By Anindya Upadhyay

The ‘green’ component in financial stimulus packages during the last global recession of 2007-08 set the tone for climate-positive actions the world is witnessing now. More than $430 billion (of nearly $2.8 trillion) in tax cuts, credits and extra spending was dedicated for environment-focused initiatives like renewables, energy efficiency, electric vehicles etc, according to research by HSBC. While the US, China, European Union and South Korea were at the forefront of dedicating big chunks of stimulus spending to sustainability, India passed the opportunity then.

The need for a `green’-themed stimulus package to address a deeper economic crisis over a decade later is even more urgent now and shouldn’t be lost amid immediate priorities, according to the International Energy Agency (IEA). South Korea, China and some countries in Europe have announced provisions pertaining to rooftop solar, electric vehicles and public transport, as part of their stimulus packages for Covid-19-induced economic recession.

READ I Covid-19 recession: New government spending key to economic revival

India’s special economic package worth Rs 20 trillion that focuses on self-reliance hasn’t yet included sustainability as a vehicle of job-creation and growth recovery. The fifth largest installer of renewable energy in the world has opened coal-mining to private investors offering 41 mines as part of self-reliance measures for economic recovery. The reform to end state-owned Coal India Ltd’s monopoly on mining has been long-awaited, but its timing coincides with cheaper renewable electricity challenging thermal power.

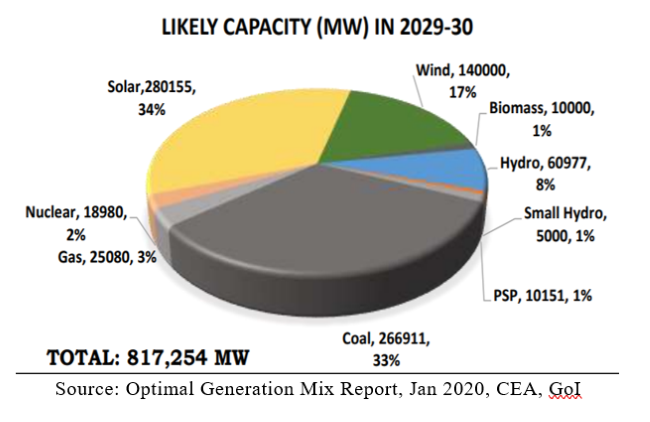

Electricity generation from green sources grew 5% in April versus a drop of 25% from thermal projects even as power demand fell by a fifth due to the lockdown, according to the Central Electricity Authority (CEA). The share of renewable energy in the electricity mix was also higher at 11.3% compared with 8% same month last year. Renewable energy projects are likely to dominate India’s capacity mix over the next 10 years, while coal power projects will form only a third of the installation base by 2030, as per the latest government projections.

READ I India must fortify FDI screening rules to escape WTO scrutiny

Time out

“The government’s concept of auctioning coal mine has failed as coal is a dying commodity and will not have much relevance beyond 15 years,” Sajjan Jindal, chairman of JSW Group said to CNBCTV18 on June 8.

Cheap thermal power is now a myth as continuous renewable energy has become more is more competitive now. A government auction in May for round-the-clock renewable power combined with storage discovered a competitive rate of Rs 2.9/kwh. This has set the ball rolling for renewable energy and not more fossil-fuel mining as the answer to the goal of stopping substitutable coal import.

The country’s largest private power project developer, Tata Power Ltd, is said to have put on hold development of new coal-fired plants for some years in favour of green ones, according to the Institute for Energy Economics and Financial Analysis (IEEFA). Some states like Gujarat are also reported to be turning away from polluting coal power and may not give permissions for building fresh projects. India’s mining reform comes at a time when global capital is fleeing from financing coal in support of climate goals. The World Bank, Norwegian Sovereign Wealth Fund, Goldman Sachs Group Inc and Blackrock are all part of an ever-growing list of multilateral institutions and investors who have announced stopping funding coal projects.

READ I Focus on life, livelihood key to an inclusive post-Covid economy

India’s thermal power projects have been running at low utilization, or load factors (PLF), of just above 50%. Low utilization not only threatens the viability of these projects but also deters new construction due to existing excess capacity. Average PLF for thermal projects is seen at 58% even in 2029-30. Lesser new projects combined with over 25 gigawatts set to be retired over the next few years make it a bleak demand scenario for coal.

Checking imports

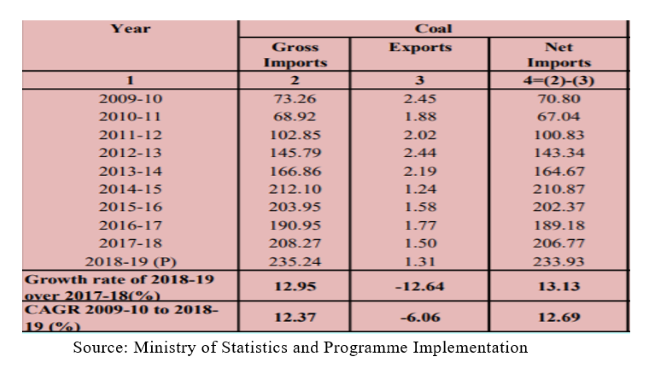

Between 2009 and 2019, the import of coal has steadily increased accompanied by a drop in coal exports, as per government data.

This is due to the inferior quality of Indian coal, which has lower energy and high ash contents. This necessitates the import of higher-quality coal to meet the requirements of steel plants and some power projects. Opening up coal mining to the private sector to raise production may not be able to reverse the import and export trends entirely, owing to the fact that quality of the fuel remains the same. The entire coal demand is not met from domestic production as the supply of high-quality coal (low-ash content) in the country is limited and resorting to import of coking coal remains the only option. Further, coal imported by power plants designed on imported coal required for blending purposes cannot be substituted by domestic coal. To be sure the 41 coal mines on offer include four fully explored coking coal mines which are fully explored mines.

READ I In theory: The economics of man vs animal conflicts

Energy efficiency, instead of liberalized coal mining, is another way to cut the fuel import bill. India’s electricity demand could potentially triple by 2040 as a result of increased appliance ownership and cooling needs, as per the IEA. “By raising the level of its energy efficiency ambition, India could save some $190 billion per year in energy imports by 2040 and avoid electricity generation of 875 terawatt hours per year, almost half of India’s current annual power generation,’’ the IEA said in a recent report.

While targeting employment creation from coal mining reforms, it is also pertinent to align economic goals with environment and employment. India employed 115,000 in the solar sector and 58,000 in wind energy in 2018 as per International Renewable Energy Agency. The coal sector employs about 500,000 directly and an equal or more number of people indirectly. Renewable energy and clean transport could be the next big employment generators that India could include in its Aatma Nirbhar Bharat Abhiyan. Focus on microgrids, energy storage and electric vehicles could accelerate the Indian economy into the future. India is as abundant in renewable energy resources as it is in coal and green power can easily be the answer to the country’s energy security. This is the area we should not lose sight of in chasing self-reliance.

(Anindya Upadhyay is Senior Technical Consultant at The Asia Foundation, Views are personal.)