Multinational enterprises have become increasingly important in the global economy. They operate in a wide range of industries and countries, and their investments can have a significant impact on economic growth and development. This article examines the role of FDI in the global economy, with a focus on India. It discusses different types of FDI as well as the benefits and challenges of FDI, and explores India’s experience with FDI, and the challenges that the country faces in attracting and retaining foreign investment.

Initially, multinational enterprises operated mainly from developed countries like the US, UK, Germany, and Japan, functioning in sectors such as mining, plantations, refining, shipping, banking, insurance, and manufacturing across continents, including both developed and developing countries. Over time, the transnationalisation of production and investment by these MNEs rendered the original parent companies irrelevant, as seen when a UK company transformed into an Indian one after Tata’s acquisition of the Tetley Group in 2000. Similarly, the manufacturing process of Apple’s iPad involves assembling 44 different components across various countries and continents.

The range of MNE manufacturing spans from light potato chips to strategic semiconductor chips, highlighting the breadth of their influence. Foreign Direct Investment (FDI) has not only become integral to global supply chains but has also bestowed these entities with the power to shape national policy decisions, and sometimes even contribute to toppling established governments.

READ I India must diversify foreign trade partners, energy sources

Why FDI is important

FDI, which refers to investments made by companies or individuals in foreign countries to further their business interests through ownership and operation control, can bring valuable knowledge, skills, and technology. Different forms of FDI include acquiring shares, establishing subsidiaries, joint ventures, loans, and technology transfers. The International Monetary Fund (IMF) defines FDI as an investment made to gain a lasting interest in enterprises outside the investor’s economy. This interest can be held by foreign individuals, companies, or groups seeking control, management, or significant influence over foreign enterprises.

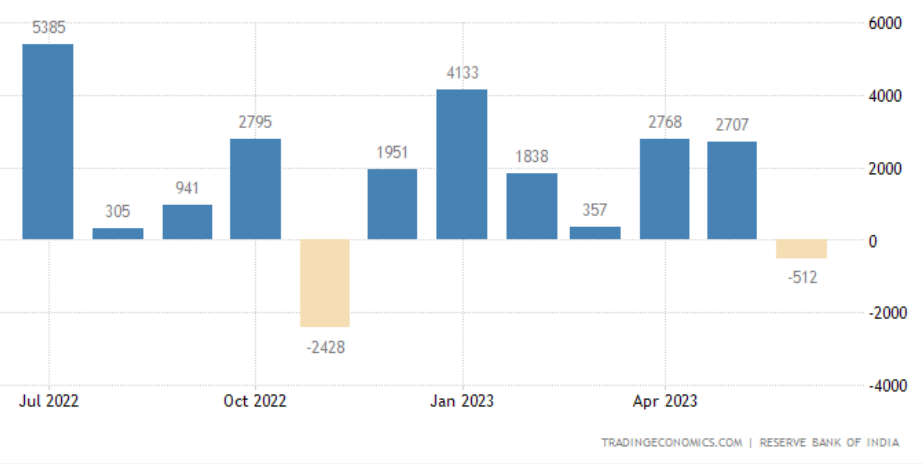

FDI inflows into India

The key components of FDI encompass equity capital, reinvested earnings, and intra-company loans. Motivated by different factors, FDI is classified as market-seeking, resource-seeking, strategic asset-seeking, or efficiency-seeking. By nature of investment, FDI is generally classified into three categories: greenfield investment (creating new capacity and jobs, transferring technology), mergers and acquisitions (combining assets and operations of firms from different countries to form a new entity), and cross-border acquisitions (transferring control of assets and operations from a local to a foreign company, making the local firm an affiliate of the foreign one).

Horizontal FDI occurs when investment is made in the same industry abroad as the firm operates in at home, while vertical FDI relates to trade-diverting aspects of regional integration that result in value-added manufacturing.

The 2023 World Investment Report by UNCTAD focuses on “Investing in Sustainable Energy for All,” recognising that millions of people worldwide lack access to electricity and safe energy sources. Investments in renewable energy in developing countries are crucial not only to bridge the energy gap but also to combat global warming. The report highlights that FDI faced challenges due to health crises, climate change, and economic shocks in the previous year, leading to economic uncertainty. Geopolitical tensions, the Ukraine war, high food and energy prices contributed to a 12% drop in global FDI in 2022 to $1.3 trillion.

This decline was most prominent in financial transactions by MNEs from developed countries, with a 37% decrease to $378 billion in Europe and North America. However, Sweden saw FDI inflows double to $46 billion, and France experienced an 18% increase to $36 billion. Developing countries received more FDI than developed economies in 2022, accounting for half of global inflows.

India and ASEAN were resilient FDI destinations, with 10% and 5% growth, respectively, while India maintained its rank as the 8th largest recipient for two consecutive years. The major sources of FDI into India were Singapore, the USA, Mauritius, Netherlands, and Switzerland, raising concerns about the practices of shell companies operating from countries like Mauritius, Cyprus, UAE, and Singapore.

The report emphasises the need for investment in sustainable energy, highlighting a global gap of $1.7 trillion per year in investment for renewable energy to address energy poverty and global warming. India’s efforts toward this goal are visible, and it ranks as the third-largest recipient of greenfield investments. FDI outflows from developed economies decreased by 17% to $1 trillion, led by a decline in outward investment from European MNEs. However, MNEs from the USA increased investment outflows by 7% to $373 billion, with cross-border mergers and acquisitions growing by 21% to $273 billion.

Japan’s outward investment rose by 10% to $161 billion, making it the second-largest investor globally. Despite a 16% drop to $42 billion in Indian MNEs’ outflows in 2022, greenfield projects in renewable energy, like Acme’s $13 billion plant in Egypt for green hydrogen production, signalled positive developments. While Latin America and the Caribbean saw FDI outflows rise to $59 billion, overall FDI flows remain essential for economic growth and non-debt financing, with India poised as a significant beneficiary.

However, attracting FDI remains a challenge amid competition from emerging Asian countries like China, Vietnam, Indonesia, and Bangladesh, offering advantages like lower production costs, superior infrastructure, and investor-friendly policies. While simplifying regulatory processes and introducing single-window clearance systems or digital platforms for FDI regulation, India must address its dependence on certain imports and enhance its efforts toward green renewable energy. Although the nation’s digital revolution is well-regarded, the hesitation to innovate independently and the tendency of startups to sell to foreign investors hinder self-reliance.

India’s rich biodiversity, traditional knowledge, and systems of medicine hold immense potential for innovation and investment, including intellectual property rights. To meet UN Sustainable Development Goals (SDGs), increased investment in energy, water, and transport infrastructure is vital. Despite these challenges, India ranks as the third-largest recipient of greenfield investment, signifying its potential for growth on the global stage.

(The author is an economist based in Kochi. He was the head of the Department of Economics, Central University of Kerala, Kasaragod.)

Ravindran AM

Ravindran AM is an economist based in Kochi. He was the head of Department of Economics at the Central University of Kerala. He has also served as Associate Professor, Directorate of Higher Education, Puducherry.