The global economic narrative often mirrors the complex interplay of variables such as inflation, interest rates, employment figures, and GDP growth. But occasionally, collective concerns coalesce into focused topics that dominate global discourse. This year’s OECD Economic Outlook squarely places two mammoth challenges at the forefront — burgeoning inflation and disappointing growth. As these issues cloud the horizon, policymakers, economists, and citizens are all tuned in raising the question — How to tackle these issues that require conflicting policy approaches.

Historical lessons often act as the lodestar in such situations. The term stagflation, indicative of stagnant growth coupled with inflation, dates back to the 1970s—a period remembered for oil price shocks and sustained economic crisis. The current economic backdrop prompts a revisit of those days. With several OECD nations experiencing inflation rates higher than 5% and a noticeable deceleration in GDP growth trajectories The US projections dropping from a robust 6% in 2021 to a potential 3% by 2023, and there is a pressing need to confront the realities head on.

READ I Women’s Reservation Bill: A landmark in addressing gender disparities in politics

OECD economic outlook

To understand the roots of the current crisis, one needs to view the intricacies:

Pandemic’s economic impact: The unprecedented fiscal measures adopted post-pandemic saw governments, like that of the US, pump trillions of dollars into their economies. This massive liquidity, combined with supply chain disturbances, became a bedrock for inflationary trends.

Supply chain fractures: The semiconductor dearth crippling the tech and automotive sectors is a glaring example. The latter reportedly suffered over $110 billion in 2021 losses. These disruptions, running parallel to other sectors, have contributed to rising costs.

Geopolitical undercurrents: The geopolitical crises, triggered often by the great power rivalry between the US and China, often exacerbate supply chain issues, causing cost inflations across sectors and political rifts.

Furthermore, external factors, like the war in Ukraine, compounded by escalating energy and food prices, further strain the global economic machinery. For households, especially low-income ones, inflation is not a mere statistic—it is an erosion of purchasing power, impacting everyday life.

The OECD’s lenses on these dynamics reveal some stark truths. Countries like Canada are hitting inflation rates not seen in two decades. Simultaneously, Brazil and Turkey face the double-edged sword of double-digit inflation and economic instability. Despite nominal wage growth in the developed world, real wages, when adjusted for inflation (for instance, the US’ 3.6% wage growth in 2022), portray a bleaker reality.

Policymaker’s conundrum

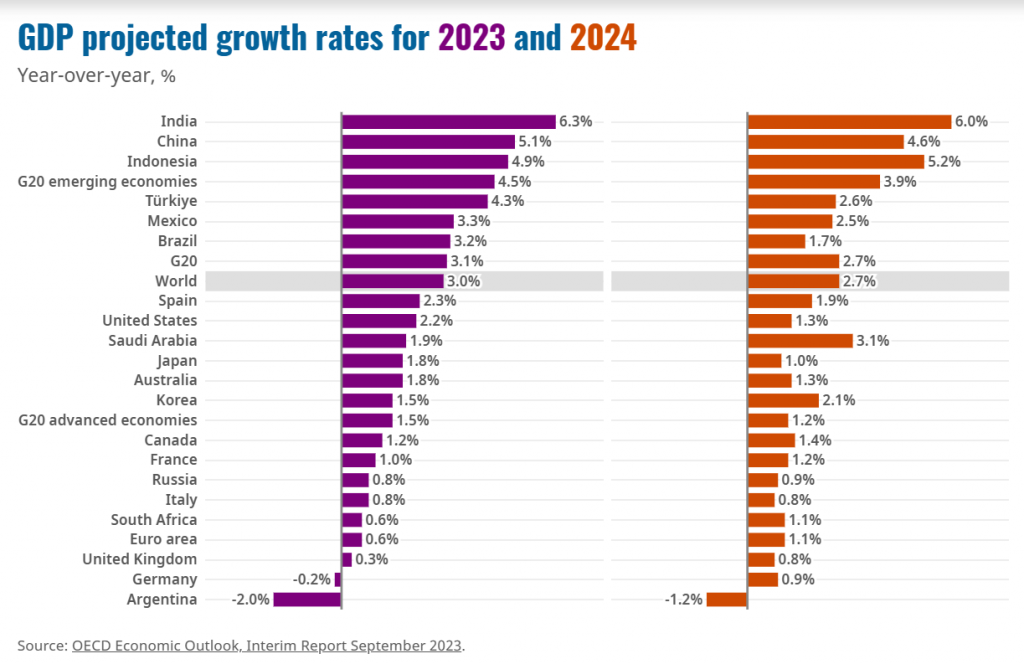

Central banks are in a precarious balancing act—raising interest rates to rein in inflation, albeit at the risk of stifling economic growth. With projections placing global GDP growth at a tepid 2.7% in 2023 and 2.9% in 2024, well below pre-pandemic averages, and disparities in growth across countries, a holistic strategy is vital.

Emerging economies, despite being intertwined with global headwinds, might experience relatively better growth—around 4.5% for both 2023 and 2024. However, the pressures of inflation eroding real household incomes remain universal.

