Monetary policy decisions are a critical lever for India’s economic management. Across the world, central banks adjust policy rates to balance inflation control with growth. In India, the RBI monetary policy committee has kept the repo rate unchanged at 5.5% and retained neutral stance at its bi-monthly meeting on October 1. This is the second pause in a row after a cumulative 100 basis-point cut earlier in the year.

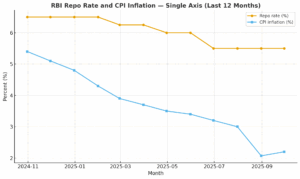

The meeting comes against a backdrop of fiscal easing through the recent cut in Goods and Services Tax (GST) rates. The stimulus is expected to lift domestic demand, particularly when external headwinds from tariffs and slowing trade are evident. Retail inflation has been benign, slipping below 4% since February and falling to a six-year low of 2.07% in August, helped by soft food prices and a favourable base effect. The inflation forecast for FY26 has been revised down to 2.6% from 3.1%, easing bond market concerns and creating room for future policy manoeuvre.

READ I India could turn H-1B visa restrictions to its advantage

Monetary policy transmission

Monetary policy continuity provides certainty for borrowers and lenders. Binod Kumar, MD and CEO of Indian Bank, noted that a stable rate environment helps anchor consumer behaviour by keeping EMI outgo predictable and ensuring credit availability. The reduction in risk weights for MSME and residential real estate lending could also unlock fresh demand. Together, these measures support credit growth and reinforce the rupee’s external strength.

Market participants read the October decision as a dovish pause. Upasna Bhardwaj, Chief Economist at Kotak Mahindra Bank, said the MPC has kept the window open for further cuts, given that tariff uncertainties pose risks to growth. She sees scope for 25–50 basis-point easing in FY26 if downside risks materialise. This follows earlier reductions—25 bps each in February and April 2025, and a larger 50 bps cut in June—bringing the repo rate to 5.5% before the August pause.

The MPC’s core task is to target inflation at 4% Consumer Price Index (CPI), with a tolerance band of 2% on either side. The repo rate—at which banks borrow from the Reserve Bank of India—directly influences liquidity, lending costs, and consumption. Lower rates stimulate loans for housing, autos, and corporate investment; higher rates curb excess demand and inflationary pressures. The effectiveness of this transmission remains central to the credibility of monetary policy.

While the repo rate is the benchmark, the real economy feels policy through lending rates faced by households and firms. For corporates, average borrowing costs remain between 8–9% for top-rated companies, but can cross 11% for lower-rated borrowers. Home loan rates for individuals are currently in the 8.3–9% range, while personal loans often command double-digit interest. The spread between the policy rate and actual lending rates reflects both credit risk and the still-incomplete transmission of monetary policy. This gap means that even as the MPC signals accommodation, the relief for borrowers is gradual and uneven across sectors.

Global and domestic backdrop

The October review took place amid shifting global dynamics. Rising protectionism in the US, fragile signs of de-escalation in the Israel–Hamas conflict, and a sharp softening of US interest rate expectations all form the external backdrop. Domestically, the overhaul of the GST regime and stable inflation dynamics offer a cushion. The MPC raised its FY26 GDP growth forecast to 6.8% from 6.5%, signalling confidence in India’s growth momentum despite global headwinds.

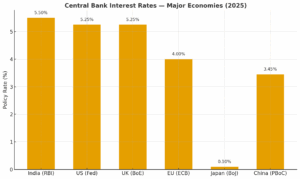

Globally, interest rate trajectories are shifting in ways that influence India’s policy space. In the United States, the Federal Reserve has paused rate hikes after a peak of 5.25–5.50%, with markets now pricing in cuts as inflation retreats from its highs. The European Central Bank has held its benchmark rate at 4%, while the Bank of England is balancing high wage growth against easing inflation at its 5.25% rate. In Asia, China has cut its loan prime rate to stimulate a faltering economy, and Japan remains an outlier with ultra-low rates despite modest adjustments in yield curve control. The divergence underscores that while India’s repo rate at 5.5% looks moderate, it must be judged against both domestic inflation dynamics and global capital flows.

Even as growth forecasts brighten, the monetary policy committee flagged persistent downside risks. Trade and tariff disputes could disrupt supply chains and hit exports. Geopolitical flashpoints could unsettle commodity markets and financial flows. These factors underline why the MPC has opted for measured continuity rather than aggressive easing.

October’s pause was largely anticipated. Yet the door remains open for another 25–50 basis-point cut in the coming quarters. Strong growth, subdued inflation, and the prospect of global monetary easing together create a favourable backdrop for Indian financial markets. The task for the MPC will be to maintain this balance—supporting domestic demand while insulating the economy from volatile external shocks.