India’s solar energy push: India has set itself an audacious twin target: touch a $30 trillion economy by 2047 while keeping its carbon ledger in check. Convinced the two ambitions can coexist, government think-tank NITI Aayog is drafting a fresh energy playbook that extends well beyond the usual power sector fixes. The new roadmap trains its sights on mobility, agriculture, industry, cooking fuel and electricity—each a major source of emissions, each a potential lever for low-carbon growth.

At the core of this exercise lies an upgraded India Energy Security Scenarios (IESS) model. Originally built to project trends to 2047, the model now runs to 2070—the year India has pledged to reach net-zero. It is a bottom-up framework that matches supply with demand, plugging any gaps through simulated imports or exports. The tool draws on alternative macroeconomic trajectories, sector-specific technology choices and demographic shifts (population is expected to stabilise near 1.65 billion by 2047). Early results confirm what policymakers long suspected: industry will remain the country’s single largest energy sink.

READ I Health diplomacy must drive India’s foreign policy strategy

Sectoral levers: Industry, mobility, agriculture

Nine working groups—spanning equipment makers, academics and industry bodies—are currently stress-testing assumptions. Crucially, the upgraded platform will be interactive, letting outside users craft their own net-zero pathways and test policy trade-offs in real time. NITI Aayog aims to publish the first full dataset, in five-year increments, within the next two months.

Clean power is only the opening chapter. The roadmap considers every serious fuel option—thermal, nuclear, hydrogen, bioenergy—and weighs their cost curves against a projected three- to four-fold jump in overall demand. Cargo transport, still stubbornly road-heavy, remains a weak link; yet other green pilots in rail, inland shipping and precision farming are gaining traction. For heavy industry, the model calculates resource needs down to tonnes of steel and aluminium, then converts them into electricity, gas or LPG requirements—detail that should help regulators design targeted incentives rather than blanket mandates.

Coal’s last stand—and solar energy

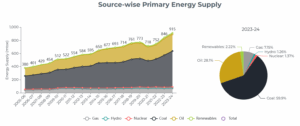

For all the talk of solar panels and wind turbines (renewables already make up 45 per cent of the country’s 462 GW installed capacity), coal refuses to go quietly. Record output in FY 2023-24 underscores its role in meeting baseload demand. Phasing it down—without jeopardising energy security—will test both policy agility and public finances.

Transport poses a parallel dilemma. The sector accounts for about 18 per cent of India’s greenhouse emissions, with diesel trucks the chief culprits. Electric vehicles are the obvious antidote, yet charging infrastructure lags badly: one public charger now serves roughly 135 EVs, far below international norms. Government subsidies—FAME, PM E-Drive, the PLI scheme—and a modest $3.6 billion of FY 2023 investment are helping, but a step change is still needed if India is to reach 30 per cent EV sales by 2030.

Financing the pivot

None of this will fly without capital. Global green-finance flows remain tight even as climate alarms grow louder. One immediate task for NITI Aayog is to use the new IESS model to put concrete price tags on solar energy parks, battery plants, transmission upgrades and industrial decarbonisation. Clear numbers should sharpen budget planning and lure private money. Beyond that, Delhi will need to expand its green-bond market, cut capital costs for clean projects and coax banks into longer-tenor lending. India’s deep pool of engineering talent can then be redeployed—from coal seams and diesel engines—to the business of building a low-carbon future.

The blueprint is sound; success will hinge on execution. Matching break-neck growth with deep decarbonisation has few precedents, and every delay raises both fiscal costs and climate stakes. Yet India has shown, notably in solar energy where capacity has grown at a 36 per cent CAGR, that it can scale clean technologies swiftly once the policy stars align. If NITI Aayog’s overhauled model can turn ambition into actionable data—and if ministries act on its insights—New Delhi may yet square the circle of prosperity and planet.