Policy prescriptions by OECD Economic Outlook

Robust supply chains: A future-forward approach demands robust, diversified supply chains, supplemented by significant infrastructure investments.

Tailored fiscal measures: A targeted approach, like the European Union’s NextGenerationEU initiative, which focuses on sustainable and digital transformations, can yield dividends.

International collaboration: A fragmented approach in today’s interdependent economies might not yield results. Synchronizing fiscal, trade, and even geopolitical policies is the need of the hour.

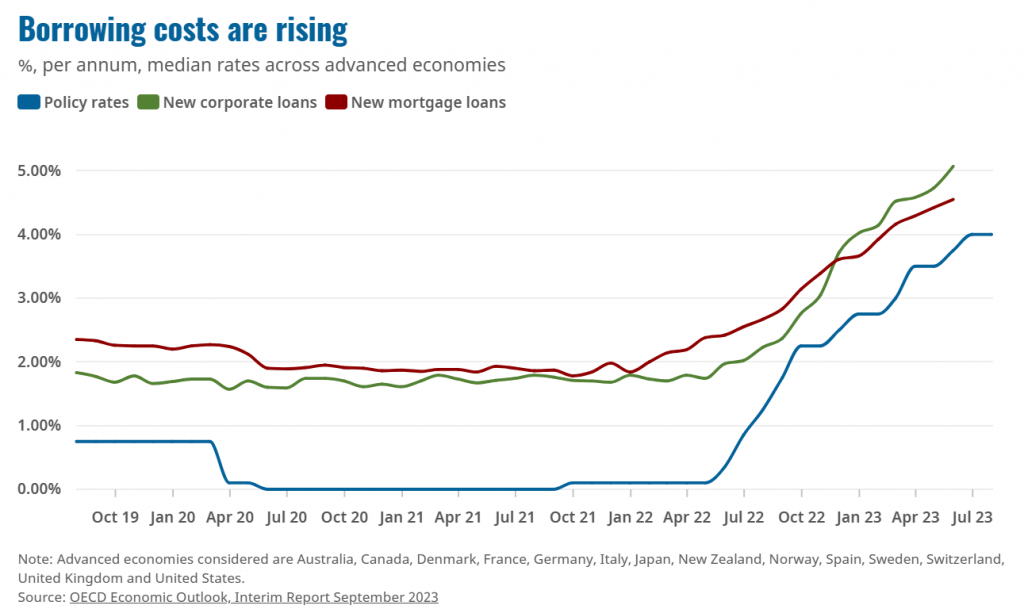

Balanced monetary policies: While interest rate tweaks are on the table, calibrating these with a keen eye on broader implications will be pivotal.

Support mechanisms: The governments should provide financial aid to vulnerable households and businesses. Initiatives like wage subsidies can offer interim relief.

Long-term vision: Investments in education, research, and infrastructure can fuel long-term growth. Concurrently, supporting transitions to low-carbon economies is imperative.

The way ahead

The OECD’s reports are more than just a diagnostic tool; they provide critical insights into the complex machinery of our global economic system. At this juncture, when the shadow of the past threatens a rerun, their findings are especially significant. Stagflation, a term that many hoped was relegated to the annals of history, looms as a potential reality in today’s context. With inflation biting at the heels of many economies and growth rates that fail to inspire confidence, we are at a crossroads that demands both introspection and action.

It is evident that this issue does not have a silver bullet solution. The challenges are manifold: the lingering effects of the pandemic, which pushed governments into uncharted fiscal territories; supply chain disruptions, exemplified by the semiconductor shortage; and the ever-present intricacies of geopolitics. These intricacies have created a situation that both policymakers and the general populace must confront. For households, particularly those on the lower end of the income spectrum, these are not abstract concepts but palpable realities. The erosion of purchasing power impacts their daily lives, their dreams, and their future.

Yet, as daunting as these challenges are, they are not insurmountable. History has shown that with the right strategies, economies can pivot, adapt, and thrive. A diversified and resilient supply chain can act as the backbone of our global trade system, cushioning against future shocks.

Fiscal measures, if tailored smartly, can propel sectors that are foundational for future growth. And perhaps most importantly, in an era of global interconnectedness, collaboration is not just beneficial—it is imperative. Economies no longer function in isolation; a shock in one part of the world reverberates in another. As such, harmonised fiscal, trade, and geopolitical policies could be our compass in these turbulent waters.

In addition to these strategies, there is a need to address some foundational aspects of our economic framework. The emphasis on relentless GDP growth might require re-evaluation. It is essential to question whether we should pivot to a more holistic metric, one that captures not just economic activity but also social welfare, environmental considerations, and more equitable wealth distribution.

In the end, confronting the dual threats of inflation and stagnant growth will require both individual and collective action. Governments, central banks, businesses, and citizens will all have roles to play. Through concerted, informed, and synergized efforts, the global community has the potential not only to navigate these challenges but to emerge stronger, fostering a more balanced, inclusive, and resilient economic era for all. The journey may be fraught with challenges, but with the right strategies and collaborative spirit, a brighter economic future is achievable.