India will experience a muted growth rate of 0.2% in remittances in 2023 after reporting stellar growth last year, says the World Bank’s latest Migration and Development Brief. This is a dramatic decline from 2022, when the country received $111 billion in remittances, recording a growth rate of more than 24%. This amount was way higher than the World Bank forecast of $100 billion. The lower remittance inflows this year can be attributed to the slow growth in OECD and GCC economies, as well as the high base effect.

The significance of remittance inflows cannot be overstated, particularly at a time when the world is still grappling with the consequences of the Ukraine-Russia conflict and the aftermath of the Covid-19 pandemic. Remittances are a major source of foreign exchange for India and other South Asian countries. In 2022, India accounted for 63% of all remittances into South Asia, which grew by more than 12% to touch $176 billion.

The higher inward remittances from last year provided a macroeconomic cushion for India’s external sector. They bolstered the country’s foreign exchange reserves, fuelled investment, and consumption, and strengthened the value of the rupee. Non-resident Indians (NRIs) sent record amounts of money to their families and relatives, greatly benefiting the economy. Additionally, higher remittances support forex reserves, which are crucial for funding imports such as crude oil, paying off external debt, and further strengthening India’s currency.

READ | Sustainable FDI: Impact of climate risks on investments

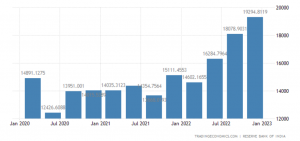

Quarterly remittances into India ($m)

So, why is India not experiencing a cash windfall like last year? The services sector in foreign countries contributes significantly to remittance inflows for India. Slower growth in OECD economies, particularly in the United States and European Union, has impacted the demand for information technology workers. There Gulf Cooperation Council countries, a group of six Arab nations located around the Persian Gulf, are also experiencing lower demand for migrants. A drastic fall in crude oil prices has dragged down the economic growth rates in GCC countries from 5.3% in 2022 to 3% in 2023, leading to a fall in demand for migrant workers.

In 2022, several factors contributed to the increased inflows. However, the host economies of migrants in the East Asia and Pacific region are projected to not benefit from those factors this year. Additionally, the report highlights that high-income countries are facing challenges such as continued tight monetary policies to counter inflation, limited fiscal buffers to absorb shocks given historically high debt levels, and uncertainties related to Russia’s invasion of Ukraine. These factors are further weighing down growth prospects in these countries.

With a looming recession affecting major world economies, the demand for manufactured goods has also been impacted, which has significant implications for migrants employed in China, Malaysia, and Thailand’s manufacturing sectors. The fall in GDP growth from 2.8% in 2022 to approximately 1.0% in 2023 and 2024 will erode employment and income gains that high-skilled migrants enjoyed in 2022, thereby dampening remittance flows in 2023.

Top remittance sources for India

High-skilled and predominantly high-tech Indian migrants contribute nearly one-third of India’s remittances. These migrants live across three high-income destinations: the United States, United Kingdom, and Singapore. The member countries of the Gulf Cooperation Council are the second largest source of remittances, accounting for around 28% of India’s total inflows. Less-skilled Indian migrants often secure employment in these countries.

During challenging times, remittances are highly complementary to government cash transfers and are essential for households, as highlighted by Michal Rutkowski, the Global Director of the Social Protection and Jobs Global Practice at the World Bank. In 2022, remittances were about 326% of foreign direct investment (FDI) inflows, a significant increase from 247% in 2019. Remittances have become a crucial financial lifeline for many countries, particularly throughout the pandemic. For instance, remittances amount to nearly one-fourth of Nepal’s GDP. Remittances accounted for just 3.3% of India’s GDP in 2022.

Remittances constitute a substantial share of the GDPs in several countries such as Tajikistan (51% of GDP), Tonga (44%), Lebanon (35%), Samoa (34%), and the Kyrgyz Republic (31%). These countries have huge current account deficits, and injecting foreign funds can stimulate consumption, enabling households to allocate more resources for food, education, and transportation. The countries that received the highest amounts as remittances in 2022 are India ($111 billion), Mexico ($61 billion), China ($51 billion), the Philippines ($38 billion), and Pakistan ($30 billion).