Asian giant Japan, once threatened to overtake the US as the world’s largest economy, has been pushed to the fourth position by Germany, weighed down by a depreciating yen and an ageing population. The Japanese economy finds itself at a pivotal moment, grappling with a recession that underscores deeper systemic challenges. The recent contraction of its gross domestic product at an annual rate of 0.1% in the last quarter of 2023, follows a sharper decline of 3.3% in the preceding three months.

This downturn, falling short of the anticipated 1.4% growth, highlights critical vulnerabilities within the Japanese economy. As domestic consumption wanes and questions about the efficacy of existing economic policies surface, Japan stands at a crossroads, seeking pathways to recovery and sustainable growth.

Once a beacon of rapid industrialisation and economic miracle post-World War II, Japan’s trajectory has been marked by periods of explosive growth and decades of stagnation. The nation’s current economic woes are rooted in a demographic shift that resulted in an ageing population and shrinking workforce; stagnant wages amidst rising living costs; and a heavy reliance on imports, exacerbated by a depreciating yen. Japanese economy witnessed spectacular growth in the 1970s and 80s, backed by booming exports of consumer electronics and cars, prompting economists to believe that it will overtake the US economy.

READ I WTO ministerial seeks to mend the fractured trade order

Japanese economy faces demand slump

The downturn in Japan’s economy is triggered by weak domestic demand with consumer spending falling for three consecutive quarters. The decline in private consumption is a direct consequence of the rising cost of living, exacerbated by Japan’s heavy reliance on imports for energy and food. The depreciation of the yen by 6.6% against the dollar since the beginning of the year has further inflated these costs, straining household budgets and dampening consumer confidence.

The decline in consumer spending is not merely a symptom, but a confluence of factors brewing for years. Japan’s ageing population, with its shrinking workforce and lower spending propensity, creates a demographic headwind. Stagnant wages further tighten household budgets, especially with rising import costs fuelled by the weakening yen. Additionally, the cultural emphasis on saving exacerbates the issue, as individuals prioritise future security over present spending.

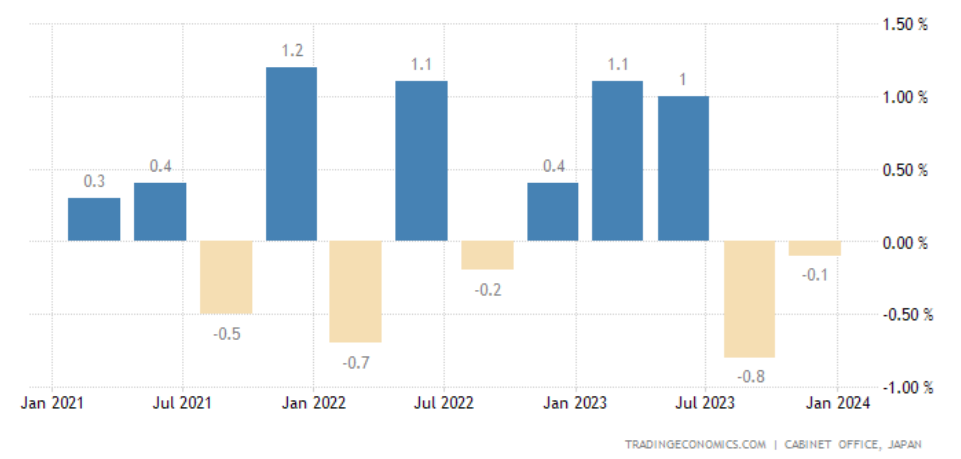

Japan GDP growth rate

External demand, driven by exports and inbound consumption, notably from tourism, has provided a silver lining, supported by the weak yen. However, this has not been sufficient to offset the negative impact of falling domestic demand. The recent earthquake in the Sea of Japan adds another layer of uncertainty, likely to further impact consumer sentiment and spending.

The situation presents a complex challenge for policymakers and the Bank of Japan (BOJ) which is looking to end the negative rate policy. The unexpected economic contraction complicates the BOJ’s decision-making process, as it had been ramping up discussions on exiting the sub-zero rate policy. Market reactions have been somewhat paradoxical, with the Nikkei share average rallying to its highest level in 34 years, suggesting investor optimism or perhaps a disconnect with the underlying economic fundamentals.

The Bank of Japan’s dilemma lies at the heart of the recovery debate. Exiting the negative rate policy risks dampening investment and further weakening the yen, potentially exacerbating inflation. Maintaining it, however, raises concerns about financial stability and the long-term effectiveness of such unconventional measures.

Some economists remain hopeful for a rebound in the first quarter of 2024, citing potential stabilisation in inflation and expected growth in wages. However, the consensus is not unanimous, with concerns about continued weak domestic demand and the potential impact of external factors such as global economic conditions and geopolitical tensions.

The broader implications of Japan’s economic downturn are significant. Not only does it impact the livelihoods of the Japanese population, particularly those in sectors most affected by the cost-of-living increases and wage stagnation, but it also has ramifications for global economic stability. Japan’s position as a major economic power means its performance has ripple effects, influencing international trade, investment, and economic confidence globally.

Japan slipping to become the world’s fourth-largest economy behind Germany is symbolic of broader shifts in the global economy. It underscores the need for Japan to reassess its economic strategies, focusing on enhancing domestic consumption, addressing demographic challenges, and fostering innovation and productivity growth.

Japan’s economic contraction and the challenges it faces are a wake-up call for both policymakers and the business community. The path to recovery and sustainable growth will require a multifaceted approach, addressing immediate challenges of cost of living and consumer confidence, while also laying the groundwork for long-term structural reforms. The resilience of Japan’s economy and its ability to adapt to these challenges will be critical in determining its future position on the global stage.