of leverage and limits

Cancellations, capacity shocks, and pricing

Competition concerns intensify during episodes of large-scale flight cancellations, such as those seen during IndiGo’s operational disruptions. Mass cancellations do more than inconvenience travellers. They temporarily alter market structure. When a dominant carrier withdraws capacity across multiple routes, remaining airlines face an abrupt reduction in competitive pressure.

Such episodes can create short-lived monopolies or duopolies on critical routes. Passengers, constrained by time and necessity, are forced to rebook at sharply higher prices. The interaction between cancellations and surge pricing produces outcomes resembling excessive pricing, an area where Indian competition law has traditionally struggled.

The harm is immediate and irreversible. Ex post remedies—consumer forums or competition investigations—arrive long after the fare has been paid or the journey missed. This time lag exposes the limits of reactive enforcement in fast-moving digital markets.

Regulatory gaps and policy design

Aviation regulation in India remains fragmented. The Directorate General of Civil Aviation oversees safety and operations. The Airports Economic Regulatory Authority of India regulates airport charges. Airfare pricing and ancillary charges, however, lie largely outside direct supervision.

This institutional gap assumes that market forces alone can discipline pricing, even in a concentrated, algorithm-mediated market. Recent judicial scrutiny has questioned that assumption, not by endorsing price controls, but by emphasising the State’s obligation to prevent exploitative outcomes in markets that provide essential connectivity.

This raises a policy design issue: should aviation be subject to calibrated ex ante competition safeguards during peak demand periods, similar to approaches used in network industries such as telecom or electricity?

Beyond blunt price controls

The Court’s intervention should not be read as support for rigid fare caps. From a competition perspective, blunt controls risk distorting incentives and discouraging capacity expansion. The challenge is to design tools that preserve efficiency while curbing exploitation.

Options include transparency obligations for pricing algorithms, route-specific monitoring during peak periods, and surge thresholds that trigger regulatory scrutiny rather than automatic intervention. Such measures reflect contemporary competition policy, which increasingly favours ex ante obligations in concentrated, digitally mediated markets.

Stronger grievance redressal and data disclosure requirements would also help. Access to granular fare and capacity data would allow regulators to distinguish genuine demand-driven price increases from outcomes driven by strategic capacity withdrawal or algorithmic amplification of market power.

Constitutional dimensions of competition

Litigation around airfare surge pricing has foregrounded a constitutional dimension. Access to transport during emergencies and peak travel periods is closely linked to rights to equality, mobility, and dignity.

For competition policy, this framing is instructive. It suggests that welfare analysis in essential service markets cannot be confined to price efficiency alone. Vulnerability, compulsion, and the absence of alternatives become relevant in assessing whether outcomes are genuinely competitive.

This does not displace economic analysis. It broadens it. In essential services, competition policy must account for access and distributional effects, particularly where algorithms magnify the consequences of concentration.

As the matter returns to the Supreme Court, the outcome could shape the future of aviation regulation. More broadly, it may influence how competition policy adapts to algorithm-driven markets where harm is immediate and disproportionately borne by those least able to absorb it.

The issue is not whether airfare surge pricing should exist, but whether it operates within a framework that recognises market power, protects constitutional values, and restrains exploitation. In that sense, the Court’s intervention is about more than fares. It is about redefining competition policy for essential digital markets.

Gazal Arora is Research Associate at CUTS Institute for Regulation & Competition.