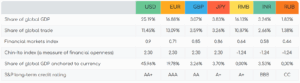

When the BRICS leaders assemble in Rio de Janeiro on 6–7 July, they will confront a global economy in flux. Over the last fortnight the dollar index has slipped to a three-year low, breaking below key technical supports and signalling the prospect of yet deeper losses. Bank of America’s latest fund-manager survey registers the largest collective under-weight on the greenback in two decades, a verdict on Washington’s swelling deficits and tariff brinkmanship. Diplomatic briefings confirm that settlement in national currencies tops the BRICS summit agenda and that a common currency is off the table.

Two data points reveal how rapidly the ground is shifting beneath the dollar. First, official figures show that foreign direct investment into the United States covered barely a tenth of its current-account shortfall in the latest quarter, despite headline pledges of multi-trillion-dollar inflows. Second, global investors are no longer instinctively running to Treasuries in times of turmoil.

The dollar’s steepest first-half fall since 1986, coinciding with record short positions, suggests that confidence in America’s fiscal and institutional fortitude is ebbing. President Trump’s threatened up to 100 per cent tariffs on BRICS exports and a mooted 20 per cent “Section 899” tax on foreigners’ US income heighten the perception that the greenback is turning from safe harbour into policy hazard.

READ I Trump’s Fed chair gambit could sink dollar credibility

BRICS summit to push national currencies

Much ink has been spilled on whether BRICS should mint a supranational currency. Brasília’s sherpas, after discreet consultations, have concluded that the political, legal and macro-economic hurdles are insurmountable for now; the focus therefore shifts to local settlement. The judgment is sober and sound.

Institutional mechanisms are already in place. India has opened 123 Special Rupee Vostro accounts across 30 partner countries. Russia’s SPFS and China’s CIPS now handle a rising share of cross-border messages, and South Africa’s central-bank switch is being linked to both. These pipes can be scaled far faster than designing, legislating and ratifying a Maastricht-style convergence pact.

Macro-stability is another motive. Invoicing imports in home currency shields the balance of payments from exchange-rate whiplash and buffers sovereign ratings during commodity-price swings. Sanctions pushed ruble-yuan trade from 20 to 90 per cent of bilateral flows in roughly 18 months.

Political feasibility seals the argument. BRICS members span inflation rates from China’s mild deflation to Argentina’s triple digits; exchange-rate regimes from India’s managed float to Saudi Arabia’s peg; and fiscal paths from Moscow’s surplus to Brasília’s chronic deficit. Imposing a single monetary policy would be folly. By contrast, a network of currency swaps and clearing arrangements respects sovereignty while still dismantling the dollar’s monopoly.

Gold, sanctions and the search for real assets

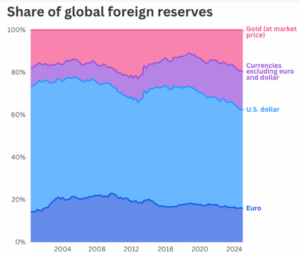

De-dollarisation is no longer a BRICS hobby-horse. An independent tracker counts about 90 jurisdictions experimenting with non-dollar settlement now use alternative invoicing or barter, and central banks are stockpiling gold at levels last seen in the mid-1960s.

Bullion—not the euro—has become the chief beneficiary of the dollar’s retreat, its share of global reserves (about 20 per cent) rising above the single currency’s (about 16 per cent) for the first time. The message is unmistakable: countries rich in hydrocarbons or minerals can sell in currencies they create, reinvest the proceeds domestically and sidestep the Federal Reserve’s rate cycle.

What BRICS Summit can deliver

Against this backdrop, the BRICS Summit communiqué must move beyond rhetoric and announce a BRICS Local Currency Settlement Facility. Such a scheme would match importers and exporters across the bloc, route payments through existing Vostro and SPFS/CIPS channels and offer modest guarantees from the New Development Bank. A clear mandate to double the share of local-currency trade within three years would give the facility measurable bite.

Complementing settlement should be a woven network of central-bank swap lines. Brazil and India could add a real-rupee swap line, complementing existing PBOC and SAARC agreements. Linking the existing bilaterals under a transparent cost cap tied to policy-rate corridors would create a collective safety net against liquidity squeezes—a regional equivalent of the Chiang Mai Initiative in East Asia, but without dollar tranches.

The third deliverable at the BRICS summit ought to be a roadmap for cross-border central-bank digital currencies. China’s e-CNY and the mBridge pilot linking Hong Kong, Thailand and the UAE prove that programmable settlement works. A BRICS fintech working group, charged with drafting interoperability standards within six months and launching a live pilot by the Durban finance ministers’ meeting next spring, would propel the bloc to the frontier of payment innovation.

None of these steps infringes sovereignty; each can be implemented with statutory powers already possessed by member central banks. More important, they cumulatively chip away at the dollar’s network effect by making local-currency finance cheap, familiar and reliable.

Monetary hegemony rarely collapses overnight; it erodes through incremental choices made by treasurers, traders and tourists. The choice confronting BRICS next week is therefore not whether to overthrow the dollar but whether to widen the alternative lanes already under construction.

A decisive push toward routine settlement in rupees, reais, renminbi, roubles and rand at the BRICS summit will diversify reserve portfolios, deepen regional capital markets and, crucially, equip smaller economies with a buffer against the weaponisation of finance. Leave the siren call of a single coin to academics; deliver a functional mosaic of national currencies now, while the door opened by a weakening dollar remains ajar.