India has made significant progress in recent years, with strong economic growth and rising living standards. There are also several risks that could derail India’s economic progress. A recent report by Moody’s Investors Service provides some insights into the state of the Indian economy. The report has affirmed India’s sovereign credit rating at Baa3 with a stable outlook. The report also highlights some significant downside risks to the Indian economy. These risks include rising government debt levels, a weakening of institutions and governance, and increased political and social tension.

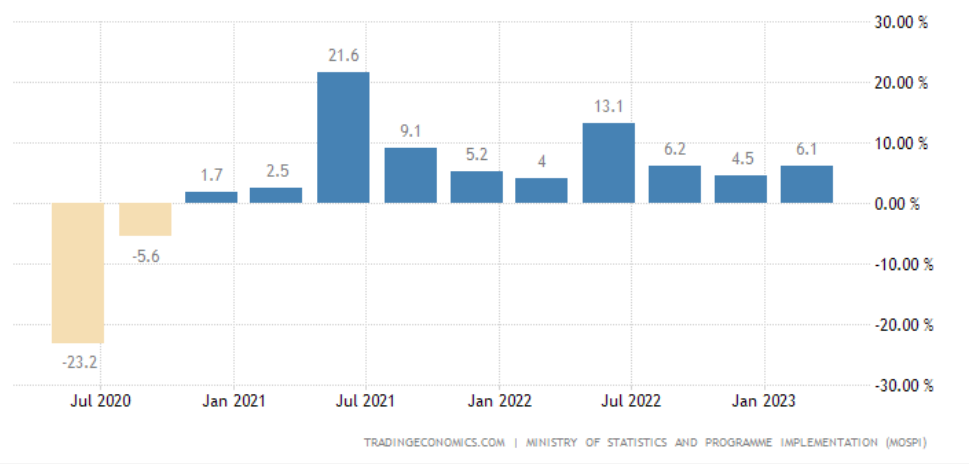

India’s economic growth rate has been on an upward trajectory since 2014-15. The country’s economic growth rate was 7.4% in 2014-15, 8.2% in 2015-16, 7.1% in 2016-17, 6.7% in 2017-18, 7.2% in 2018-19, and 4.2% in 2019-20. The growth rate slowed down in 2020-21 due to the COVID-19 pandemic, but made a smart recovery in 2021-22. The economy grew by 7.2% in 2022-23.

READ I Sustainable energy investments drive FDI in developing countries

Rising government debt

One of the biggest concerns highlighted in the Moody’s report is India’s rising government debt levels. Moody’s expects India’s government debt to reach 90% of GDP by 2025. This is a high level of debt, and it could make it more difficult for India to finance its future borrowing needs.

There are several reasons for the rising government debt. One reason is the government’s large fiscal deficit, or the difference between the government’s spending and revenue. In India, the fiscal deficit has been widening in recent years, due to factors such as increased spending on social programmes and infrastructure projects, and lower tax revenue.

Another reason for India’s rising government debt levels is the slowing economy. The Indian economy has slowed in recent years, due to factors such as the global economic slowdown and the COVID-19 pandemic. This has led to lower tax revenue and higher spending on social safety nets, which has contributed to the rising debt levels.

Institutions and governance

Another concern highlighted in the Moody’s report is the weakening of institutions and governance in India. Moody’s notes that India’s institutions and governance have weakened in recent years. This could make it more difficult for India to attract foreign investment and to implement necessary reforms.

There are several reasons for the weakening of institutions and governance in India. One reason is the government’s increasing control over the judiciary and the media. The government has also been accused of interfering in the work of independent institutions such as the Election Commission and the Central Bureau of Investigation.

Another reason for the weakening of institutions and governance in India is corruption. Corruption is widespread in India, and it undermines the rule of law and the effectiveness of government institutions.

Economic growth and social tension

The Moody’s report also highlights the increased political and social tensions in India. These tensions could disrupt economic activity and make it more difficult for India to maintain its growth momentum.

There are several reasons for the increased political and social tensions in India. One reason is the government’s policies on issues such as agriculture and labour. The government’s policies have been criticised by farmers, labourers, and other groups. Another reason for the increased political and social tension in India is the rise of religious extremism. Such ideologies have been criticised for their divisiveness and its potential to undermine India’s secular democracy.

India annual GDP growth rate

In order to address the risks highlighted in the Moody’s report, India needs to take several policy measures. These measures include reducing government debt levels, strengthening institutions and governance, and addressing political and social tensions.

India has the potential to overcome these challenges and continue its economic progress. However, it will need to take steps to reduce the risks and build a more resilient economy. The way India addresses these challenges will have a major impact on its economic future.

Meanwhile, the government expressed disappointment over the Moody’s assessment of the Indian economy. It dismissed the concern over the rising public debt, saying the bulk of India’s government borrowing is domestic. The official refused to comment on the report’s assessment of political risks from sectarian tension.