Impact of Fed rate freeze: The United States Federal Reserve, the world’s most powerful central bank, has chosen to wait. Again. With interest rates held steady at 4.25%–4.5%, Fed Chair Jerome Powell struck a tone of cautious patience, repeating the phrase “wait and see” no fewer than eleven times during his press conference. For investors, central bankers, and governments around the globe, that refrain is both familiar and deeply unsettling.

This is not just a tale of monetary orthodoxy. It is, as Powell himself admitted, a dilemma. The Fed’s twin mandates—ensuring price stability and maximising employment—are no longer in alignment. Instead, they are now tugging violently in opposite directions. The inflation dragon, believed to be vanquished, is threatening a comeback in the form of Trump’s renewed tariff wars. At the same time, signs of slowing growth and rising unemployment flicker at the edges of America’s solid economy.

For the Fed, it is a no-win situation. For the rest of the world, especially emerging economies like India, it is a ticking clock.

READ I India-UK FTA will boost jobs, exports

Trump tariffs: The uninvited guest at the Fed table

The Federal Reserve is not accustomed to being outmanoeuvred by fiscal policy. Yet that is exactly what President Trump’s tariff juggernaut has accomplished. With import duties on Chinese goods raised to a staggering 145%, and a universal 10% tariff in place, Trump’s actions have reintroduced inflationary pressures that were slowly ebbing after a brutal tightening cycle in 2022 and 2023.

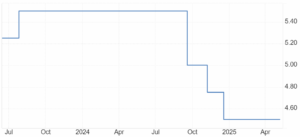

US Federal Reserve Funds interest rate (%)

Powell was blunt. Tariffs are a supply shock that raise costs without expanding output, hurting growth and job creation. They sow uncertainty and suppress investment, especially from small businesses caught in the crossfire. Yet the Fed is constrained—unable to stimulate without reigniting inflation, and unwilling to hike rates into a downturn. This is textbook stagflation, and central banks have few tools to fight it.

The cost of delay, as some fear, may be steeper than the Fed acknowledges. Waiting until July or September to cut could necessitate larger, more abrupt rate reductions later, amplifying rather than containing volatility. The real economy may not grant Powell the luxury of time.

Fed rate freeze and the world’s anxiety

Markets, for the moment, remain placated. The S&P 500 rose marginally after the Fed announcement. Bond yields wobbled but held firm. The dollar strengthened as Powell struck a hawkish-neutral tone. But these are shallow waters. Beneath the surface, global finance is bracing for rough seas.

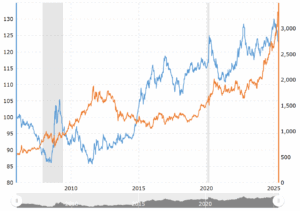

Gold prices and dollar correlation – 10 years

A strong dollar, underpinned by high US rates and capital flight from emerging markets, will weigh heavily on economies already battling imported inflation. For India, where the Reserve Bank has so far managed to hold the rupee steady, the spectre of renewed depreciation looms large. A widening current account deficit and rising crude prices could soon test the central bank’s resolve.

Moreover, dollar strength poses a systemic threat to global debt sustainability. According to the Institute of International Finance, emerging market debt stood at $104 trillion at the end of 2024. Much of it is dollar-denominated. Each Fed-induced rally in the greenback tightens the noose on developing economies, triggering capital outflows, currency crises, and—eventually—political upheaval.

A precarious balancing act

Powell’s caution is not unfounded. The Fed has been burned before. In 2021, it famously underestimated the persistence of inflation, believing it to be transitory. The result was a delayed tightening cycle that ultimately required aggressive rate hikes. Powell is determined not to repeat that mistake.

But this determination carries its own risks. If the Fed waits too long to cut, especially in the face of softening job growth and declining consumer sentiment, the US could slide into recession. And when America sneezes, the export-reliant economies catch cold.

Ironically, the very uncertainty that restrains the Fed is also paralysing private investment. Businesses cannot plan for an environment where inflation and employment are both variables and where the central bank is deliberately ambiguous. As Julia Hermann of New York Life Investments puts it, “The Fed is constrained both ways.” It cannot cut without growth data, and it cannot hike without knowing how inflation will behave post-tariff.

Meanwhile, Treasury Secretary Scott Bessent’s hints at currency realignment, possibly to weaken the dollar as part of trade negotiations, have introduced another layer of uncertainty. If the executive is perceived to be intervening in monetary policy or currency valuation, the credibility of US institutions—long the bedrock of global financial stability—will erode.

Implications for India and the Global South

For India, the Fed’s indecision is doubly disruptive. As an energy importer, India is vulnerable to dollar appreciation and rising oil prices. As an investment destination, it relies on foreign capital that is notoriously sensitive to shifts in US rates. The Reserve Bank of India must now calibrate its own policy against a moving, uncertain American backdrop—tightening risks choking recovery; loosening risks capital flight.

More broadly, the developing world finds itself once again held hostage to decisions made in Washington. This is not a new story, but it is a troublingly familiar one. Global financial governance remains disproportionately shaped by the US Federal Reserve, whose decisions, though domestic in intent, have global consequences.

The question is not just what Powell should do. It is why the world has no alternative institution to mitigate the spillover effects of Fed policy. The dollar’s dominance, though waning at the margins, still commands an outsized influence on commodity pricing, capital flows, and debt servicing. Until alternatives mature—such as the long-awaited internationalisation of the Chinese yuan or the euro’s reassertion—the world economy will remain on this tether.

The Fed is doing what central banks are supposed to do in uncertain times: wait for data, assess trade-offs, and communicate transparently. But it is also caught in a political and economic maelstrom not entirely of its own making. The return of Trump’s tariff brinkmanship has thrown a wrench into the slow normalisation of monetary policy.

As Powell rightly notes, the central bank cannot be pre-emptive. But nor can it be passive. Strategic patience must not become policy paralysis. The risks of both inflation and stagnation are real—and rising.

From New Delhi, the picture is clear. When the Fed waits, the rest of us must brace.