The Reserve Bank of India has issued a concept note on eRupee, covering the objectives, choices, benefits, and the risks associated with India’s central bank digital currency. The pilot of the digital currency will be launched in a smooth manner over a period to avoid possible disruptions. The idea of a central bank digital currency for India was floated by Finance Minister Nirmala Sitharaman in her 2022-23 budget.

The eRupee can provide real time and cost-effective seamless integration of cross border payments. It will also offer huge savings of cost associated with printing of cash, transportation and safety measures. The total expenditure incurred on printing of currencies in financial year 2021-22 was Rs 4,984.80 crore compared with Rs 4,012.10 crore in the previous financial year.

READ I eRupee explained: How will India’s CBDC work

eRupee benefits for Indian economy

India is the world’s largest recipient of remittances. It received $87 billion in 2021 with the United States being the biggest source accounting for over 20% of the total. The cost involved in transferring the amount is huge and this could be reduced to a minimum by using eRupee.

According to the 2022 Global CFO Survey report by Everest group, the adoption of digital technologies in the last two years has increased with 70% CFOs considering the implementation of digital technologies to improve efficiency, effectiveness, and shareholder trust.

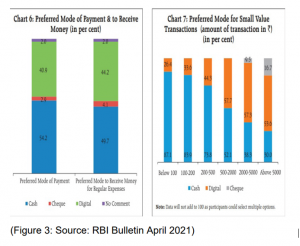

The year 2021-22 witnessed a higher-than-average increase in banknotes in circulation, primarily due to precautionary holding of cash by the public induced by the second wave of the Covid-19 pandemic. According to the RBI Annual report, most cash transactions were in notes of denominations lower than Rs 500.

READ I Cryptocurrencies: India may firm up rules around OECD framework

The RBI is exploring options to increase cross-border transactions and wants this aspect to constitute an important part of India’s G20 presidency from December 2022. It is the responsibility of the central bank to keep the confidence of the common man amid the uncertainty created by cryptocurrencies and to ensure the validity and core values of the currency. CBDC may mitigate significant risks related to money laundering and financing of terrorism in the country which leads to national security issues.

The committee has recommended two types of CBDC:

General Purpose: CBDC-R (retail) is potentially available for use by all private sector, non-financial consumers, and businesses. This will improve the efficiency of interbank payments and securities settlement. It is basically an electronic version of the currency.

Wholesale: CBDC–W (wholesale) has the potential to transform the settlement systems for financial transactions undertaken by banks, G-Sec Segment, Inter-bank market and capital market and make them more efficient and secure in terms of operational costs, use of collateral and liquidity management.

Key CBDC models – Issuance of legal claims

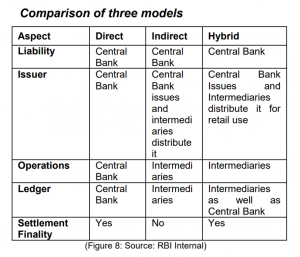

- Single-tier model (direct CBDC model): The central bank is responsible only for managing all aspects of the CBDC system.

- Two-tier model (indirect CBDC model): Consumers would hold their CBDC in an account/wallet with a bank or service provider.

- Hybrid model: The direct claim on the central bank is combined with a private sector messaging layer.

A snapshot of the comparison as per the RBI document is as follows. It states the advantages and difficulties in adopting various models when releasing the digital currency in India.

RBI takes numerous factors into consideration before releasing the final outcome:

- Technology platform and its related issues

- Architecture options

- DLT or Non DLT (distributed ledger technology)

- Scalability

- Trusted environment

- Policy related tech considerations

- Offline functionality

- Integration with existing systems

- Security issues

- Data analytics

The phases involved in introducing the same in India are:

- Build a protype

- Test the idea

- Perform test case

- Evaluate Test result

- Conducting large-scale pilot cases.

The Central Bank examines the implications of the introduction of CBDC on the banking system, monetary policy, financial stability, and analyses privacy issues. One can hope that this will help India and many other countries globally as India takes the Presidency of G-20 from December 2022. There is a need to study the positives and risks of introducing new concept into the market so that the difficulties will be limited when it is introduced in phases.

(CA Aravinda Garikipati is a Hyderabad-based chartered accountant.)

Dr Badri Narayanan Gopalakrishnan is Fellow, NITI Aayog. Views expressed are personal.