As expected, the Monetary Policy Committee of the Reserve Bank of India raised the repo rate by 50 basis points to 5.90%. With this, the cumulative increase in the policy rate during this rate hiking cycle rose to 190 basis points. The cycle started with a 40 basis points hike in May. The Governor’s message said the MPC decided to act swiftly to minimise the spillover impact of the aggressive monetary policy tightening by the central banks of the advanced economies.

The increase in policy rate was needed for a few factors. India’s retail inflation measured in terms of consumer price index (CPI) remained higher than RBI’s upper tolerance limit of 6% for the eighth straight month in August 2022. Food inflation is expected to stay higher due to higher cereal prices. Wheat production got affected by the heat wave in the northern part of India earlier this year and now lower rice production during the kharif season will weigh on prices.

READ I Chinese economy is not in terminal decline

Factors behind repo rate hike

Last week, the US Fed raised the policy rate by 75 basis points to take the target range of federal funds rate to 3-3.25%. The hawkish policy guidance by the US Fed led to increased volatility in the market with dollar index soaring to a multi-year high. At home, the rupee depreciated and breached the Rs 80 a dollar mark. The RBI spent at around $100 billion in the last 12 months from the forex reserves to address exchange rate volatility.

Uneven spatial distribution of monsoon adversely impacted the prices of perishable items such as tomatoes. Moreover, with the service sector getting back strong, the pricing power is coming back that could fuel inflation. Nonetheless, lower commodity and crude prices will cool off inflation a bit. These factors will keep inflation above MPC’s target of 6% for most part of FY23 and thus a 50 basis points increase in repo was appropriate.

On the growth front, Indian economy is resilient. Credit growth of banks remained robust and increased by 16.2% in the earlier fortnight. GST collections remained above INR 1.4 trillion for the sixth consecutive months in August. Manufacturing PMI stayed resilient at 56.2 in August with increased capacity utilisation in manufacturing. Service sector indicators such as rail freight traffic, domestic air passenger traffic, toll collection show strong resilience.

Kharif sowing being higher by about 1.7% of normal sowing; agriculture remains resilient. Both consumption and investment demand are showing signs of traction. Vehicle sales increased by 20% in August and now on a 3-year CAGR basis up by 1.7%. The rate hiking cycle will not have a very significant adverse impact on India’s growth outlook which allows MPC to deliver bigger hikes.

Real repo rate adjusted for inflation is still negative and that will dwindle household savings. Gross household financial savings decreased to 10.8% in FY22 from 15.9% in FY21. It is expected that the MPC will continue to raise the repo rate to take it to neutral level to boost savings.

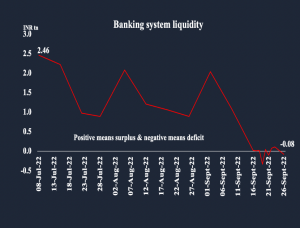

MPC retained its stance of “withdrawal of accommodation” despite banking system liquidity remaining in deficit on some days recently. This is the correct approach since the government is expected to spend higher on capex and subsidies, liquidity will come to the banking system and RBI will have to mop-up excess liquidity to bring it to neutral level. Government has about INR 3.5tn cash balance with RBI.

Going forward, the repo rate is expected to become the operating rate since eventually RBI will go in liquidity injection mode. This will see market rates moving higher across tenures. RBI is expected to continue its forex market intervention to stabilise volatility in rupee and outflow of funds. Forex reserves even though decreased, still remain favourable compared with that of other emerging markets which gives RBI the room to do forex intervention.

(Sudarshan Bhattacharjee is Principal Economist at Yubi.)