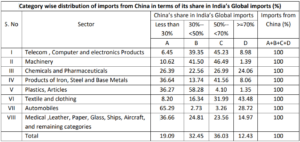

India’s trade deficit with China has expanded alarmingly, with imports surpassing the $100 billion mark in 2023-24, up from about $70 billion in 2018-19. China now accounts for 30% of India’s industrial goods imports, a figure that has steadily risen over the last 15 years. A report by Global Trade Research Initiative (GTRI) predicts a continued influx of Chinese imports across eight major industrial sectors, including machinery, chemicals, pharmaceuticals, and textiles, debunking the common perception that Chinese imports dominate only the electronics sector.

While imports from China have skyrocketed, India’s exports to the nation have stagnated at around $16 billion annually between 2018-2019 and 2023-24, resulting in a cumulative trade deficit exceeding $387 billion over six years. However, government data reveals that India’s exports to China actually increased last year across nearly 90 principal commodities. India exports a total of 161 items to China, with these 90 commodities constituting 67.7% of India’s export basket, including iron ore, telecom instruments, and electronic components, as stated by the commerce ministry in April.

READ | Hunger pangs: Global crisis demands action, not innovation

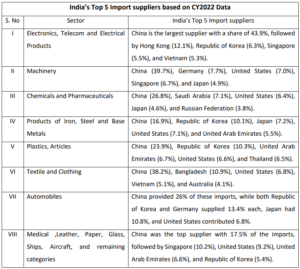

Nevertheless, China’s share in India’s total merchandise imports stands at 15%, a stark contrast to the figures from India’s second-largest import partner, the UAE, which made up 6.7% in 2020-21 and 7.31% in 2021-22. These numbers reveal the importance of China as India’s largest source of imports.

The report also notes that the presence of Chinese firms in the Indian market might lead to an increase in imports, as these firms often source most of their requirements from their parent companies. Excluding oil, which constitutes 25-30% of India’s total imports, China’s dominance becomes even more apparent, with the country potentially accounting for up to 25% or more of India’s non-oil goods imports.

Given that half of the imports from China consist of capital goods and machinery, there is an urgent need for focused research and development in these areas. Efforts are needed to enhance other industries too, including organic chemicals, active pharmaceutical ingredients (APIs), and plastics, which represent 37% of imports.

Historically, India and China did not always have such an imbalanced trade relationship. In 2005, India enjoyed a trade surplus with China. However, since then, Chinese goods have dominated trade flows, significantly widening India’s trade deficit. A substantial trade deficit has serious implications for India’s economic well-being and national security, as imports can destabilise domestic industries, potentially leading to premature deindustrialisation and unemployment.

On the other hand, imports play a crucial role in bridging gaps between domestic production and consumer demand. This is particularly true for raw materials and intermediate goods, which can enhance the competitiveness of Indian manufacturers in global markets. The economic principle of comparative advantage supports this, suggesting that countries should focus on producing what they do best and import what others excel at. Additionally, imports can introduce cutting-edge technologies and provide cheaper alternatives to consumers, helping to control domestic inflation.

Chinese imports rise globally

Despite international efforts to curb its export dominance, such as the ‘China-plus-one’ strategy by several nations and companies, China remains a central figure in the global supply chain. This is concerning, especially given the recent slowdown in China and subsequent massive supply disruptions.

Policymakers must devise strategies to strengthen domestic industries and reduce dependence on imports from geopolitical rivals like China. This urgency is compounded by the fact that Chinese imports have risen despite India signing several free trade agreements (FTAs) with East and Southeast Asian nations. Although India has no FTAs with China and withdrew from the Regional Comprehensive Economic Partnership (RCEP), giving China a theoretical disadvantage, this has not translated into reduced market share for Chinese imports.

There is widespread optimism in India about long-term results from government initiatives like the Production Linked Incentive (PLI) scheme. Nonetheless, India must critically assess its reliance on inexpensive Chinese goods.