By Nebu John Abraham

Those who grew up on a staple of Indian movies of 1970s and 1980s will understand how important was gold smuggling as an economic activity those days. One of the key characters in the typical Indian potboiler — either the protagonist or the antagonist — was invariably a gold smuggler. Smuggling involved great amounts of the precious metal that it gave birth to a powerful underworld in coastal cities that wielded influence over business and politics.

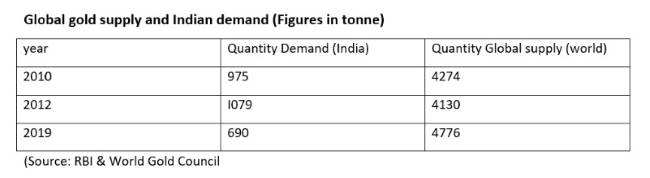

India is a society that attached a lot of importance to gold — as an asset and in the form of jewellery — from ancient times. India has been a net importer of gold throughout history. Indians still have this fascination for gold. The gold demand in the country was more than a fourth of the global supply in 2012. Customs, festivals, dowry — Indians always have some reason for the buying the yellow metal.

The amount of gold shown in the table is just a small part of the demand. In addition to dore gold, refined gold from UAE reaches through airports, sea ports and by land. Almost 75% of the refined gold reaches India through airports. In 2014, imports peaked at 335 tonnes. The huge gap between demand and supply is the prime driver behind the thriving gold smuggling activity.

What makes gold smuggling a lucrative business activity and how does it affect our economy? Prof. Arunkumar has estimated that black economy formed 40% of the country’s GDP in 1995-96. Drugs, gold smuggling, counterfeit notes and illegal funds together contributed another 8% while the rest 32% was generated by manufacturing and trade, says Prof Kumar in his book Understanding the Black Economy in India, published in 2017.

READ I Atmanirbhar Bharat: Reducing dependence on China for pharmaceutical ingredients

Former Reserve Bank Governor Y V Reddy once mentioned that 80% of the gold consumption in India is for ornaments and only 15% goes to investment and 5% to industrial uses. Thus the money spend on gold is not productive. The macroeconomic side of it is even more deleterious. The more the gold imports, the larger the deficits. Petroleum and gold are main the drivers of India’s trade and current account deficits. Smugglers use foreign exchange to purchase gold, driving down the value of the rupee.

Smuggling happens because of high import tariffs, corruption, and shortages in supply. In India, all these factors are responsible for the activity. During emergency, Indira Gandhi declared a war on smuggling, however, the Licence Raj and undemocratic politics allowed it to thrive. Gold imports were banned till 1992. This resulted in a surge in smuggling activity that bridged the demand-supply gap.

After the liberalisation of the economy in the early 1990s, there was an expansion of the black economy in the economy. This happened because of the active connivance of officials and private players. There is a rise in smuggling activity these days because of several policy decisions that are discussed below.

The first reason is the 80:20 scheme announced by the Manmohan Singh government in 2013. As per this policy, gold importers are mandated to export 20% of the imports. Exports from India are not very lucrative and this forces importers to rely on smuggled consignments.

READ I India needs a comprehensive population policy

Another reason for the increase in smuggling is the tariff differential between the imports of dore gold (8%) and refined Gold (10%). India does not have many gold refineries. Despite this, the government made this irrational policy hoping that it will help the domestic industry. This is proving to be counterproductive.

Income disclosure schemes and demonetisation also encouraged people to invest in gold. Just after demonetisation, the government wanted all households to produce bills to legalise gold assets beyond a threshold. The news created panic among people, especially among those who inherited gold. This opened a good opportunity for gold merchants to exchange old ornaments for jewellery.

Price for 10 grams was gold rose to Rs 41,600 in May 2020 from Rs 31,700 in May 2019. Recently, the import tariff on gold was raised from 10% to 12.5% and the GST to 3%. This also helped gold smugglers to improve their profit margins.

Finally, the government failed to clamp down on people who have multiple permanent account numbers (PAN). This helped people to illegally store wealth in any form of gold.

READ I Global warming to test 1.5C limit set by Paris Agreement

While there has been a stream of public utterances against black money and smuggling, there was hardly any action against illegal activities. In 2019, two customs officials in Kerala were caught for smuggling 680 kg of gold. No information was revealed to public on the sources and destination of the smuggled consignment. Recently, an ex-employee of the UAE consulate, currently working for a contractor to the Kerala government, was arrested for helping gold smugglers. This case has created a raging controversy because of the links one of the smugglers had with a senior bureaucrat in the Pinarayi Vijayan government.

This case may also fail to remove the veil of secrecy over the real beneficiaries of the smuggling activity, unless the central agency probing it showed grit to withstand political pressure. The Union government needs to take strict action against such illegal activity in the larger interest of the economy. There is also a need to take a relook at the faulty policies that allows the illegal trade to thrive.

(Dr Nebu John Abraham is an economist based in Kottayam, Kerala. The views expressed in this article are personal)