Rising interest rates, geopolitical tensions, and supply chain disruptions have cast a shadow on global financial stability. The RBI’s Financial Stability Report assesses the domestic situation and provides crucial insights into how Indian financial institutions are navigating these external challenges. By analysing the potential impact of global events on Indian banks and NBFCs, the report equips policymakers with the necessary information to implement targeted measures and safeguard the sector against external shocks.

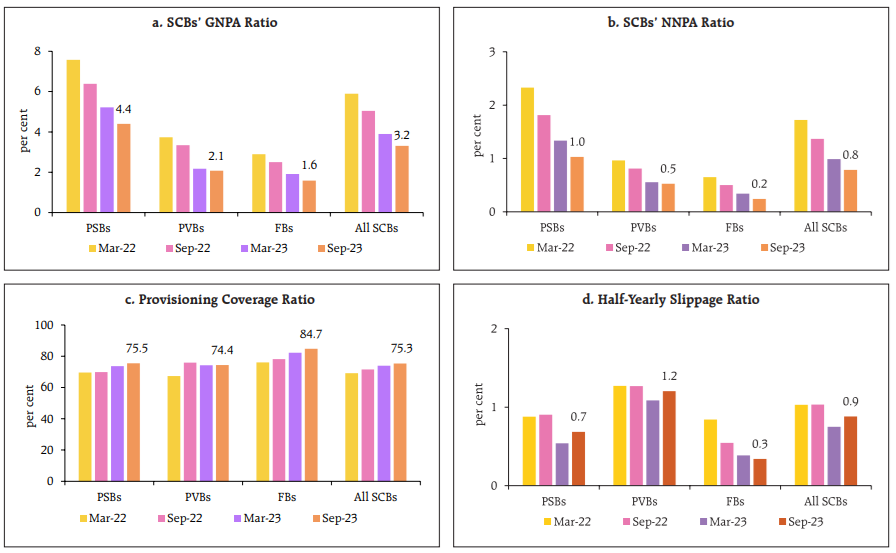

The highlight of the report is the robust health of scheduled commercial banks. The decline in net non-performing assets to a mere 0.8% and a robust capital adequacy ratio of 16.6% as of September noted in the December edition of the Financial Stability Report are commendable. This not only reflects an efficient management of assets but also a strategic foresight in handling bad loans.

READ I Valuations deflated, VCs shy: Startups pivot towards pragmatism

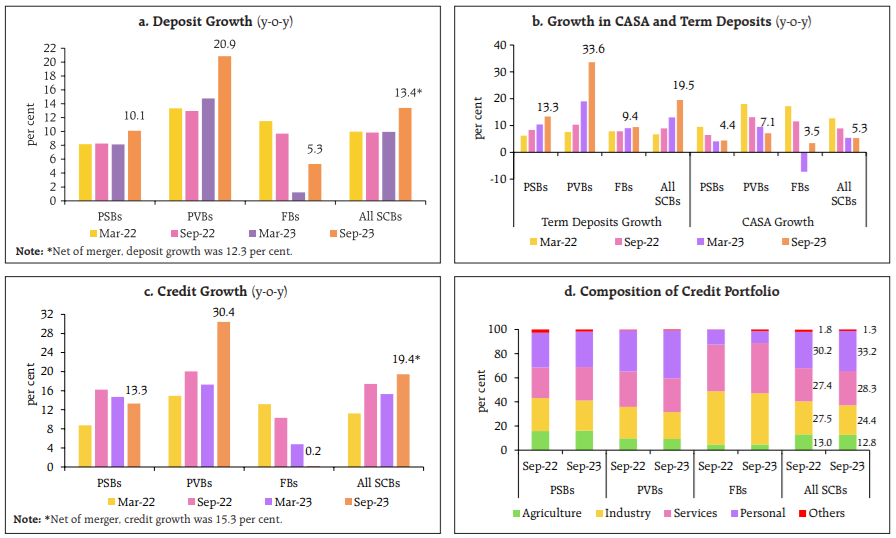

Commercial banks in pink of health

The stress test results further reinforce the notion of resilience. They underscore that SCBs, the linchpins of financial stability in India, are well-equipped to withstand macroeconomic shocks without needing additional capital infusions. This resilience is crucial in a landscape where the farm sector still grapples with high bad loans, and the retail segment shows some marginal impairment in credit card receivables.

The other pillar of the financial sector, NBFCs, shows an impressive compound annual growth rate (CAGR) in personal loans. However, the RBI’s report cautions about the relative increase in stress under high-risk scenarios compared to March 2023. This necessitates a balanced approach, where growth does not overshadow the need for risk management.

The RBI’s analysis goes beyond individual institutions, offering a holistic view of the financial system through a combined focus on microprudential and macroprudential aspects. While microprudential supervision ensures the health of individual entities like banks and NBFCs, macroprudential oversight assesses systemic risks across the entire financial system. The reports analyse potential spillovers and contagion effects, ensuring both individual institutions and the broader financial ecosystem remain resilient.

Often in the shadow of their larger counterparts, Urban Cooperative Banks (UCBs) have demonstrated significant progress. Improved capital positions, better asset quality, and enhanced profitability metrics are heartening signs of their growing stability.

Financial stability report highlights

Expanding the scope, the RBI report analyses the insurance sector, mutual funds, and clearing corporations. The insurance sector’s solvency ratios being well above regulatory requirements add a layer of security. The mutual funds, especially debt schemes, show stability with only a few instances of stress. The adequacy of stress test results for clearing corporations ensures the integrity of financial markets.

A key highlight of the RBI’s analysis is the interconnectedness within the financial system. The expanding bilateral exposures among financial entities point to increased interdependence. This interconnectedness, while beneficial in terms of efficiency and risk diversification, also poses systemic risks.

The contagion analysis in the reports is a critical component. It assesses the potential impact of the failure of key financial institutions on the system. The finding that the banking sector can absorb shocks from the failure of the largest entities without additional failures is a reassuring sign of systemic robustness.

The RBI’s comprehensive analysis instils confidence in the resilience of India’s financial sector. However, the dynamic and uncertain global economic environment calls for continued vigilance and adaptability. Maintaining this stability will require continuous monitoring, robust stress testing, and adaptive regulatory measures. Enhancing transparency and strengthening financial reporting and risk management infrastructure will be crucial in fortifying the sector against potential shocks.

The RBI’s Financial Stability Reports not only assess the present but also look towards the future. By identifying emerging trends like the rise of fintech and digital lending, the reports pave the way for proactive policy interventions. They emphasize the need for continuous innovation and adaptation to keep pace with the evolving financial landscape. This forward-looking approach allows policymakers to anticipate and mitigate potential risks, ensuring the Indian financial sector remains robust and competitive in the long run.