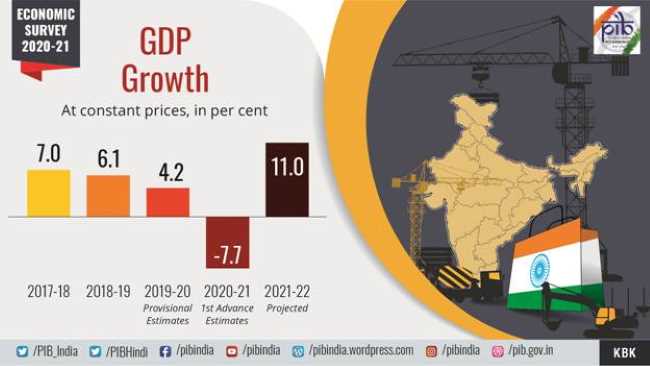

The Economic Survey 2020-21, tabled in Parliament on Friday by finance minister Nirmala Sitharaman, presented an optimistic picture of Indian economy. The survey predicted a V-shaped recovery of the economy ravaged by the Covid-19 pandemic and the economic crisis triggered by it. The document predicted a GDP growth rate of 11% in the next financial year beginning April 2011 and a nominal growth rate of 15.4%, the highest recorded since Independence.

The finance minister will present the Union Budget for the financial year 2021-22 on Monday in the Lok Sabha. The robust predictions by the Economic Survey will raise the hopes of major economic packages in Budget 2021 to boost consumption demand and generate jobs in the economy.

READ I Budget 2021: What to expect from Nirmala Sitharaman’s budget speech

The optimism evident in the Economic Survey came from the expectations of a robust growth in investment and consumption and the prospect of a major recovery in services sector that accounts for more than half of India’s GDP. The double-digit GDP growth is also on account of the low-base effect due to the dismal growth rate in the current financial year, revival in economic activity and the rollout of COVID-19 vaccines in the country.

Economic Survey lauds Modi government

The Economic Survey also credit the revival packages offered by the Narendra Modi government under Atmanirbhar Bharat Mission and the roll back of lockdown measures for the economic upswing. These forecasts are in line with IMF estimates of 6.8% GDP growth in 2020-21 and 11.5% growth in 2021-22. IMF expects India to become the fastest growing economy in the next two years.

India’s mature response to the most severe economic crisis in almost 100 years offers lessons for democracies world over to focus on long-term gains, says the Economic Survey. India had a four-pillar strategy that involved containment, fiscal, financial, and long-term reforms, scripted by the Union government and the Reserve Bank of India.

READ I Budget 2021: Proposals to put Indian economy, industry back on track

The country’s GDP will contract by 7.7% in the current financial year because of a sharp 15.7% fall in first half. Agriculture remained the growth engine of the economy while the crisis took a toll on contact-based services, manufacturing, and construction. The fall was cushioned by high government consumption and exports. The first quarter of the current fiscal saw the economy shrinking by 23.9%, while there was a 7.5% decline in the second quarter. The economy saw a robust V-shaped recovery since July 2020.

READ I Covid-19: Busting the myth of herd immunity

Survey predicts V-shaped manufacturing recovery

The Economic Survey highlights the resilience shown by the manufacturing sector, rural demand. It says agriculture sector cushioned an economic decline with a 3.4% growth in Q1 and Q2. A number of reforms undertaken by the government contributed to the stellar growth of the agricultural sector.

Industrial production also witnessed a V-shaped recovery in the current fiscal. A rebound in manufacturing helped the industrial sector normalise. The services sector also recovered from the depths it hit during the lockdown days, the Economic Survey says.

Credit growth to agriculture and allied sectors rose to 7.4% in October 2020 from 7.1% in the year-ago period. However, there was hardly any recovery in bank credit in FY 2020-21 due to risk aversion and low credit appetite. Sectors such as construction, trade and hospitality saw robust credit growth since October 2020. Bank Credit growth to the services sector picked up in October to 9.5%, compared with 6.5% in the same period previous year.

READ I Trade negotiations: How can India strike a strategic balance

Inflation remained high in the April-November period because of high food prices. But it fell back into the RBI’s comfort zone of 4+/-2% in December from 6.9% in November. This was due to a sharp fall in vegetables, cereals, and protein products.

The external sector offered relief to the economy with the country recording a current account surplus of 3.1% of the GDP in the first six months of the year on the back of strong growth in services exports and a fall in imports due to weak demand weak demand. India’s forex reserves rose to cover 18 months of imports in December 2020.

Anil Nair is Founder and Editor, Policy Circle.