India launched the digital rupee, its retail Central Bank Digital Currency, on December 1, 2022. A CBDC is a digital form of legal tender issued by a central bank, serving as a non-interest-bearing digital equivalent of physical currency. The digital rupee, or e₹, can potentially grant India geopolitical leverage through participation in CBDC agreements, a move accelerated by factors such as disruptions in global value chains due to the Ukraine war and the China Plus One strategy. India’s G20 Presidency has further underscored the need for expeditious CBDC experimentation.

The dominance of the US dollar as the global reserve currency, accounting for nearly 90% of worldwide foreign exchange transactions, has spurred the trend toward de-dollarisation, particularly in the wake of the Ukraine conflict. The weaponisation of US currency via sanctions against Russia during this period has diminished the appeal of the dollar as a reserve currency. Consequently, countries like India, affected by such sanctions in the past, are seeking to reduce their reliance on the dollar.

READ I Dedollarisation in action: Nations seek to reduce dependence on the dollar

Digital rupee a tool for dedollarisation

To counteract dollarisation, a CBDC is viewed as a strategic tool. China, for instance, introduced its own CBDC, the digital yuan, aiming to challenge the US dollar’s global dominance. This initiative aims to capitalise on a first-mover advantage and encourage trade invoicing using the digital yuan.

The Bank for International Settlements (BIS) and central banks of various nations have embarked on multi CBDC (mCBDC) projects, exemplified by endeavours like Project mBridge (China, UAE, Thailand, Hong Kong) and Project Dunbar (Australia, South Africa, Singapore, Malaysia). Private entities like the Society for Worldwide Interbank Financial Telecommunications (SWIFT) and VISA have pursued similar undertakings, as seen in projects like the SWIFT sandbox project and Universal Payment Channels.

These initiatives have demonstrated the viability of mCBDC arrangements for diverse use cases, enabling participating countries to engage in trade using their respective currencies and circumvent the USD. These multi-CBDC agreements hold the potential to reshape foreign exchange transactions fundamentally.

In March 2023, India entered into a bilateral CBDC agreement with the UAE, but it has yet to partake in any multilateral Central Bank Digital Currency (CBDC) initiatives. However, future engagements of this nature have been hinted at. India intends to collaborate with relevant stakeholders, including the BIS, to establish universal global standards simplifying cross-border transactions. This approach outlines a potential trajectory for India’s deeper involvement in CBDC projects.

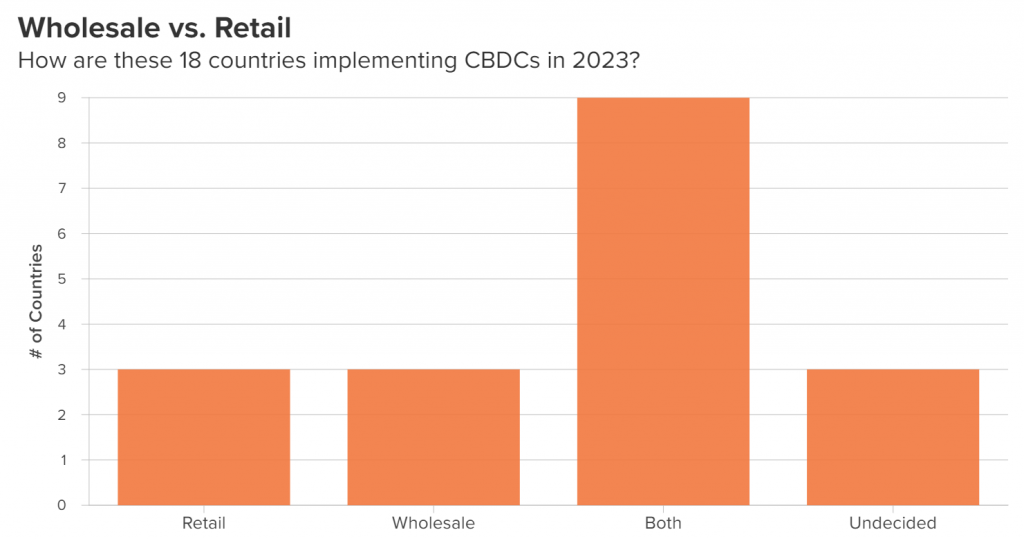

The Reserve Bank of India (RBI) is presently engaged in talks with counterparts from 18 other countries to explore cross-border payment possibilities utilising the digital rupee. Considering India’s status as the world’s largest recipient of remittances, totalling $87 billion in 2021, with the United States contributing over 20% of these funds, the potential to alleviate challenges in cheaper cross-border payments through the digital rupee is a significant advantage for India.

On a geopolitical front, the digital rupee’s launch aligns with India’s intent to leverage its G20 Presidency in 2023 to promote international CBDC agreements. This pilot coincides with India assuming the G20 chairmanship, a position through which it aims to influence other developing economies within the group. India seeks to spearhead this domain’s advancement, utilising the G20 platform to facilitate CBDC interoperability among central banks.

In the short term, the digital rupee promises streamlined and cost-effective cross-border transactions. Looking ahead, it represents a pivotal opportunity for India to help shape and adopt global digital currency standards through participation in international agreements. Building on the success of the Unified Payment Interface (UPI), India’s adeptness in digital finance is evident, bolstering its negotiation prowess in CBDC agreements and further solidifying its global standing as the world’s fifth-largest economy and a major e-commerce market.

(Gayatri Ganpule is Senior Research Associate with CUTS International, a global public policy research and advocacy group.)