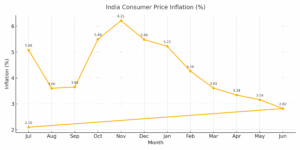

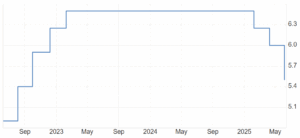

Retail inflation has slipped to 2.1 per cent — its lowest reading in more than six years — reviving expectations that the Reserve Bank of India’s Monetary Policy Committee will resume easing at its August or October meeting. Markets have already priced in at least another 25 basis point reduction in the repo rate, which currently stands at 5.5 per cent after a cumulative 100-basis-point rate cut since February.

The case for further easing looks persuasive: price pressures have cooled faster than the RBI’s own projections, and growth, though steady, remains below the nation’s potential. Yet two caveats cannot be ignored. First, lower policy rates will stimulate demand only if banks transmit them fully to borrowers. Second, the inflation trend must be sustained; a premature surge in food or fuel prices would negate the benefits of cheaper credit. In short, additional easing is needed—but it must be accompanied by relentless scrutiny of both rate transmission and the inflation trajectory.

READ I India’s $10bn semiconductor bet faces execution test

Inflation and rate cuts

A steep decline in food prices has pulled headline CPI below the midpoint of the RBI’s 2–6 per cent tolerance band. Economists now forecast an average print of around 3.3 per cent in FY 2025-26, well beneath the central bank’s earlier 3.7 per cent estimate. Core inflation—traditionally sticky—has decelerated too, reflecting subdued input-cost growth and muted pricing power in consumer goods. For now, imported inflation also looks benign: crude oil has stabilised at $66–70 a barrel, global food futures have softened, and the rupee has traded in a tight range, limiting pass-through from currency depreciation.

Even so, the battle is far from won. Food inflation, notoriously volatile, can turn in a single monsoon season; a weak sowing cycle or erratic rainfall can send vegetable and cereal prices surging. Equally, global energy prices remain hostage to geopolitics. The MPC therefore needs the cushion of a real policy rate—repo minus expected inflation—that stays positive even after another modest cut. For the moment, that cushion exists, but it could erode quickly if supply shocks materialise.

Growth warrants stimulus

While headline GDP growth is pegged at 6.5 per cent for FY 2026, high-frequency indicators point to uneven momentum. Industrial production is expanding, yet capacity utilisation in key manufacturing clusters remains below pre-pandemic peaks. Credit growth, though double-digit, is fuelled mainly by unsecured retail lending, even as long-tenor corporate borrowing lags. Investment intentions—measured by new project announcements—are promising, but actual capital formation is yet to match those announcements.

Reserve Bank of India repo rate (%)

A calibrated rate cut can nudge firms to accelerate capex and consumers to advance big-ticket purchases, especially when inflation expectations are subdued. Fiscal policy, constrained by consolidation targets, cannot shoulder the entire burden of supporting demand. That places the onus on monetary policy to provide incremental stimulus without compromising the price mandate.

Transmission — the missing link

Monetary easing delivers growth only when banks lower lending rates in tandem. The record so far is mixed. Since February’s first cut, the weighted-average rate on new loans has fallen by 24 basis points, while the rate on outstanding loans is down a modest 16 basis points. Deposit rates have inched lower, but banks, flush with liquidity, still prefer parking excess funds in ultra-short-tenor paper rather than recalibrating all loan buckets. The June cash reserve ratio cut, which will release ₹2.7 trillion into the system, should enlarge banks’ appetite for lending at lower margins, yet past cycles show that transmission often stalls when credit risk rises or liabilities are repriced only gradually.

The RBI must therefore keep its foot on two pedals simultaneously: inject durable liquidity to narrow funding costs and use moral suasion—plus, if necessary, sharper disclosure norms—to ensure that banks pass on the benefit. A transparent, bank-wise scorecard on transmission could expose laggards and galvanise peer pressure.

Banking margins and financial stability

Fitch Ratings estimates that net interest margins may compress by 30 basis points in FY 2026 as loan books reprice faster than deposits. While thinner margins partly explain banks’ reluctance to cut lending rates aggressively, the bigger risk is that a rapid credit expansion could lead to riskier underwriting. Regulators must watch for pockets of overheating—unsecured consumer loans, microfinance, and real-estate advances, in particular. Simultaneously, the internal committee reviewing the liquidity-management framework should recommend tools that smooth out short-term rate spikes without flooding the system to the point of fuelling asset bubbles.

The balance sheet picture is otherwise sound: capital-adequacy ratios exceed regulatory minima, gross non-performing assets are trending down, and provisioning buffers are higher than in the pre-Covid period. These strengths provide cover for a moderate dip in margins during the transition to lower rates.

Watching the inflation dashboard

Cutting rates today assumes that tomorrow’s inflation remains subdued. That requires far sharper surveillance than a backward-looking monthly CPI release. The RBI should intensify real-time monitoring of mandi-level food prices to catch sudden spikes in perishables before they filter into retail inflation. It should track global commodities—oil, fertilisers, and edible oils in particular—because swings in these markets feed quickly into input costs and household budgets.

Household-inflation expectations surveys need a finer rural-urban split; recent data suggest rural spending has held up better than expected, and perceptions about future prices can shift credit behaviour. Equally important is a supply-chain stress index that flags logistics bottlenecks, such as rail wagon shortages or port congestion, which can amplify seasonal price pressures during harvest and festival peaks. Armed with such high-frequency intelligence, the MPC can cut now and still pivot swiftly if inflation expectations unhinge.

Ease, monitor, and communicate

On balance, a 25-basis-point reduction at the August meeting would reinforce confidence without exhausting the central bank’s ammunition. The cut should be explicitly framed as conditional: contingent on sustained inflation within target and demonstrable transmission into lending rates. To make that conditionality credible, the RBI could outline a “monitorable action matrix” that tracks the change in weighted-average lending rates, the movement in deposit costs, and a small basket of high-frequency inflation indicators. If any of these variables diverge materially from projections, the MPC could pause—or even reverse—further easing.

The policy path writes itself. Deliver a measured 25-basis-point repo-rate cut in August while real rates remain positive and inflation expectations are anchored. Follow through with a published quarterly transmission scorecard that ranks banks by the pass-through of policy cuts to both fresh and outstanding loans; sunlight will do what nudges cannot. Maintain a surplus—yet not excessive—liquidity environment through calibrated open-market operations so that funding costs ease without igniting speculative excess.

Strengthen the inflation early-warning toolkit by integrating high-frequency food and commodity trackers, expectations surveys, and supply-chain stress measures into the policy deliberation notes. Above all, communicate the data-dependence of future moves: additional easing will hinge on enduring disinflation and tangible rate transmission to households and firms.

The economy needs a gentle nudge, not a reckless shove. A finely tuned rate cut, allied with vigilant monitoring and transparent communication, offers the best prospect of rekindling investment without stoking prices. The MPC has room to act; it must also prove that lower rates will reach the real economy and that it stands ready to tighten again should inflation return. The task calls for surgical precision, not indiscriminate stimulus—and that is exactly what prudent monetary stewardship demands.