OPEC+, the world’s largest group of crude oil producers, has decided last week to extend the ongoing production cuts into 2024. The oil cartel is looking to keep oil prices buoyant amid concerns about a global economic slowdown. Comprising the Organisation of the Petroleum Exporting Countries and allies including Russia, OPEC+ pumps approximately 40% of the world’s crude. The group expects to sustain prices amid a global economic crisis that could lead to a free fall. Consequently, it has been decided that the countries within this group will further reduce output by 1 million barrels per day (bpd) in July. This announcement drove international oil futures higher on Monday.

Saudi Arabia, the group’s largest producer, will implement a significant output cut in July, in addition to the broader OPEC+ agreement to limit supply until 2024. The Saudi energy ministry said the country’s output would decrease to 9 million bpd in July, down from approximately 10 million bpd in May. This marks the most substantial reduction in years. As the only member of the OPEC+ grouping with ample spare capacity and storage, Saudi Arabia can easily adjust its output levels.

READ | Foreign exchange reserves: Impact on global trade, financial stability

For India, which imports more than 80% of its crude oil requirements, the combined announcements from Saudi Arabia and OPEC+ could have severe consequences had it not been sourcing cheaper oil from other sources. New Delhi has been seeking lower-cost crude from Russia since the Ukraine war. Otherwise, the supply reduction has the potential to drive up global oil prices. The price India pays for an imported barrel of oil has been steadily declining due to rising imports from Russia.

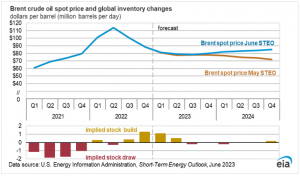

The OPEC+ had announced output cuts of 1.66 million bpd in April. However, this move did not significantly raise prices. The benchmark Brent crude futures remained below $80 a barrel, after briefly surpassing $87 following the announcement.

Brent crude oil spot price and global inventory change

With the earlier output cut of 3.66 million bpd, amounting to 3.6% of total global demand, the overall production targets from January 2024 will see a further decline of 1.4 million bpd. The adjustments also involve revising targets for Russia, Nigeria, and Angola to align them with current production levels.

Since Russia invaded Ukraine in February 2022, the Western nations have accused OPEC of manipulating oil prices and undermining the global economy through high energy costs. This has triggered a blame game, with the West accusing OPEC of siding with Russia. In response, OPEC has criticised the West’s excessive money printing over the past decade, leading to inflation and forcing oil-producing nations to act to preserve the value of their primary export.

OPEC+ means business

With its latest move, analysts believe that OPEC+ wants the world to understand that they are determined to defend their price floor at any cost. The Saudis did not just make empty statements; they followed through on their threats to speculators.

There are several reasons why OPEC+ has taken an offensive stance — the most important being speculation on data from China, the second-largest oil consumer, suggesting that the economic recovery after the coronavirus lockdowns is losing momentum. There are also concerns about a potential recession following major bank failures in the US. In fact, fears of another banking crisis have prompted investors to sell off riskier assets including commodities, resulting in oil prices falling to around $70 per barrel from a peak of $139 in March 2022. A global recession would negatively impact oil prices as economic activities come to a halt, pushing prices down.

The ongoing debt crisis in the US is also exerting pressure on oil prices. There is a high risk of the world’s largest oil consumer defaulting on its debt, which is unfavourable for oil prices. However, the US output has been increasing, with the country’s crude oil production projected to rise by 5.1% to 12.53 million bpd in 2023 and by 1.3% to 12.69 million bpd in 2024. This poses a threat to the monopoly power of OPEC+.

The move is likely to receive a negative response from Washington, which is already grappling with inflation, and tensions with leading consumer nations may escalate. Earlier, Washington criticised OPEC+’s actions in April. In response to OPEC+’s show of strength, the US is considering passing legislation known as NOPEC, which would allow the seizure of OPEC’s assets on US territory if market collusion is proven.

In India, the prices of petrol and diesel at the pump have remained unchanged since May 22, 2022, as companies attempt to shield themselves from future price hikes. Retail inflation has shown signs of easing in recent months, but private consumption has been subdued. Policymakers must reconsider their stance on fuel prices. Analysts also recommend that the government provide a fiscal boost to the economy by reducing levies on key transport fuels.