When the oil-producers’ cartel OPEC+ announced a modest increase in output targets — from November onward a mere 137,000 barrels per day — the global energy markets barely stirred. But for India — where over 85 % of crude is imported and every dollar per barrel adds billions to the import bill — this hike carries outsized significance. The question is: can New Delhi absorb that impact without unsettling inflation, the current account and fiscal stability?

At its simplest, the OPEC+ decision is less about adding supply than signalling control. After years of deep cuts and then gradual unwind — some 5.85 million bpd at the peak of restrictions — the cartel is cautious. The reasoning: demand remains soft, China’s industrial output weakens, and US shale production bites. In other words, this hike is designed less to flood the market than to protect the floor under prices.

READ I Why Indian philanthropy must move beyond charity

OPEC+ action and India’s energy bill

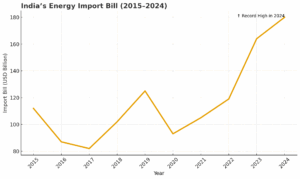

For India, this matters on many fronts. Currently, the Indian basket price of crude hovers around the mid-$60s per barrel. With imports running at about 5.6 million barrels per day, the import bill is relentlessly sensitive to price moves. Every dollar above the base adds roughly a billion-plus dollars annually. Indeed, a recent estimate suggests that if India were forced to shift away from discounted Russian crude, its oil import bill could worsen by $9-12 billion in 2026-27.

Inflation is the first casualty. Fuel and transport costs feed immediately into the headline consumer price index; higher petrol, diesel and LPG prices squeeze household budgets, erode purchasing power and force the central bank’s hand. Secondly, fiscal pressures mount. Subsidy burdens on state-owned oil firms, or delayed pass-through of cost increases, widen deficits. Thirdly, the current account deficit (CAD) risks widening: a few dollars-higher per barrel means billions flowing abroad, weakening the rupee and raising debt service costs.

Fuel inflation: Can policy cushion the shock?

Against this backdrop, the OPEC+ output hike is a warning—not a relief. What should India do? First, bolster its strategic reserves and storage infrastructure so as to buffer short-term supply shocks. The ministry of petroleum already reports that India meets about 88 % of its crude needs through imports. But storage remains modest compared to peers; widening it is not optional.

Second, deepen diversification of supply. India has aggressively bought Russian crude at discounts, making Moscow its top supplier in some years. But sanctions and global politics complicate reliability. New Delhi needs more barrels from the Middle East, Africa, Americas—and possibly via long-term contracts that insulate from spot volatility.

Third, accelerate the transition to cleaner fuels. While fossil oil won’t disappear overnight, every percentage point of crude-share that renewables, hydrogen or advanced biofuels displace reduces India’s exposure. Embedding a more realistic fossil supply risk in fiscal planning matters: India cannot continue to assume “cheap oil forever”.

Fourth, pricing reform matters. Deregulating LPG and diesel prices, rationalising excise or windfall tax mechanisms and reducing subsidies would strengthen the buffer. India already has a precedent for windfall levies on petroleum crude. But clarity, predictability and a pass-through design remain weak. A “policy freeze” or transparent review of fuel tax reform would strengthen credibility.

Finally, a currency-hedge via trade arrangements can help. If India deepens rupee-trade (or rupee-settled deals) with oil-exporting partners—say UAE, Saudi Arabia, Russia—it would reduce forex exposure. With the U.S. dollar near multi-month highs, paying more for dollar-denominated crude just amplifies the hit.

Learning from global experience

Global analogues teach useful lessons. Japan and South Korea secured long-term contracts and built up strategic storage after the 1970s crisis. China has exploited dips in global oil price cycles by ramping up reserves when prices are low and tapping them when high. The European Union, post-Ukraine war, is reinventing supply diversification, energy efficiency and coordinated procurement to blunt price shocks. India needs a hybrid of these: storage + contracts + transition + pricing discipline.

The small output increase by OPEC+ should therefore not lull us into complacency. Let us remember that oil is not just a commodity — it is a geopolitical lever. The producers may moderate supply, but any mismatched demand, currency weakness or policy mis-step in India magnifies the effect. The government’s energy strategy must therefore be anchored in realism: yes, continue the renewable push—but ensure the 85 % import-dependence is reduced structurally and the fiscal and inflation risks of crude volatility are embedded in budget forecasts.

India’s growth trajectory rests on its ability to dampen external shocks like fuel-price surges. The OPEC+ move signals caution cannot be taken for comfort. For New Delhi, the imperative is clear: diversify, store, reform and transition. Only then can the country shield its economy from the ripple effects of a barely noticed oil production tweak—and turn a potential vulnerability into strategic resilience.