Debt of state governments: The Indian economy is braving global headwinds and runaway inflation at home as it struggles to recover from the impact of the Covid-19 pandemic. Despite focused efforts, the Union government is struggling to contain its fiscal deficit to budgeted levels. Rising debt burden of state governments is adding to the problems. According to a recent CRISIL report, the indebtedness of states is expected to remain elevated at 30-31% this financial year. This is slightly lower than the level of 31.5% seen in fiscal 2021-22. The aggregate indebtedness of states is measured by debt to gross state domestic product (GSDP) and is an important indicator of the economic health.

States’ indebtedness staying above the target range is a big challenge, especially at a time when the Union government already has a host of issues to tackle such as inflation, falling rupee, and high crude prices amid an uncertain global geopolitical situation.

READ | India’s economy from Nehru to Modi – a conversation with Pulapre Balakrishnan

Earlier, the state indebtedness had risen to a decadal high of 34% in the Covid-hit fiscal 2020-21. Prior to this, it had remained range-bound between 25% and 30% during since 2016-27. The top 18 states — Maharashtra, Gujarat, Karnataka, Tamil Nadu, Uttar Pradesh, Andhra, Telangana, Rajasthan, Bengal, Madhya Pradesh, Kerala, Haryana, Bihar, Punjab, Odisha, Chhattisgarh, Jharkhand and Goa — account for 90% of the aggregate GSDP.

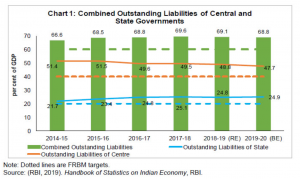

Combined liabilities of Union, state govts

Debt of state governments an indicator of economic health

State governments need to borrow from the Union government when they are unable to meet various fiscal obligations such as subsidies. This also means that states are unable to earn enough revenues to fulfil their financial obligations. The CRISIL study shows that states borrow mainly to fund their revenue deficits and for capital outlays. Besides, the states also have to provide salaries, pension, and interest payments which also weigh on the state finances. Other higher committed expenditures such as essential development expenditure and the rising subsidy outgo to the power sector are weakening the fiscal position of the states.

The situation isn’t expected to improve in the coming months as well with sticky revenue expenditure and the need for higher capital outlays expected to keep borrowings high. There is no respite in other areas such as sales tax mop-up from fuels, modest growth in central grants and discontinuation of GST compensation after June 2022. Like in the previous fiscal, revenue expenditure, which accounts for 85-90% of total expenditure, is set to rise 11-12%.

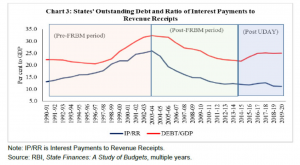

States’ debt and interest payments

The GST issue

Incidentally, several states have raised the issue of GST compensation which was supposed to be a win-win for both the Union and the state governments. The enthusiasm shown by the state governments in striking the historic deal has started to wear off. The point of contention is the 14% compensation to state governments that the union government promised for the initial five years of the new tax regime. This five-year period came to an end on June 30, throwing state finances into disarray. The end of GST compensation has also further strained state finances, leaving them with no choice but to look for other sources to increase revenues.

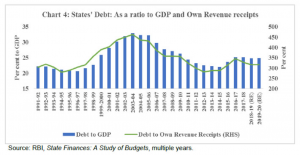

States’ debt As a ratio to GDP

Several states are heavily dependent on the GST compensation as more than a quarter of their revenues come from it. These states include Punjab, Goa, Uttarakhand, Delhi, and Himachal Pradesh. Hence, these states have called for the continuation of the compensation.

A silver lining

While the state finances are in disarray, there is some good news for states. They managed to post a small surplus on the revenue account in fiscal 2022, owing to a healthy revenue growth of 25%. This financial year, the overall revenue of states is expected to rise 7-9%, driven by strong GST collections, and healthy central tax devolutions.

Options for the Union government

In view of the ailing state treasuries, the Union government had announced in the last budget that it will provide special assistance of around Rs 1 lakh crore to states for capital spending. The assistance is in the form of 50-year interest-free loans and it is expected that this will help partially meet capital outlay targets. Also, this loan is not counted towards the borrowing limit of 3.5% this year.

Moreover, there is a need to achieve cooperative federalism in India so that both states and the Union government enjoy a balanced relationship. States must be given more freedom in formulating laws, offered fiscal support and there should be more decentralisation of power. The government must also look to offer GST compensation until it finds a better alternative to support states. Experts believe that leaving the states in a lurch will create distrust and dent the feeble economic recovery.